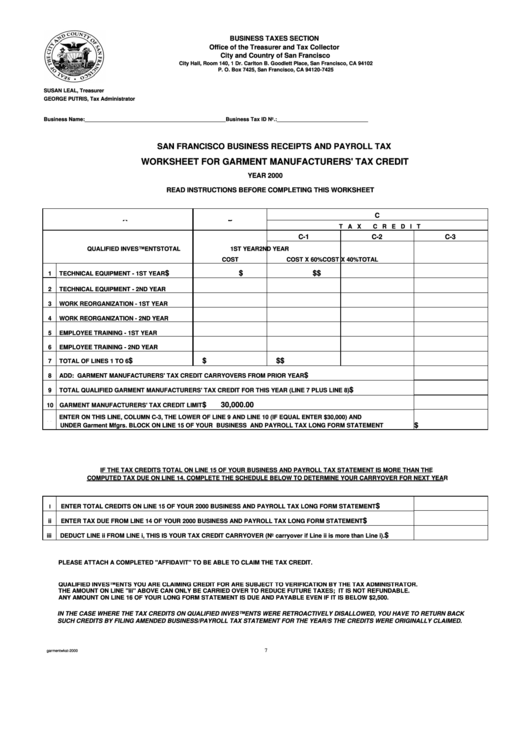

San Francisco Business Receipts And Payroll Tax Worksheet For Garment Manufacturers' Tax Credit 2000 - State Of California

ADVERTISEMENT

BUSINESS TAXES SECTION

Office of the Treasurer and Tax Collector

City and Country of San Francisco

City Hall, Room 140, 1 Dr. Carlton B. Goodlett Place, San Francisco, CA 94102

P. O. Box 7425, San Francisco, CA 94120-7425

SUSAN LEAL, Treasurer

GEORGE PUTRIS, Tax Administrator

Business Name:________________________________________________

Business Tax ID No.:_______________________________

SAN FRANCISCO BUSINESS RECEIPTS AND PAYROLL TAX

WORKSHEET FOR GARMENT MANUFACTURERS' TAX CREDIT

YEAR 2000

READ INSTRUCTIONS BEFORE COMPLETING THIS WORKSHEET

C

A

B

T A X

C R E D I T

C-1

C-2

C-3

QUALIFIED INVESTMENTS

TOTAL

1ST YEAR

2ND YEAR

COST

COST X 60%

COST X 40%

TOTAL

$

$

$

$

1

TECHNICAL EQUIPMENT - 1ST YEAR

2

TECHNICAL EQUIPMENT - 2ND YEAR

3

WORK REORGANIZATION - 1ST YEAR

4

WORK REORGANIZATION - 2ND YEAR

5

EMPLOYEE TRAINING - 1ST YEAR

6

EMPLOYEE TRAINING - 2ND YEAR

$

$

$

$

7

TOTAL OF LINES 1 TO 6

$

8

ADD: GARMENT MANUFACTURERS' TAX CREDIT CARRYOVERS FROM PRIOR YEAR

$

9

TOTAL QUALIFIED GARMENT MANUFACTURERS' TAX CREDIT FOR THIS YEAR (LINE 7 PLUS LINE 8)

$

30,000.00

10 GARMENT MANUFACTURERS' TAX CREDIT LIMIT

ENTER ON THIS LINE, COLUMN C-3, THE LOWER OF LINE 9 AND LINE 10 (IF EQUAL ENTER $30,000) AND

11

$

UNDER Garment Mfgrs. BLOCK ON LINE 15 OF YOUR BUSINESS AND PAYROLL TAX LONG FORM STATEMENT

IF THE TAX CREDITS TOTAL ON LINE 15 OF YOUR BUSINESS AND PAYROLL TAX STATEMENT IS MORE THAN THE

COMPUTED TAX DUE ON LINE 14, COMPLETE THE SCHEDULE BELOW TO DETERMINE YOUR CARRYOVER FOR NEXT YEAR

$

ENTER TOTAL CREDITS ON LINE 15 OF YOUR 2000 BUSINESS AND PAYROLL TAX LONG FORM STATEMENT

I

$

ii

ENTER TAX DUE FROM LINE 14 OF YOUR 2000 BUSINESS AND PAYROLL TAX LONG FORM STATEMENT

$

iii

DEDUCT LINE ii FROM LINE i, THIS IS YOUR TAX CREDIT CARRYOVER (No carryover if Line ii is more than Line i).

PLEASE ATTACH A COMPLETED "AFFIDAVIT" TO BE ABLE TO CLAIM THE TAX CREDIT.

QUALIFIED INVESTMENTS YOU ARE CLAIMING CREDIT FOR ARE SUBJECT TO VERIFICATION BY THE TAX ADMINISTRATOR.

THE AMOUNT ON LINE "iii" ABOVE CAN ONLY BE CARRIED OVER TO REDUCE FUTURE TAXES; IT IS NOT REFUNDABLE.

ANY AMOUNT ON LINE 16 OF YOUR LONG FORM STATEMENT IS DUE AND PAYABLE EVEN IF IT IS BELOW $2,500.

IN THE CASE WHERE THE TAX CREDITS ON QUALIFIED INVESTMENTS WERE RETROACTIVELY DISALLOWED, YOU HAVE TO RETURN BACK

SUCH CREDITS BY FILING AMENDED BUSINESS/PAYROLL TAX STATEMENT FOR THE YEAR/S THE CREDITS WERE ORIGINALLY CLAIMED.

7

garmentwkst-2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1