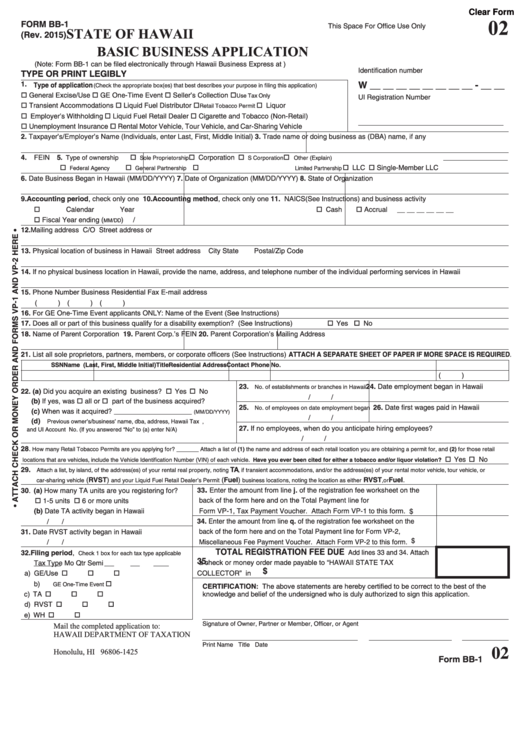

Clear Form

02

FORM BB-1

This Space For Office Use Only

STATE OF HAWAII

(Rev. 2015)

BASIC BUSINESS APPLICATION

(Note: Form BB-1 can be filed electronically through Hawaii Business Express at hbe.ehawaii.gov)

Identification number

TYPE OR PRINT LEGIBLY

W __ __ __ __ __ __ __ __ - __ __

1. Type of application (Check the appropriate box(es) that best describes your purpose in filing this application)

General Excise/Use

GE One-Time Event

Seller’s Collection

Use Tax Only

UI Registration Number

Transient Accommodations

Liquid Fuel Distributor

Retail Tobacco Permit

Liquor

Employer’s Withholding

Liquid Fuel Retail Dealer Cigarette and Tobacco (Non-Retail)

Unemployment Insurance

Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle

2. Taxpayer’s/Employer’s Name (Individuals, enter Last, First, Middle Initial)

3. Trade name or doing business as (DBA) name, if any

Type of ownership

4. FEIN

5.

Sole Proprietorship

Corporation

S Corporation Other (Explain)

Federal Agency

General Partnership Limited Partnership LLC

Single-Member LLC

6. Date Business Began in Hawaii (MM/DD/YYYY) 7. Date of Organization (MM/DD/YYYY)

8. State of Organization

9. Accounting period, check only one

10. Accounting method, check only one

11. NAICS(See Instructions) and business activity

Calendar Year

Cash

Accrual

__ __ __ __ __ __

Fiscal Year ending (

)

/

MM/DD

12. Mailing address

C/O

Street address or P.O. Box

City

State

Postal/Zip Code

13. Physical location of business in Hawaii

Street address

City

State

Postal/Zip Code

14. If no physical business location in Hawaii, provide the name, address, and telephone number of the individual performing services in Hawaii

15. Phone Number

Business

Residential

Fax

E-mail address

(

)

(

)

(

)

16. For GE One-Time Event applicants ONLY: Name of the Event (See Instructions)

17. Does all or part of this business qualify for a disability exemption?

(See Instructions)

Yes

No

18. Name of Parent Corporation

19. Parent Corp.’s FEIN

20. Parent Corporation’s Mailing Address

21. List all sole proprietors, partners, members, or corporate officers (See Instructions) ATTACH A SEPARATE SHEET OF PAPER IF MORE SPACE IS REQUIRED.

SSN

Name (Last, First, Middle Initial)

Title

Residential Address

Contact Phone No.

(

)

23. No. of establishments or branches in Hawaii 24. Date employment began in Hawaii

22. (a) Did you acquire an existing business? Yes No

/

/

(b) If yes, was all or part of the business acquired?

25. No. of employees on date employment began 26. Date first wages paid in Hawaii

(c) When was it acquired? ____________________

(MM/DD/YYYY)

/

/

(d) Previous owner’s/business’ name, dba, address, Hawaii Tax I.D. No.,

27. If no employees, when do you anticipate hiring employees?

and UI Account No. (If you answered “No” to (a) enter N/A)

/

/

28. How many Retail Tobacco Permits are you applying for? _______ Attach a list of (1) the name and address of each retail location you are obtaining a permit for, and (2) for those retail

locations that are vehicles, include the Vehicle Identification Number (VIN) of each vehicle. Have you ever been cited for either a tobacco and/or liquor violation? Yes No

29. Attach a list, by island, of the address(es) of your rental real property, noting TA, if transient accommodations, and/or the address(es) of your rental motor vehicle, tour vehicle, or

car-sharing vehicle (RVST) and your Liquid Fuel Retail Dealer’s Permit (Fuel) business locations, noting the location as either RVST, or Fuel.

.

33

Enter the amount from line j. of the registration fee worksheet on the

30. (a) How many TA units are you registering for?

back of the form here and on the Total Payment line for

1-5 units

6 or more units

(b) Date TA activity began in Hawaii

Form VP-1, Tax Payment Voucher. Attach Form VP-1 to this form.

$

34.

Enter the amount from line q. of the registration fee worksheet on the

/

/

31. Date RVST activity began in Hawaii

back of the form here and on the Total Payment line for Form VP-2,

$

Miscellaneous Fee Payment Voucher. Attach Form VP-2 to this form.

/

/

TOTAL REGISTRATION FEE DUE

32. Filing period, Check 1 box for each tax type applicable

Add lines 33 and 34. Attach

35.

Tax Type

Mo

Qtr

Semi

a check or money order made payable to “HAWAII STATE TAX

$

COLLECTOR” in U.S. dollars drawn on any U. S. Bank

a) GE/Use

b) GE One-Time Event

CERTIFICATION: The above statements are hereby certified to be correct to the best of the

c) TA

knowledge and belief of the undersigned who is duly authorized to sign this application.

d) RVST

e) WH

Mail the completed application to:

Signature of Owner, Partner or Member, Officer, or Agent

HAWAII DEPARTMENT OF TAXATION

P.O. Box 1425

Print Name

Title

Date

02

Honolulu, HI 96806-1425

Form BB-1

1

1 2

2