Publication 957 - Reporting Back Pay And Special Wage Payments To The Social Security Administration - Internal Revenue Service Page 13

ADVERTISEMENT

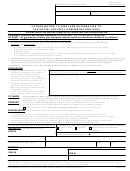

Table 3. Sample—Paper Listing for Reporting Special Wage Payments to Several

Employees

Report of Special Wage Payments

Tax Year:

Page

of

A. Employer Name:

EIN:

Address:

Contact Name:

Phone: (

)

.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1) B. Employee Name: (Last)

(First)

(MI)

C. SSN:

D. SWP:$

E. Type:

Other:

2) B. Employee Name: (Last)

(First)

(MI)

C. SSN:

D. SWP:$

E. Type:

Other:

3) B. Employee Name: (Last)

(First)

(MI)

C. SSN:

D. SWP:$

E. Type:

Other:

4) B. Employee Name: (Last)

(First)

(MI)

C. SSN:

D. SWP:$

E. Type:

Other:

5) B. Employee Name: (Last)

(First)

(MI)

C. SSN:

D. SWP:$

E. Type:

Other:

INSTRUCTIONS:

Enter tax year and page number.

A. Employer name, employer identification number (EIN), address, the name of a contact person, and a phone number where the contact

person can be reached during normal business hours.

B. Employee's name.

C. Employee's social security number (SSN).

D. Total amount of special wage payments made to the employee.

E. Type of special wage payment from the following list: (1) Vacation Pay, (2) Sick Pay, (3) Severance Pay,

(4) Bonus, (5) Deferred Compensation, (6) Stock Options, and (7) Other—Please explain.

Do not use a paper listing for nonqualified deferred compensation and section 457 plan deferrals and payments that could not be

reported in block 11 of Form W-2. (Get Form SSA-131.)

Page 12

Publication 957 (January 2013)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13