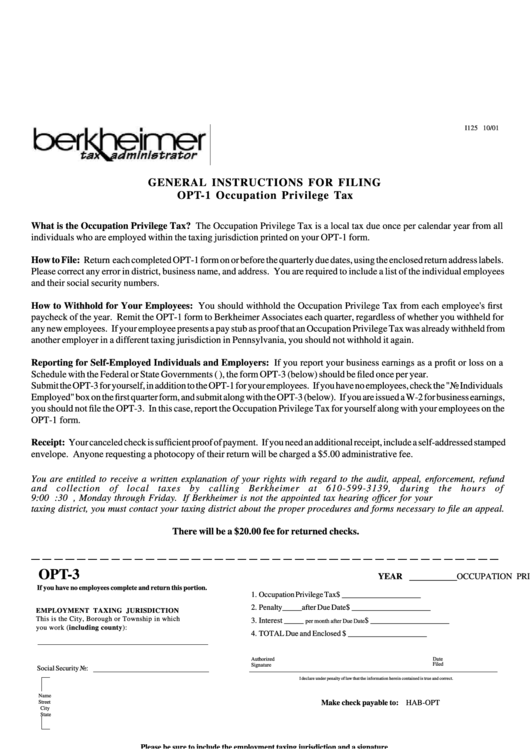

Form Opt-3 - Occupation Privilege Tax-Personal Return

ADVERTISEMENT

I125 10/01

GENERAL INSTRUCTIONS FOR FILING

OPT-1 Occupation Privilege Tax

What is the Occupation Privilege Tax? The Occupation Privilege Tax is a local tax due once per calendar year from all

individuals who are employed within the taxing jurisdiction printed on your OPT-1 form.

How to File: Return each completed OPT-1 form on or before the quarterly due dates, using the enclosed return address labels.

Please correct any error in district, business name, and address. You are required to include a list of the individual employees

and their social security numbers.

How to Withhold for Your Employees: You should withhold the Occupation Privilege Tax from each employee's first

paycheck of the year. Remit the OPT-1 form to Berkheimer Associates each quarter, regardless of whether you withheld for

any new employees. If your employee presents a pay stub as proof that an Occupation Privilege Tax was already withheld from

another employer in a different taxing jurisdiction in Pennsylvania, you should not withhold it again.

Reporting for Self-Employed Individuals and Employers: If you report your business earnings as a profit or loss on a

Schedule with the Federal or State Governments (e.g. Schedule C or E), the form OPT-3 (below) should be filed once per year.

Submit the OPT-3 for yourself, in addition to the OPT-1 for your employees. If you have no employees, check the "No Individuals

Employed" box on the first quarter form, and submit along with the OPT-3 (below). If you are issued a W-2 for business earnings,

you should not file the OPT-3. In this case, report the Occupation Privilege Tax for yourself along with your employees on the

OPT-1 form.

Receipt: Your canceled check is sufficient proof of payment. If you need an additional receipt, include a self-addressed stamped

envelope. Anyone requesting a photocopy of their return will be charged a $5.00 administrative fee.

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund

and collection of local taxes by calling Berkheimer at 610-599-3139, during the hours of

9:00 a.m. through 4:30 p.m., Monday through Friday. If Berkheimer is not the appointed tax hearing officer for your

taxing district, you must contact your taxing district about the proper procedures and forms necessary to file an appeal.

There will be a $20.00 fee for returned checks.

OPT-3

PERSONAL RETURN

YEAR __________

OCCUPATION PRIVILEGE TAX

If you have no employees complete and return this portion.

1. Occupation Privilege Tax .................. $ ____________________

2. Penalty_____after Due Date ............. $ ____________________

EMPLOYMENT TAXING JURISDICTION

This is the City, Borough or Township in which

3. Interest _____

$ ____________________

per month after Due Date .....

you work (including county):

4. TOTAL Due and Enclosed ................ $ ____________________

Authorized

Date

Filed

Signature

Social Security No:

I declare under penalty of law that the information herein contained is true and correct.

Name

Street

Make check payable to: HAB-OPT

City

State

Please be sure to include the employment taxing jurisdiction and a signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1