Form Op-3 - Occupation Privilege Tax

ADVERTISEMENT

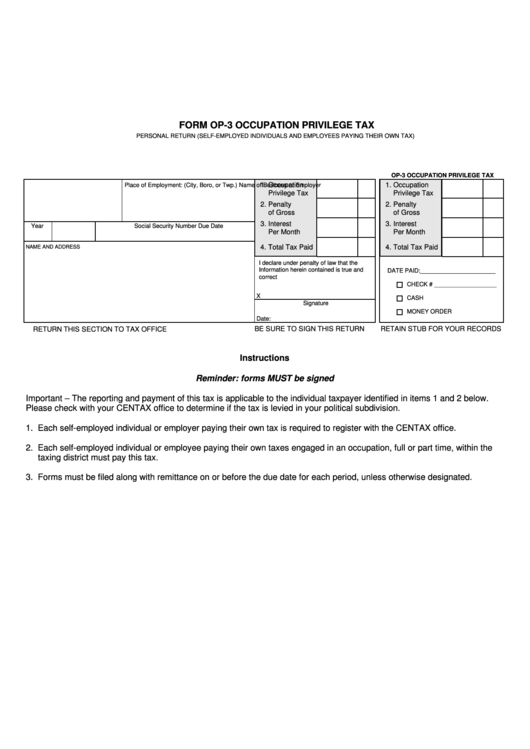

FORM OP-3 OCCUPATION PRIVILEGE TAX

PERSONAL RETURN (SELF-EMPLOYED INDIVIDUALS AND EMPLOYEES PAYING THEIR OWN TAX)

OP-3 OCCUPATION PRIVILEGE TAX

1. Occupation

1. Occupation

Name of Business or Employer

Place of Employment: (City, Boro, or Twp.)

Privilege Tax

Privilege Tax

2. Penalty

2. Penalty

of Gross

of Gross

3. Interest

3. Interest

Year

Due Date

Social Security Number

Per Month

Per Month

4. Total Tax Paid

4. Total Tax Paid

NAME AND ADDRESS

I declare under penalty of law that the

Information herein contained is true and

DATE PAID:_______________________

correct

CHECK # ___________________

X

CASH

Signature

MONEY ORDER

Date:

BE SURE TO SIGN THIS RETURN

RETAIN STUB FOR YOUR RECORDS

RETURN THIS SECTION TO TAX OFFICE

Instructions

Reminder: forms MUST be signed

Important – The reporting and payment of this tax is applicable to the individual taxpayer identified in items 1 and 2 below.

Please check with your CENTAX office to determine if the tax is levied in your political subdivision.

1. Each self-employed individual or employer paying their own tax is required to register with the CENTAX office.

2. Each self-employed individual or employee paying their own taxes engaged in an occupation, full or part time, within the

taxing district must pay this tax.

3. Forms must be filed along with remittance on or before the due date for each period, unless otherwise designated.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1