San Francisco Business Receipts & Payroll Tax 1999 New Jobs Tax Credit Instructions

ADVERTISEMENT

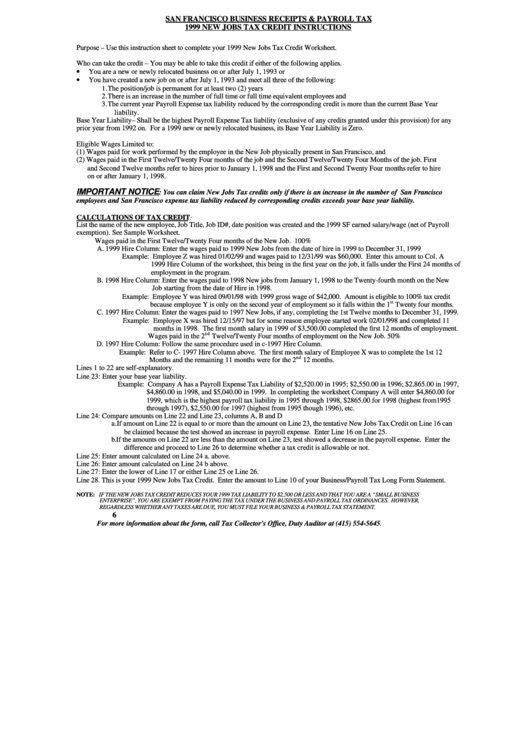

SAN FRANCISCO BUSINESS RECEIPTS & PAYROLL TAX

1999 NEW JOBS TAX CREDIT INSTRUCTIONS

Purpose – Use this instruction sheet to complete your 1999 New Jobs Tax Credit Worksheet.

Who can take the credit – You may be able to take this credit if either of the following applies.

•

You are a new or newly relocated business on or after July 1, 1993 or

•

You have created a new job on or after July 1, 1993 and meet all three of the following:

1. The position/job is permanent for at least two (2) years

2. There is an increase in the number of full time or full time equivalent employees and

3. The current year Payroll Expense tax liability reduced by the corresponding credit is more than the current Base Year

liability.

Base Year Liability– Shall be the highest Payroll Expense Tax liability (exclusive of any credits granted under this provision) for any

prior year from 1992 on. For a 1999 new or newly relocated business, its Base Year Liability is Zero.

Eligible Wages Limited to:

(1) Wages paid for work performed by the employee in the New Job physically present in San Francisco, and

(2) Wages paid in the First Twelve/Twenty Four months of the job and the Second Twelve/Twenty Four Months of the job. First

and Second Twelve months refer to hires prior to January 1, 1998 and the First and Second Twenty Four months refer to hire

on or after January 1, 1998.

IMPORTANT NOTICE

: You can claim New Jobs Tax credits only if there is an increase in the number of San Francisco

employees and San Francisco expense tax liability reduced by corresponding credits exceeds your base year liability.

CALCULATIONS OF TAX CREDIT

:

List the name of the new employee, Job Title, Job ID#, date position was created and the 1999 SF earned salary/wage (net of Payroll

exemption). See Sample Worksheet.

Wages paid in the First Twelve/Twenty Four months of the New Job. 100%

A. 1999 Hire Column: Enter the wages paid to 1999 New Jobs from the date of hire in 1999 to December 31, 1999

Example: Employee Z was hired 01/02/99 and wages paid to 12/31/99 was $60,000. Enter this amount to Col. A

1999 Hire Column of the worksheet, this being in the first year on the job, it falls under the First 24 months of

employment in the program.

B. 1998 Hire Column: Enter the wages paid to 1998 New jobs from January 1, 1998 to the Twenty-fourth month on the New

Job starting from the date of Hire in 1998.

Example: Employee Y was hired 09/01/98 with 1999 gross wage of $42,000. Amount is eligible to 100% tax credit

st

because employee Y is only on the second year of employment so it falls within the 1

Twenty four months.

C. 1997 Hire Column: Enter the wages paid to 1997 New Jobs, if any, completing the 1st Twelve months to December 31, 1999.

Example: Employee X was hired 12/15/97 but for some reason employee started work 02/01/998 and completed 11

months in 1998. The first month salary in 1999 of $3,500.00 completed the first 12 months of employment.

nd

Wages paid in the 2

Twelve/Twenty Four months of employment on the New Job. 50%

D. 1997 Hire Column: Follow the same procedure used in c-1997 Hire Column.

Example: Refer to C- 1997 Hire Column above. The first month salary of Employee X was to complete the 1st 12

nd

Months and the remaining 11 months were for the 2

12 months.

Lines 1 to 22 are self-explanatory.

Line 23: Enter your base year liability.

Example: Company A has a Payroll Expense Tax Liability of $2,520.00 in 1995; $2,550.00 in 1996; $2,865.00 in 1997,

$4,860.00 in 1998, and $5,040.00 in 1999. In completing the worksheet Company A will enter $4,860.00 for

1999, which is the highest payroll tax liability in 1995 through 1998, $2865.00 for 1998 (highest from1995

through 1997), $2,550.00 for 1997 (highest from 1995 though 1996), etc.

Line 24: Compare amounts on Line 22 and Line 23, columns A, B and D

a. If amount on Line 22 is equal to or more than the amount on Line 23, the tentative New Jobs Tax Credit on Line 16 can

be claimed because the test showed an increase in payroll expense. Enter Line 16 on Line 25.

b. If the amounts on Line 22 are less than the amount on Line 23, test showed a decrease in the payroll expense. Enter the

difference and proceed to Line 26 to determine whether a tax credit is allowable or not.

Line 25: Enter amount calculated on Line 24 a. above.

Line 26: Enter amount calculated on Line 24 b above.

Line 27: Enter the lower of Line 17 or either Line 25 or Line 26.

Line 28. This is your 1999 New Jobs Tax Credit. Enter the amount to Line 10 of your Business/Payroll Tax Long Form Statement.

NOTE: IF THE NEW JOBS TAX CREDIT REDUCES YOUR 1999 TAX LIABILITY TO $2,500 OR LESS AND THAT YOU ARE A “SMALL BUSINESS

ENTERPRISE”, YOU ARE EXEMPT FROM PAYING THE TAX UNDER THE BUSINESS AND PAYROLL TAX ORDINANCES. HOWEVER,

REGARDLESS WHETHER ANY TAXES ARE DUE, YOU MUST FILE YOUR BUSINESS & PAYROLL TAX STATEMENT.

6

For more information about the form, call Tax Collector's Office, Duty Auditor at (415) 554-5645.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1