General Instructions For Form As-22 Refund Request

ADVERTISEMENT

GENERAL INSTRUCTIONS FOR FORM AS-22 - REFUND REQUEST

***Notice: There is a 3-year statute of limitation on refund requests. ***

Contact the Tax Dept at (937) 754-3006 for information.

This form is to be used by individuals claiming a refund of city income tax withheld in excess of their actual liability. Designate

the calendar year for which the refund is claimed. If the individual has other taxable income, the standard city income tax

return (Form R-1040) must also be used. If a refund is claimed for tax withheld by more than one employer, a separate refund

request form must be completed for each employer. All forms must be submitted together.

The completed form AS-22 is to be submitted to the City of Fairborn, Division of Taxation at the address shown on the front of

this form. Remember: Missing or incorrect information will delay your refund.

1.

BASIS FOR REFUND: A brief but complete explanation by the Applicant is required concerning the reason for the

overpayment. Explain method of calculation and show computations used to determine the amount of taxable city

income. If duties required travel, you must provide a list of dates and location of city or cities worked. If

traveling was not required, show where duties were performed.

2.

Refund Calculation is based on your gross compensation (including any deferred income). A copy of the W-2 must

be attached. This will be returned to you if requested.

3.

If the refund is because Fairborn tax was withheld on income earned prior to age 16, you must submit proof of age

(birth certificate or other acceptable proof).

4.

Total Days Available: (The Total Days Available for use in this refund calculation may vary from year to year. Contact

our office for details.) For tax year 2004, the working year consisted of 262 days (Saturday and Sunday are not

considered working days). If you were not employed the full year, you must adjust your Total Days Available

accordingly (contact our office for details). Sick Days, Vacation Days, and Holiday Days should be prorated in the

same way as time worked-in and time worked-out of the City of Fairborn (see formula below).

5.

Part B, Certification of Employer, must be completed by an authorized official of the employer. No person claiming a

refund may certify their own refund request form.

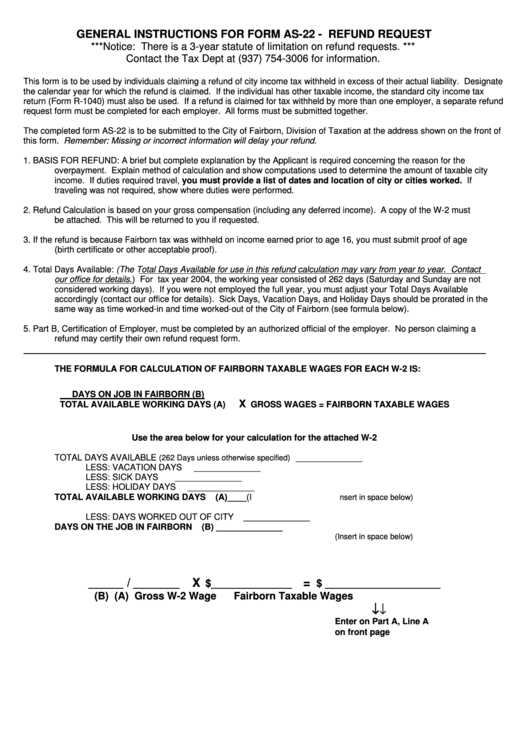

THE FORMULA FOR CALCULATION OF FAIRBORN TAXABLE WAGES FOR EACH W-2 IS:

DAYS ON JOB IN FAIRBORN (B)

X

GROSS WAGES = FAIRBORN TAXABLE WAGES

TOTAL AVAILABLE WORKING DAYS (A)

Use the area below for your calculation for the attached W-2

TOTAL DAYS AVAILABLE

______________

(262 Days unless otherwise specified)

LESS: VACATION DAYS

______________

LESS: SICK DAYS

______________

LESS: HOLIDAY DAYS

______________

TOTAL AVAILABLE WORKING DAYS

(A)____(I

nsert in space below)

LESS: DAYS WORKED OUT OF CITY

______________

DAYS ON THE JOB IN FAIRBORN

(B)

______________

(Insert in space below)

/

X

=

______

________

$______________

$ ____________________

(B)

(A)

Gross W-2 Wage

Fairborn Taxable Wages

↓ ↓ ↓ ↓

Enter on Part A, Line A

on front page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1