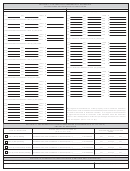

SECTION V - FOR AREAS NOT RESIDENTIALLY DISTRESSED

PERCENTAGES AND AMOUNTS OF DEDUCTIONS

YEAR OF DEDUCTION / PERCENTAGE / AMOUNT OF DEDUCTION

YEAR OF DEDUCTION / PERCENTAGE / AMOUNT OF DEDUCTION

(1) For deductions allowed over a 1 year period:

(8) For deductions allowed over a eight (8) year period:

1st

pay

100% $

1st

pay

100% $

2nd

pay

88%

$

(2) For deductions allowed over a two (2) year period:

3rd

pay

75%

$

1st

pay

100% $

4th

pay

63%

$

2nd

pay

50%

$

5th

pay

50%

$

6th

pay

38%

$

(3) For deductions allowed over a three (3) year period:

7th

pay

25%

$

1st

pay

100% $

8th

pay

13%

$

2nd

pay

66%

$

(9) For deductions allowed over a nine (9) year period:

3rd

pay

33%

$

1st

pay

100% $

(4) For deductions allowed over a four (4) year period:

2nd

pay

88%

$

1st

pay

100% $

3rd

pay

77%

$

2nd

pay

75%

$

4th

pay

66%

$

3rd

pay

50%

$

5th

pay

55%

$

4th

pay

25%

$

6th

pay

44%

$

7th

pay

33%

$

(5) For deductions allowed over a five (5) year period:

8th

pay

22%

$

1st

pay

100% $

9th

pay

11%

$

2nd

pay

80%

$

(10) For deductions allowed over a ten (10) year period:

3rd

pay

60%

$

4th

pay

40%

$

1st

pay

100% $

5th

pay

20%

$

2nd

pay

95%

$

3rd

pay

80%

$

(6) For deductions allowed over a six (6) year period:

4th

pay

65%

$

1st

pay

100% $

5th

pay

50%

$

2nd

pay

85%

$

6th

pay

40%

$

3rd

pay

66%

$

7th

pay

30%

$

4th

pay

50%

$

8th

pay

20%

$

5th

pay

34%

$

9th

pay

10%

$

6th

pay

17%

$

10th

pay

5%

$

(7) For deductions allowed over a seven (7) year period:

1st

pay

100% $

2nd

pay

85%

$

If a general reassessment of real property occurs within the deduction

3rd

pay

71%

$

period, the amount of the deduction shall be adjusted to reflect the percentage

4th

pay

57%

$

increase or decrease in assessed valuation. If an appeal of an assessment

5th

pay

43%

$

is approved that results in a reduction of the assessed value, the deduction

6th

pay

29%

$

amount shall be adjusted to reflect the percentage decrease that resulted

7th

pay

14%

$

from the appeal. (IC 6-1.1-12.1-4 (b))

SECTION VI - FOR RESIDENTIALLY DISTRESSED AREAS (AS DEFINED BY IC 6-1.1-12.1-2b-d)

AMOUNT OF DEDUCTION

DEDUCTION IS ALLOWED FOR A FIVE (5)

DEDUCTION IS THE LESSER OF:

TYPE OF DWELLING

YEAR PERIOD WHICH INCLUDES

(IC 6-1.1-12.1-4.16)

YEARS:

One (1) family dwelling

Assessed value (after rehabilitation or redevelopment) $___________ or $74,880 AV

_____ pay _____ through _____ pay _____

Two (2) family dwelling

Assessed value (after rehabilitation or redevelopment) $___________ or $106,080 AV

_____ pay _____ through _____ pay _____

Three (3) unit multifamily dwelling

Assessed value (after rehabilitation or redevelopment) $___________ or $156,000 AV

_____ pay _____ through _____ pay _____

Four (4) unit multifamily dwelling

Assessed value (after rehabilitation or redevelopment) $___________ or $199,680 AV

_____ pay _____ through _____ pay _____

Assessed value limits for taxes due and payable prior to January 1, 2005 were $36,000, $51,000, $75,000, and $96,000 for one to four family dwellings respectively.

SECTION VII - APPROVAL OF COUNTY AUDITOR (COMPLETE ONLY IF APPROVED)

This application is approved in the amounts shown above.

Signature of County Auditor

Date signed

1

1 2

2