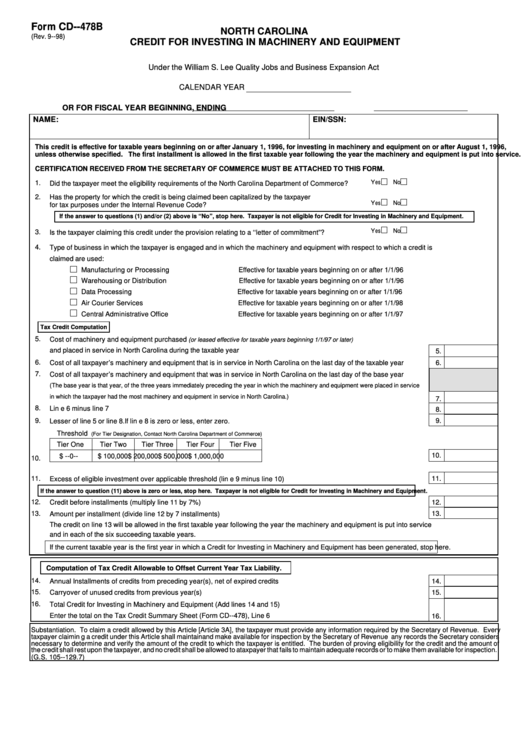

Form CD--478B

NORTH CAROLINA

(Rev. 9--98)

CREDIT FOR INVESTING IN MACHINERY AND EQUIPMENT

Under the William S. Lee Quality Jobs and Business Expansion Act

CALENDAR YEAR

OR FOR FISCAL YEAR BEGINNING

, ENDING

NAME:

EIN/SSN:

This credit is effective for taxable years beginning on or after January 1, 1996, for investing in machinery and equipment on or after August 1, 1996,

unless otherwise specified. The first installment is allowed in the first taxable year following the year the machinery and equipment is put into service.

CERTIFICATION RECEIVED FROM THE SECRETARY OF COMMERCE MUST BE ATTACHED TO THIS FORM.

1.

Yes

No

Did the taxpayer meet the eligibility requirements of the North Carolina Department of Commerce?

2.

Has the property for which the credit is being claimed been capitalized by the taxpayer

Yes

No

for tax purposes under the Internal Revenue Code?

If the answer to questions (1) and/or (2) above is ‘ ‘ No”, stop here. Taxpayer is not eligible for Credit for Investing in Machinery and Equipment.

Yes

No

3.

Is the taxpayer claiming this credit under the provision relating to a ‘ ‘ letter of commitment” ?

4.

Type of business in which the taxpayer is engaged and in which the machinery and equipment with respect to which a credit is

claimed are used:

Manufacturing or Processing

. . . . . . . . . . . . . . . . . . .

Effective for taxable years beginning on or after 1/1/96

Warehousing or Distribution

. . . . . . . . . . . . . . . . . . .

Effective for taxable years beginning on or after 1/1/96

Data Processing

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Effective for taxable years beginning on or after 1/1/96

Air Courier Services

. . . . . . . . . . . . . . . . . . . . . . . . . .

Effective for taxable years beginning on or after 1/1/98

Central Administrative Office

. . . . . . . . . . . . . . . . . . .

Effective for taxable years beginning on or after 1/1/97

Tax Credit Computation

5.

Cost of machinery and equipment purchased

(or leased effective for taxable years beginning 1/1/97 or later)

and placed in service in North Carolina during the taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6.

Cost of all taxpayer’ s machinery and equipment that is in service in North Carolina on the last day of the taxable year . . . . . . .

6.

7.

Cost of all taxpayer’ s machinery and equipment that was in service in North Carolina on the last day of the base year

(The base year is that year, of the three years immediately preceding the year in which the machinery and equipment were placed in service

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

in which the taxpayer had the most machinery and equipment in service in North Carolina.)

7.

8.

Line 6 minus line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9.

9.

Lesser of line 5 or line 8. If line 8 is zero or less, enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Threshold

(For Tier Designation, Contact North Carolina Department of Commerce)

Tier One

Tier Two

Tier Three

Tier Four

Tier Five

10.

$ --0--

$ 100,000

$ 200,000

$ 500,000

$ 1,000,000

10.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

Excess of eligible investment over applicable threshold (line 9 minus line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

If the answer to question (11) above is zero or less, stop here. Taxpayer is not eligible for Credit for Investing in Machinery and Equipment.

12.

Credit before installments (multiply line 11 by 7%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13.

13.

Amount per installment (divide line 12 by 7 installments) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

The credit on line 13 will be allowed in the first taxable year following the year the machinery and equipment is put into service

and in each of the six succeeding taxable years.

If the current taxable year is the first year in which a Credit for Investing in Machinery and Equipment has been generated, stop here.

Computation of Tax Credit Allowable to Offset Current Year Tax Liability.

14.

Annual Installments of credits from preceding year(s), net of expired credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

15.

Carryover of unused credits from previous year(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

16.

Total Credit for Investing in Machinery and Equipment (Add lines 14 and 15)

Enter the total on the Tax Credit Summary Sheet (Form CD--478), Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

Substantiation. To claim a credit allowed by this Article [Article 3A], the taxpayer must provide any information required by the Secretary of Revenue. Every

taxpayer claiming a credit under this Article shall maintain and make available for inspection by the Secretary of Revenue any records the Secretary considers

necessary to determine and verify the amount of the credit to which the taxpayer is entitled. The burden of proving eligibility for the credit and the amount of

the credit shall rest upon the taxpayer, and no credit shall be allowed to a taxpayer that fails to maintain adequate records or to make them available for inspection.

(G.S. 105--129.7)

1

1