Seed Capital Investment Tax Credit Worksheet For Tax Year 2003

ADVERTISEMENT

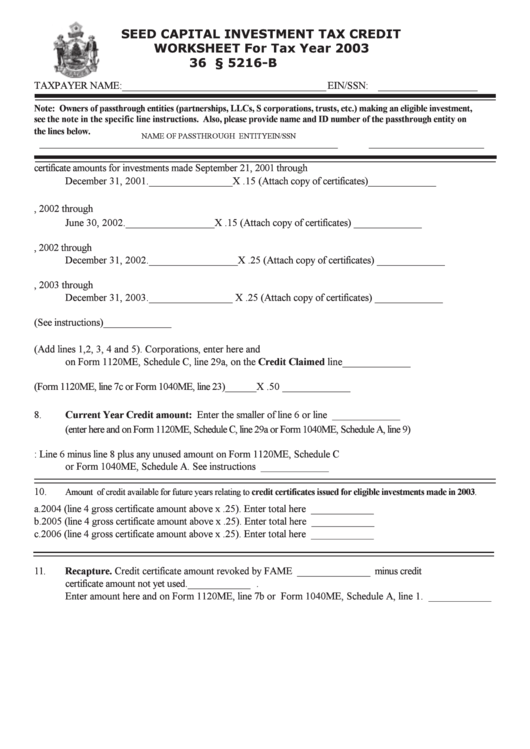

SEED CAPITAL INVESTMENT TAX CREDIT

WORKSHEET For Tax Year 2003

36 M.R.S.A. § 5216-B

TAXPAYER NAME: _______________________________________ EIN/SSN: ___________________

Note: Owners of passthrough entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible investment,

see the note in the specific line instructions. Also, please provide name and ID number of the passthrough entity on

the lines below.

NAME OF PASSTHROUGH ENTITY

EIN/SSN

_________________________________________________________

______________________

1.

Investment Credit certificate amounts for investments made September 21, 2001 through

December 31, 2001. ________________ X .15 (Attach copy of certificates) ............

_____________

2.

Investment credit certificate amounts for investments made January 1, 2002 through

June 30, 2002. _________________ X .15 (Attach copy of certificates) ..................

_____________

3.

Investment credit certificate amounts for investments made July 1, 2002 through

December 31, 2002. _________________ X .25 (Attach copy of certificates) ........

_____________

4.

Investment credit certificate amounts for investments made January 1, 2003 through

December 31, 2003. ________________ X .25 (Attach copy of certificates) ..........

_____________

5.

Unused credit amounts carried to 2003 (See instructions) ............................................

_____________

6.

Total credit available this year (Add lines 1,2, 3, 4 and 5). Corporations, enter here and

on Form 1120ME, Schedule C, line 29a, on the Credit Claimed line ..........................

_____________

7.

Tax before credits (Form 1120ME, line 7c or Form 1040ME, line 23) ______ X .50 .........

_____________

8.

Current Year Credit amount: Enter the smaller of line 6 or line 7 ..............................

_____________

(enter here and on Form 1120ME, Schedule C, line 29a or Form 1040ME, Schedule A, line 9)

9.

Carryover: Line 6 minus line 8 plus any unused amount on Form 1120ME, Schedule C

or Form 1040ME, Schedule A. See instructions ..........................................................

_____________

10.

Amount of credit available for future years relating to credit certificates issued for eligible investments made in 2003.

a.

2004 (line 4 gross certificate amount above x .25). Enter total here ..............................

____________

b.

2005 (line 4 gross certificate amount above x .25). Enter total here ..............................

____________

c.

2006 (line 4 gross certificate amount above x .25). Enter total here ..............................

____________

11.

Recapture. Credit certificate amount revoked by FAME ______________ minus credit

certificate amount not yet used. ____________ .

Enter amount here and on Form 1120ME, line 7b or Form 1040ME, Schedule A, line 1. ____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1