Seed Capital Investment Tax Credit Worksheet For Tax Year 2012

ADVERTISEMENT

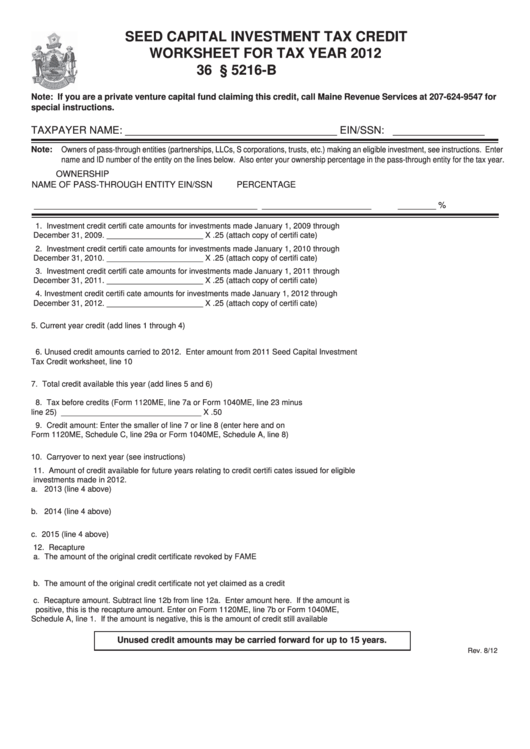

SEED CAPITAL INVESTMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2012

36 M.R.S.A. § 5216-B

Note: If you are a private venture capital fund claiming this credit, call Maine Revenue Services at 207-624-9547 for

special instructions.

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note:

Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible investment, see instructions. Enter

name and ID number of the entity on the lines below. Also enter your ownership percentage in the pass-through entity for the tax year.

OWNERSHIP

NAME OF PASS-THROUGH ENTITY

EIN/SSN

PERCENTAGE

_______________________________________________

_______________________

________ %

1. Investment credit certifi cate amounts for investments made January 1, 2009 through

December 31, 2009. ______________________ X .25 (attach copy of certifi cate) ............................ 1. ______________________

2. Investment credit certifi cate amounts for investments made January 1, 2010 through

December 31, 2010. ______________________ X .25 (attach copy of certifi cate) .............................2. ______________________

3. Investment credit certifi cate amounts for investments made January 1, 2011 through

December 31, 2011. ______________________ X .25 (attach copy of certifi cate) .............................3. ______________________

4. Investment credit certifi cate amounts for investments made January 1, 2012 through

December 31, 2012. ______________________ X .25 (attach copy of certifi cate) .............................4. ______________________

5. Current year credit (add lines 1 through 4) ...........................................................................................5. ______________________

6. Unused credit amounts carried to 2012. Enter amount from 2011 Seed Capital Investment

Tax Credit worksheet, line 10 ...............................................................................................................6. ______________________

7. Total credit available this year (add lines 5 and 6) ............................................................................... 7. ______________________

8. Tax before credits (Form 1120ME, line 7a or Form 1040ME, line 23 minus

line 25) ________________________________ X .50 ...................................................................... 8. ______________________

9. Credit amount: Enter the smaller of line 7 or line 8 (enter here and on

Form 1120ME, Schedule C, line 29a or Form 1040ME, Schedule A, line 8) ....................................... 9. ______________________

10. Carryover to next year (see instructions) ........................................................................................... 10. ______________________

11. Amount of credit available for future years relating to credit certifi cates issued for eligible

investments made in 2012.

a. 2013 (line 4 above) ....................................................................................................................11a. ______________________

b. 2014 (line 4 above) ....................................................................................................................11b. ______________________

c. 2015 (line 4 above) .................................................................................................................... 11c. ______________________

12. Recapture

a. The amount of the original credit certifi cate revoked by FAME .................................................. 12a. ______________________

b. The amount of the original credit certifi cate not yet claimed as a credit .....................................12b. ______________________

c. Recapture amount. Subtract line 12b from line 12a. Enter amount here. If the amount is

positive, this is the recapture amount. Enter on Form 1120ME, line 7b or Form 1040ME,

Schedule A, line 1. If the amount is negative, this is the amount of credit still available ............12c. ______________________

Unused credit amounts may be carried forward for up to 15 years.

Rev. 8/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1