Form Vm-2ap - Virginia Vending Machine Dealer'S Sales Tax Return

ADVERTISEMENT

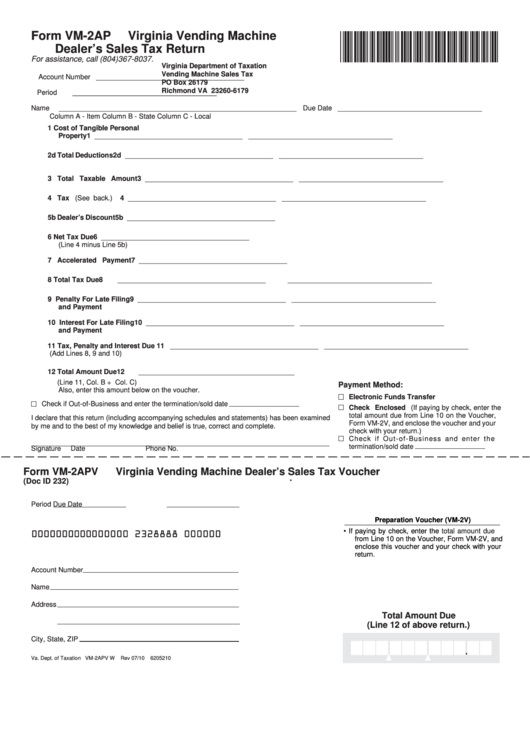

Form VM-2AP

Virginia Vending Machine

Dealer’s Sales Tax Return

For assistance, call (804)367-8037.

Virginia Department of Taxation

Vending Machine Sales Tax

Account Number ______________________________________

PO Box 26179

Richmond VA 23260-6179

Period

_____________________________________

Name _____________________________________________________________

Due Date _____________________________________

Column A - Item

Column B - State

Column C - Local

1 Cost of Tangible Personal

Property ................................... 1

______________________________________

_____________________________________

2d Total Deductions ..................... 2d ______________________________________

_____________________________________

3 Total Taxable Amount ............. 3

______________________________________

_____________________________________

4 Tax (See back.) ...................... 4

______________________________________

_____________________________________

5b Dealer’s Discount .................... 5b ______________________________________

6 Net Tax Due .............................. 6

______________________________________

(Line 4 minus Line 5b)

7 Accelerated Payment .............. 7

______________________________________

8 Total Tax Due .......................... 8

______________________________________

_____________________________________

9

Penalty For Late Filing ........... 9

______________________________________

_____________________________________

and Payment

10 Interest For Late Filing .......... 10 ______________________________________

_____________________________________

and Payment

11 Tax, Penalty and Interest Due 11 ______________________________________

_____________________________________

(Add Lines 8, 9 and 10)

12 Total Amount Due ..............................................................12

________________________________________

(Line 11, Col. B + Col. C)

Payment Method:

Also, enter this amount below on the voucher.

Electronic Funds Transfer

Check if Out-of-Business and enter the termination/sold date

Check Enclosed (If paying by check, enter the

total amount due from Line 10 on the Voucher,

I declare that this return (including accompanying schedules and statements) has been examined

Form VM-2V, and enclose the voucher and your

by me and to the best of my knowledge and belief is true, correct and complete.

check with your return.)

Check if Out-of-Business and enter the

termination/sold date

Signature

Date

Phone No.

Form VM-2APV

Virginia Vending Machine Dealer’s Sales Tax Voucher

.

(Doc ID 232)

Period

Due Date

Preparation Voucher (VM-2V)

0000000000000000 2328888 000000

•

If paying by check, enter the

total amount due

from Line 10 on the Voucher, Form VM-2V, and

enclose this voucher and your check with your

return.

Account Number

Name

Address

Total Amount Due

(Line 12 of above return.)

City, State, ZIP

.

Va. Dept. of Taxation VM-2APV W

Rev 07/10

6205210

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1