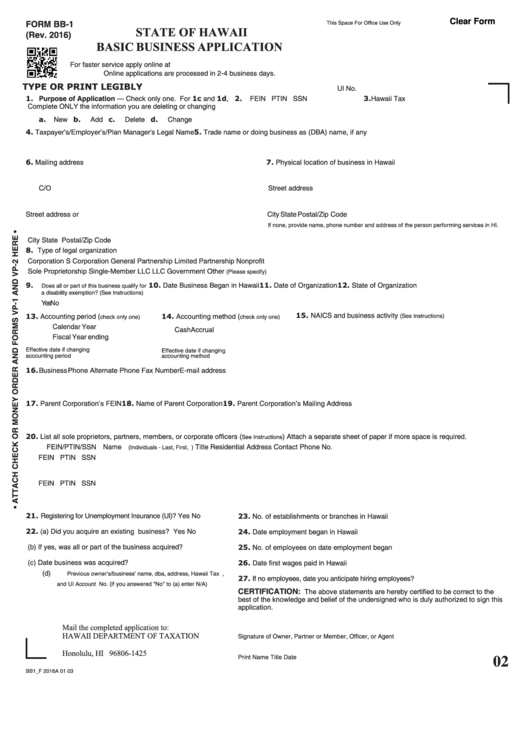

Clear Form

FORM BB-1

This Space For Office Use Only

STATE OF HAWAII

(Rev. 2016)

BASIC BUSINESS APPLICATION

For faster service apply online at https://tax.hawaii.gov/eservices/business

Online applications are processed in 2-4 business days.

TYPE OR PRINT LEGIBLY

UI No.

2.

1. Purpose of Application — Check only one. For 1c and 1d,

3. Hawaii Tax I.D. No.

FEIN

PTIN

SSN

Complete ONLY the information you are deleting or changing

a.

New b.

Add c.

Delete d.

Change

4. Taxpayer’s/Employer’s/Plan Manager's Legal Name

5. Trade name or doing business as (DBA) name, if any

6. Mailing address

7. Physical location of business in Hawaii

C/O

Street address

Street address or P.O. Box

City State

Postal/Zip Code

If none, provide name, phone number and address of the person performing services in HI.

City State

Postal/Zip Code

8. Type of legal organization

Corporation

S Corporation

General Partnership

Limited Partnership

Nonprofit

Sole Proprietorship

Single-Member LLC

LLC

Government

Other (Please specify)

9.

10. Date Business Began in Hawaii

11. Date of Organization

12. State of Organization

Does all or part of this business qualify for

a disability exemption? (See Instructions)

Yes

No

15. NAICS and business activity (See Instructions)

13. Accounting period (check only one)

14. Accounting method (check only one)

Calendar Year

Cash

Accrual

Fiscal Year ending

Effective date if changing

Effective date if changing

accounting period

accounting method

16. Business Phone

Alternate Phone

Fax Number

E-mail address

17. Parent Corporation’s FEIN

18. Name of Parent Corporation

19. Parent Corporation’s Mailing Address

20. List all sole proprietors, partners, members, or corporate officers (See Instructions) Attach a separate sheet of paper if more space is required.

FEIN/PTIN/SSN

Name (Individuals - Last, First, M.I.)

Title

Residential Address

Contact Phone No.

FEIN

PTIN

SSN

FEIN

PTIN

SSN

21. Registering for Unemployment Insurance (UI)?

23. No. of establishments or branches in Hawaii

Yes

No

22. (a) Did you acquire an existing business?

24. Date employment began in Hawaii

Yes

No

25. No. of employees on date employment began

(b) If yes, was

all or

part of the business acquired?

26. Date first wages paid in Hawaii

(c) Date business was acquired?

(d) Previous owner’s/business’ name, dba, address, Hawaii Tax I.D. No.,

27. If no employees, date you anticipate hiring employees?

and UI Account No. (If you answered “No” to (a) enter N/A)

CERTIFICATION:

The above statements are hereby certified to be correct to the

best of the knowledge and belief of the undersigned who is duly authorized to sign this

application.

Mail the completed application to:

HAWAII DEPARTMENT OF TAXATION

Signature of Owner, Partner or Member, Officer, or Agent

P.O. Box 1425

Honolulu, HI 96806-1425

02

Print Name

Title

Date

BB1_F 2016A 01 03

1

1 2

2 3

3