Gaa Schedule - Insurance Guaranty Association Credit - 2002

ADVERTISEMENT

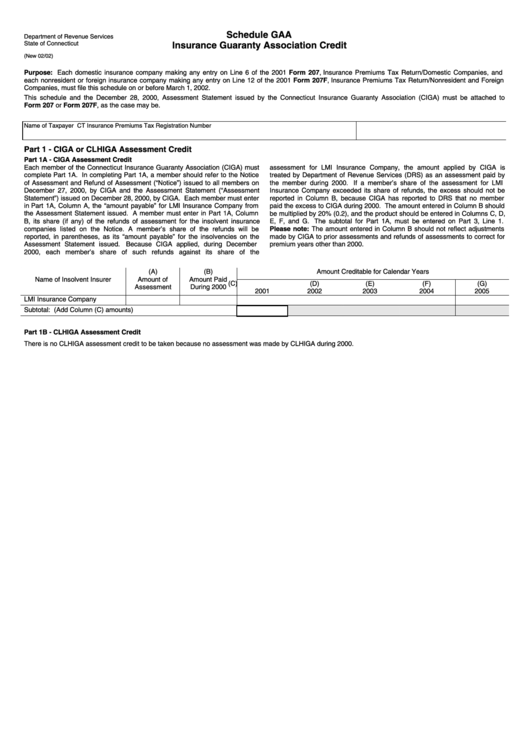

Schedule GAA

Department of Revenue Services

State of Connecticut

Insurance Guaranty Association Credit

(New 02/02)

Purpose: Each domestic insurance company making any entry on Line 6 of the 2001 Form 207, Insurance Premiums Tax Return/Domestic Companies, and

each nonresident or foreign insurance company making any entry on Line 12 of the 2001 Form 207F, Insurance Premiums Tax Return/Nonresident and Foreign

Companies, must file this schedule on or before March 1, 2002.

This schedule and the December 28, 2000, Assessment Statement issued by the Connecticut Insurance Guaranty Association (CIGA) must be attached to

Form 207 or Form 207F, as the case may be.

Name of Taxpayer

CT Insurance Premiums Tax Registration Number

Part 1 - CIGA or CLHIGA Assessment Credit

Part 1A - CIGA Assessment Credit

Each member of the Connecticut Insurance Guaranty Association (CIGA) must

assessment for LMI Insurance Company, the amount applied by CIGA is

complete Part 1A. In completing Part 1A, a member should refer to the Notice

treated by Department of Revenue Services (DRS) as an assessment paid by

of Assessment and Refund of Assessment (“Notice”) issued to all members on

the member during 2000. If a member’s share of the assessment for LMI

December 27, 2000, by CIGA and the Assessment Statement (“Assessment

Insurance Company exceeded its share of refunds, the excess should not be

Statement”) issued on December 28, 2000, by CIGA. Each member must enter

reported in Column B, because CIGA has reported to DRS that no member

in Part 1A, Column A, the “amount payable” for LMI Insurance Company from

paid the excess to CIGA during 2000. The amount entered in Column B should

the Assessment Statement issued. A member must enter in Part 1A, Column

be multiplied by 20% (0.2), and the product should be entered in Columns C, D,

B, its share (if any) of the refunds of assessment for the insolvent insurance

E, F, and G. The subtotal for Part 1A, must be entered on Part 3, Line 1.

companies listed on the Notice. A member’s share of the refunds will be

Please note: The amount entered in Column B should not reflect adjustments

reported, in parentheses, as its “amount payable” for the insolvencies on the

made by CIGA to prior assessments and refunds of assessments to correct for

Assessment Statement issued.

Because CIGA applied, during December

premium years other than 2000.

2000, each member’s share of such refunds against its share of the

(A)

(B)

Amount Creditable for Calendar Years

Name of Insolvent Insurer

Amount of

Amount Paid

(C)

(D)

(E)

(F)

(G)

Assessment

During 2000

2001

2002

2003

2004

2005

LMI Insurance Company

Subtotal: (Add Column (C) amounts)

Part 1B - CLHIGA Assessment Credit

There is no CLHIGA assessment credit to be taken because no assessment was made by CLHIGA during 2000.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2