Instructions For Form Nh-1040 - Business Profits Tax Return - 1999

ADVERTISEMENT

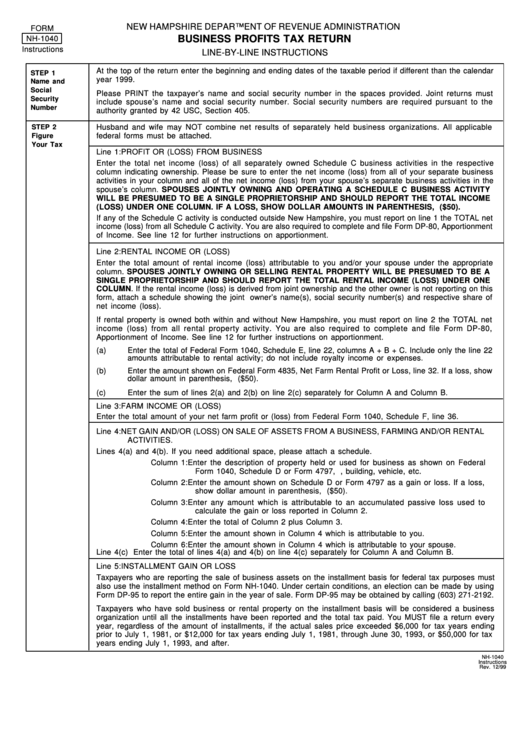

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

BUSINESS PROFITS TAX RETURN

NH-1040

Instructions

LINE-BY-LINE INSTRUCTIONS

At the top of the return enter the beginning and ending dates of the taxable period if different than the calendar

STEP 1

year 1999.

Name and

Social

Please PRINT the taxpayer’s name and social security number in the spaces provided. Joint returns must

Security

include spouse’s name and social security number. Social security numbers are required pursuant to the

Number

authority granted by 42 USC, Section 405.

STEP 2

Husband and wife may NOT combine net results of separately held business organizations. All applicable

Figure

federal forms must be attached.

Your Tax

Line 1:

PROFIT OR (LOSS) FROM BUSINESS

Enter the total net income (loss) of all separately owned Schedule C business activities in the respective

column indicating ownership. Please be sure to enter the net income (loss) from all of your separate business

activities in your column and all of the net income (loss) from your spouse’s separate business activities in the

spouse’s column. SPOUSES JOINTLY OWNING AND OPERATING A SCHEDULE C BUSINESS ACTIVITY

WILL BE PRESUMED TO BE A SINGLE PROPRIETORSHIP AND SHOULD REPORT THE TOTAL INCOME

(LOSS) UNDER ONE COLUMN. IF A LOSS, SHOW DOLLAR AMOUNTS IN PARENTHESIS, E.G. ($50).

If any of the Schedule C activity is conducted outside New Hampshire, you must report on line 1 the TOTAL net

income (loss) from all Schedule C activity. You are also required to complete and file Form DP-80, Apportionment

of Income. See line 12 for further instructions on apportionment.

Line 2:

RENTAL INCOME OR (LOSS)

Enter the total amount of rental income (loss) attributable to you and/or your spouse under the appropriate

column. SPOUSES JOINTLY OWNING OR SELLING RENTAL PROPERTY WILL BE PRESUMED TO BE A

SINGLE PROPRIETORSHIP AND SHOULD REPORT THE TOTAL RENTAL INCOME (LOSS) UNDER ONE

COLUMN. If the rental income (loss) is derived from joint ownership and the other owner is not reporting on this

form, attach a schedule showing the joint owner’s name(s), social security number(s) and respective share of

net income (loss).

If rental property is owned both within and without New Hampshire, you must report on line 2 the TOTAL net

income (loss) from all rental property activity. You are also required to complete and file Form DP-80,

Apportionment of Income. See line 12 for further instructions on apportionment.

(a)

Enter the total of Federal Form 1040, Schedule E, line 22, columns A + B + C. Include only the line 22

amounts attributable to rental activity; do not include royalty income or expenses.

(b)

Enter the amount shown on Federal Form 4835, Net Farm Rental Profit or Loss, line 32. If a loss, show

dollar amount in parenthesis, e.g. ($50).

(c)

Enter the sum of lines 2(a) and 2(b) on line 2(c) separately for Column A and Column B.

Line 3:

FARM INCOME OR (LOSS)

Enter the total amount of your net farm profit or (loss) from Federal Form 1040, Schedule F, line 36.

Line 4: NET GAIN AND/OR (LOSS) ON SALE OF ASSETS FROM A BUSINESS, FARMING AND/OR RENTAL

ACTIVITIES.

Lines 4(a) and 4(b). If you need additional space, please attach a schedule.

Column 1: Enter the description of property held or used for business as shown on Federal

Form 1040, Schedule D or Form 4797, e.g. land, building, vehicle, etc.

Column 2: Enter the amount shown on Schedule D or Form 4797 as a gain or loss. If a loss,

show dollar amount in parenthesis, e.g. ($50).

Column 3: Enter any amount which is attributable to an accumulated passive loss used to

calculate the gain or loss reported in Column 2.

Column 4: Enter the total of Column 2 plus Column 3.

Column 5: Enter the amount shown in Column 4 which is attributable to you.

Column 6: Enter the amount shown in Column 4 which is attributable to your spouse.

Line 4(c) Enter the total of lines 4(a) and 4(b) on line 4(c) separately for Column A and Column B.

Line 5:

INSTALLMENT GAIN OR LOSS

Taxpayers who are reporting the sale of business assets on the installment basis for federal tax purposes must

also use the installment method on Form NH-1040. Under certain conditions, an election can be made by using

Form DP-95 to report the entire gain in the year of sale. Form DP-95 may be obtained by calling (603) 271-2192.

Taxpayers who have sold business or rental property on the installment basis will be considered a business

organization until all the installments have been reported and the total tax paid. You MUST file a return every

year, regardless of the amount of installments, if the actual sales price exceeded $6,000 for tax years ending

prior to July 1, 1981, or $12,000 for tax years ending July 1, 1981, through June 30, 1993, or $50,000 for tax

years ending July 1, 1993, and after.

NH-1040

Instructions

Rev. 12/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3