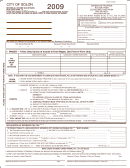

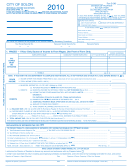

Form S-1040 - Individual Return - 2011 Page 2

ADVERTISEMENT

FAILURE TO FILL OUT EMPLOYMENT INFORMATION/EXEMPTION SCHEDULE AND ADDRESSES

OR FAILURE TO ATTACH DOCUMENTATION OR ATTACHING INCORRECT OR INCOMPLETE DOCUMENTATION

WILL DELAY PROCESSING OF RETURN AND MAY RESULT IN DEDUCTIONS AND LOSSES BEING DISALLOWED

REQUIRED--MUST BE FILLED OUT COMPLETELY

)

(NOT COMPLETING WILL DELAY PROCESSING YOUR RETURN

EMPLOYERS

- LIST ALL EMPLOYERS DURING 2011 & ACTUAL JOB LOCATION ( if more than 4 list on separate sheet & attach)

FROM

TO

Total Wages

ACTUAL WORK

ADDRESS OF

from Box 1 on

LOCATION

Saginaw Tax

(may be different from

W2 from

EMPLOYERS

Withheld

address on W-2)

Month

Day

Month

Day

employer

Enter total on page

Enter total on page one, in box 1

one, line 27

EXEMPTIONS SCHEDULE

Date of birth

Regular

65 & over

Blind

Box A. Number of boxes checked

Box A

You

Spouse

Box B. Number of dependents

Box B

DEPENDENTS

(attach copy of Federal return Page 1)

Box C. Total Exemptions

Box C

Attach Copy of Federal Return PAGE 1

(Add Box A and Box B)

Enter Box C amount on page 1

ADDRESSES

. (If same as 2011 write "SAME". If none filed, please give reason. )

Enter name and address used on 2010 return

LIST ALL ADDRESSES WHERE YOU RESIDED IN 2011 (if more than 2 list on separate sheet and attach)

INDICATE:

T = TAXPAYER

S = SPOUSE

B = Both

FROM

TO

T,S, B

ADDRESS

MONTH

DAY

MONTH

DAY

NONRESIDENT WAGE ALLOCATION

IF YOU WERE A RESIDENT AT ANY TIME DURING THE YEAR DO NOT USE THIS SCHEDULE (SEE INSTRUCTIONS)

Employer name (A COMPUTATION MUST BE MADE FOR EACH EMPLOYER)

Example

A. Actual number of days worked for employer during 2011 include vacation, holiday

100

and sick days

B. Actual number of days worked outside the City of Saginaw

20

B

A

C. Subtract line

from line

80

C

A

D. Percentage of days worked in the City of Saginaw (Line

divided by Line

)

80%

%

%

%

E. Total wages shown on W-2, box 1

$20,000

F. Wages earned in the Saginaw City. Line E multiplied by percentage on line D

$16,000

Enter amount from line F on page 1, line 1, in column Subject to Tax

SCHEDULE B - EXCLUDIBLE INTEREST AND DIVIDEND INCOME (FOR USE BY RESIDENTS ONLY)

Excludible Interest Income

Excludible Dividend Income

Interest income from federal return

Dividend income from federal return

Excludible interest income

Excludible dividend income

Interest from federal obligations

Dividend from federal obligations

Other excludible dividend income

Interest from Subchapter S corp

Other excludible interest income

Total excludible interest income

Total excludible dividend income

Taxable interest income

Taxable dividend income

SCHEDULE C - BUSINESS INCOME, BUSINESS ALLOCATION FORMULA AND PROFIT OR LOSS (ATTACH FEDERAL SCHEDULE C).

SCHEDULE D - SALE OR EXCHANGE OF PROPERTY (ATTACH FEDERAL FORM SCHEDULE D)

SCHEDULE E - SUPPLEMENTAL INCOME (ATTACH FEDERAL FORM SCHEDULE E)

1. Rents (Excludable by NON-RESIDENTS only on property located outside the City of Saginaw)

2. Partnerships (Excludable by NON-RESIDENTS only on partnerships located outside the City of Saginaw)

3. Other (Identify)

4. Total Excludable Supplemental Income (Add Lines 1, 2 and 3)

THIRD-PARTY DESIGNEE

Do you want to allow another person to discuss this return with the Income Tax Department?

Yes. Complete the following

No

Designee's

Phone

name

No. (

)

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct

and complete. If prepared by a person other than taxpayer, the preparer's declaration is based on all information of which preparer has any knowledge.

/

/

/

/

SIGN

TAXPAYERS' SIGNATURE-

If joint return, both husband and wife must sign.

DATE

PRINT NAME OF PREPARER

DATE

/

/

(

)

SPOUSE'S SIGNATURE

DATE

PREPARER'S PHONE NUMBER

PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2