Publication 957 - Reporting Back Pay And Special Wage Payments To The Social Security Administration - Internal Revenue Service Page 8

ADVERTISEMENT

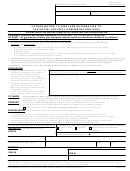

Instructions for Form SSA–131

EMPLOYER INSTRUCTIONS FOR COMPLETING SPECIAL WAGE PAYMENT FORM

1.

Provide the EIN that was used or will be used to report the employee's wages on the Form W-2.

2.

Enter the date the employee retired. Enter “Not Retired” if the employee has not retired.

3.

Enter the date that the employee last performed services; was not expected to return to work; and was not subject to

recall to render additional services. This date should be the same as or earlier than the date in item “2”. Enter “Not

Retired” if the employee has not retired.

4.

Enter the wages that were paid to the employee in the tax year that were for services that were performed in years prior

to the tax year or that were paid on account of retirement.

Examples (not all inclusive) of payments to be included:

Payments in lieu of vacation that were earned in a year prior to the tax year.

Accumulated sick payments which were paid in a lump sum based on “retirement” as the sole condition of payment.

Accumulated sick payments paid at or after the date in item 3, which were earned in a year prior to the tax year.

Payments “on account of retirement”–dismissal, severance or termination pay paid because of retirement.

Bonuses which are paid pursuant to a prior contract, agreement or promise causing the employee to expect such

payments regularly; or announced to induce the employee to work more steadily, rapidly or efficiently or to remain

with the employer.

Stock Options.

Do not include in item “4” payments:

For annual, sick, holiday, or vacation pay if used (absence from work) prior to the date of retirement (earlier of items

“2” or “3”).

That were reported or will be reported under “Nonqualified Plans” on the Form W-2.

That were deducted from the employee's wages and paid to a deferred compensation plan (e.g., 401k).

Employees health and dental plan benefits (non-covered/non-taxable for Social Security Wages).

Bonuses earned and paid in the tax year.

5.

Check whether payments listed in item 4 will be made for years after the tax year. If yes, please show the amounts and

years in which these will be paid, if known.

6.

Nonqualified deferred compensation and section 457 plans only. If you were unable to report nonqualified

deferred compensation or section 457 plan payments and deferrals (contributions) on Form W-2 because both

payments and deferrals occurred during the year, show the amount of wages earned by the employee during the tax

year. Generally, the wages earned will be the compensation reported in block 1 of Form W-2 less payments from a

nonqualified deferred compensation (or 457) plan, but including any amounts deferred under the plan during the tax

year (See IRS Publication 957).

Paperwork/Privacy Act Notice: This report is authorized by regulation 20 CFR 404.702. The information that you provide

will be used in making a determination regarding the amount of Social Security benefits payable to the above named

individual. While your response is voluntary, if you do not respond we may not be able to make a correct determination

regarding the amount of Social Security benefits payable to the above named individual for the year in question.

We may also use the information you give us when we match records by computer. Matching programs compare our records

with those of other Federal, State, or local government agencies. Many agencies may use matching programs to find or

prove that a person qualifies for benefits paid by the Federal Government. The law allows us to do this even if you do not

agree to it. Explanations about these and other reasons why information you provide us may be used or given out are

available in Social Security Offices. If you want to learn more about this, contact any Social Security Office.

The Paperwork Reduction Act: This information collection meets the clearance requirements of 44 U.S.C. §3507, as

amended by Section 2 of the Paperwork Reduction Act of 1995. You are not required to answer these questions unless we

display a valid Office of Management and Budget control number. We estimate that it will take you about 20 minutes to read

the instructions, gather the necessary facts, and answer the questions.

Form SSA-131 (8-2001) EF (06-2002)

Submit Form SSA-131 to the SSA office nearest your

Do not report payments from nonqualified defer-

place of business. Or, the employee can submit it to the

red compensation or section 457 plans that were

!

SSA office handling the claim. You or the employee must

reported in box 11 of Form W-2. Use Form

CAUTION

submit this form before the SSA can exclude the special

SSA-131 if deferrals to and payments from nonqualified or

wage payments for purposes of the earnings test. If re-

section 457 plans occurred during the tax year.

porting on more than one employee, complete a separate

Form SSA-131 for each employee or use the paper listing

Reporting Nonstatutory

format (except for reporting nonqualified and section 457

(Nonqualified) Stock Options as

plan deferrals and payments) in Table 3.

Special Wage Payments

A nonstatutory (nonqualified) option to purchase stock

which is exercised in a year after the year in which the op-

tion was earned is a special wage payment. It should not

Publication 957 (January 2013)

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13