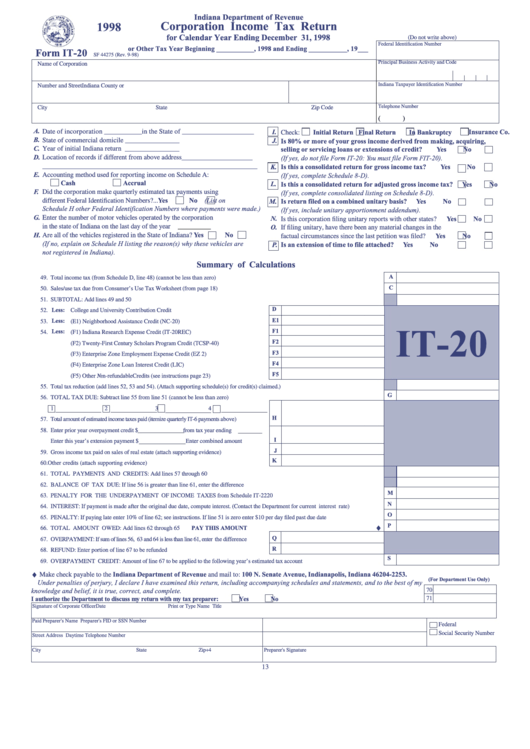

Indiana Department of Revenue

Corporation Income Tax Return

1998

for Calendar Year Ending December 31, 1998

(Do not write above)

Federal Identification Number

or Other Tax Year Beginning ___________, 1998 and Ending ___________, 19___

Form IT-20

SF 44275 (Rev. 9-98)

Principal Business Activity and Code

Name of Corporation

Indiana Taxpayer Identification Number

Number and Street

Indiana County or O.O.S.

Telephone Number

City

State

Zip Code

(

)

A.

I.

Insurance Co.

Initial Return

Final Return

In Bankruptcy

Date of incorporation ___________in the State of _____________________

Check:

B.

J.

Is 80% or more of your gross income derived from making, acquiring,

State of commercial domicile ________________

C.

selling or servicing loans or extensions of credit?...................

Yes

No

Year of initial Indiana return ________________

D.

(If yes, do not file Form IT-20: You must file Form FIT-20).

Location of records if different from above address_____________________

K.

Is this a consolidated return for gross income tax?.................

Yes

No

_____________________________________________________________

E.

(If yes, complete Schedule 8-D).

Accounting method used for reporting income on Schedule A:

Cash

Accrual

L.

Is this a consolidated return for adjusted gross income tax?....

Yes

No

F.

(If yes, complete consolidated listing on Schedule 8-D).

Did the corporation make quarterly estimated tax payments using

Yes

No (List on

M.

Is return filed on a combined unitary basis?..............................

Yes

No

different Federal Identification Numbers?...

Schedule H other Federal Identification Numbers where payments were made.)

(If yes, include unitary apportionment addendum).

G.

N.

Enter the number of motor vehicles operated by the corporation

Yes

No

Is this corporation filing unitary reports with other states?.............

in the state of Indiana on the last day of the year

O.

If filing unitary, have there been any material changes in the

H.

Yes

No

Are all of the vehicles registered in the State of Indiana?........

Yes

No

factual circumstances since the last petition was filed?...................

(If no, explain on Schedule H listing the reason(s) why these vehicles are

P.

Is an extension of time to file attached?......................................

Yes

No

not registered in Indiana).

Summary of Calculations

A

49.

Total income tax (from Schedule D, line 48) (cannot be less than zero) .................................................................................................................

C

50.

Sales/use tax due from Consumer’s Use Tax Worksheet (from page 18) ................................................................................................................

51.

SUBTOTAL: Add lines 49 and 50 ...........................................................................................................................................................................

D

Less:

52.

College and University Contribution Credit ..............................................................

E1

Less:

53.

(E1) Neighborhood Assistance Credit (NC-20) ........................................................

IT-20

F1

Less:

54.

(F1) Indiana Research Expense Credit (IT-20REC) .................................................

F2

(F2) Twenty-First Century Scholars Program Credit (TCSP-40) ..............................

F3

(F3) Enterprise Zone Employment Expense Credit (EZ 2) ......................................

F4

(F4) Enterprise Zone Loan Interest Credit (LIC) ......................................................

F5

(F5) Other Non-refundableCredits (see instructions page 23) ...................................

55.

Total tax reduction (add lines 52, 53 and 54). (Attach supporting schedule(s) for credit(s) claimed.) ....................................................................

G

56.

TOTAL TAX DUE: Subtract line 55 from line 51 (cannot be less than zero) ........................................................................................................

1

2

3

4

H

57.

Total amount of estimated income taxes paid (itemize quarterly IT-6 payments above) ..................

58.

Enter prior year overpayment credit $

from tax year ending

I

Enter this year’s extension payment $

Enter combined amount ............

J

59.

Gross income tax paid on sales of real estate (attach supporting evidence) ............................

K

60.

Other credits (attach supporting evidence)..................................................................................

61.

TOTAL PAYMENTS AND CREDITS: Add lines 57 through 60 ......................................................................................................................

62.

BALANCE OF TAX DUE: If line 56 is greater than line 61, enter the difference ..............................................................................................

M

63.

PENALTY FOR THE UNDERPAYMENT OF INCOME TAXES from Schedule IT-2220 ..........................................................................

N

64.

INTEREST: If payment is made after the original due date, compute interest. (Contact the Department for current interest rate) ....................

O

65.

PENALTY: If paying late enter 10% of line 62; see instructions. If line 51 is zero enter $10 per day filed past due date ....................................

♦

P

PAY THIS AMOUNT

66.

TOTAL AMOUNT OWED: Add lines 62 through 65 ........................................................................................

Q

67.

OVERPAYMENT: If sum of lines 56, 63 and 64 is less than line 61, enter the difference ...........

R

68.

REFUND: Enter portion of line 67 to be refunded .................................................................

S

69.

OVERPAYMENT CREDIT: Amount of line 67 to be applied to the following year’s estimated tax account .....................................................

♦

Make check payable to the Indiana Department of Revenue and mail to: 100 N. Senate Avenue, Indianapolis, Indiana 46204-2253.

(For Department Use Only)

Under penalties of perjury, I declare I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

70

I authorize the Department to discuss my return with my tax preparer:

Yes

No

71

Signature of Corporate Officer

Date

Print or Type Name

Title

Paid Preparer's Name

Preparer's FID or SSN Number

Federal I.D. Number

Social Security Number

Street Address

Daytime Telephone Number

City

State

Zip+4

Preparer's Signature

13

1

1 2

2