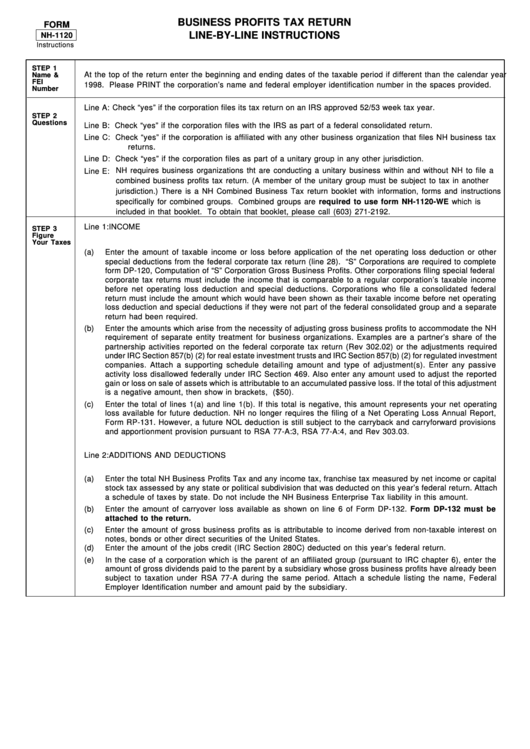

Instructions For Form Nh-1120 - Business Profits Tax Return

ADVERTISEMENT

BUSINESS PROFITS TAX RETURN

FORM

LINE-BY-LINE INSTRUCTIONS

NH-1120

Instructions

STEP 1

At the top of the return enter the beginning and ending dates of the taxable period if different than the calendar year

Name &

FEI

1998. Please PRINT the corporation’s name and federal employer identification number in the spaces provided.

Number

Check “yes” if the corporation files its tax return on an IRS approved 52/53 week tax year.

Line A:

STEP 2

Questions

Line B: Check “yes” if the corporation files with the IRS as part of a federal consolidated return.

Line C: Check “yes” if the corporation is affiliated with any other business organization that files NH business tax

returns.

Line D: Check “yes” if the corporation files as part of a unitary group in any other jurisdiction.

NH requires business organizations tht are conducting a unitary business within and without NH to file a

Line E:

combined business profits tax return. (A member of the unitary group must be subject to tax in another

jurisdiction.) There is a NH Combined Business Tax return booklet with information, forms and instructions

specifically for combined groups. Combined groups are required to use form NH-1120-WE which is

included in that booklet. To obtain that booklet, please call (603) 271-2192.

Line 1:

INCOME

STEP 3

Figure

Your Taxes

(a)

Enter the amount of taxable income or loss before application of the net operating loss deduction or other

special deductions from the federal corporate tax return (line 28). “S” Corporations are required to complete

form DP-120, Computation of “S” Corporation Gross Business Profits. Other corporations filing special federal

corporate tax returns must include the income that is comparable to a regular corporation’s taxable income

before net operating loss deduction and special deductions. Corporations who file a consolidated federal

return must include the amount which would have been shown as their taxable income before net operating

loss deduction and special deductions if they were not part of the federal consolidated group and a separate

return had been required.

(b)

Enter the amounts which arise from the necessity of adjusting gross business profits to accommodate the NH

requirement of separate entity treatment for business organizations. Examples are a partner’s share of the

partnership activities reported on the federal corporate tax return (Rev 302.02) or the adjustments required

under IRC Section 857(b) (2) for real estate investment trusts and IRC Section 857(b) (2) for regulated investment

companies. Attach a supporting schedule detailing amount and type of adjustment(s). Enter any passive

activity loss disallowed federally under IRC Section 469. Also enter any amount used to adjust the reported

gain or loss on sale of assets which is attributable to an accumulated passive loss. If the total of this adjustment

is a negative amount, then show in brackets, e.g. ($50).

(c)

Enter the total of lines 1(a) and line 1(b). If this total is negative, this amount represents your net operating

loss available for future deduction. NH no longer requires the filing of a Net Operating Loss Annual Report,

Form RP-131. However, a future NOL deduction is still subject to the carryback and carryforward provisions

and apportionment provision pursuant to RSA 77-A:3, RSA 77-A:4, and Rev 303.03.

Line 2:

ADDITIONS AND DEDUCTIONS

(a)

Enter the total NH Business Profits Tax and any income tax, franchise tax measured by net income or capital

stock tax assessed by any state or political subdivision that was deducted on this year’s federal return. Attach

a schedule of taxes by state. Do not include the NH Business Enterprise Tax liability in this amount.

(b)

Enter the amount of carryover loss available as shown on line 6 of Form DP-132. Form DP-132 must be

attached to the return.

(c)

Enter the amount of gross business profits as is attributable to income derived from non-taxable interest on

notes, bonds or other direct securities of the United States.

(d)

Enter the amount of the jobs credit (IRC Section 280C) deducted on this year’s federal return.

(e)

In the case of a corporation which is the parent of an affiliated group (pursuant to IRC chapter 6), enter the

amount of gross dividends paid to the parent by a subsidiary whose gross business profits have already been

subject to taxation under RSA 77-A during the same period. Attach a schedule listing the name, Federal

Employer Identification number and amount paid by the subsidiary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2