Publication 957 - Reporting Back Pay And Special Wage Payments To The Social Security Administration - Internal Revenue Service Page 5

ADVERTISEMENT

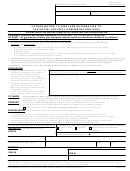

Table 1. Format for Report (Under Covering Letter) to Request SSA to Allocate Back Pay

Under Statute Wages

Employer's EIN: xx-xxxxxxx

Tax Year in Which Award Payment Was Paid: 2012

(1)

(2)

(3)

(4)

1

2,3

3

SSN and

Award Amount and

Other Soc. Sec./Med. Wages Paid

Allocation

Employee Name

Period(s)

In Award Year

Soc. Sec.

Med./MQGE

Year

Soc. Sec.

Med./MQGE

xxx-xx-xxxx

$100,000

$40,000

$40,000

2009

$20,000

$20,000

HELEN T. SMITH

1/2009 - 12/2012

2010

25,000

25,000

2011

27,000

27,000

2012

28,000

28,000

xxx-xx-xxxx

30,000

-0-

-0-

1989

6,000

SAM W. EVANS

7/89-12/91

1990

12,000

1991

12,000

xxx-xx-xxxx

15,000

-0-

-0-

9/80

3,500

ROLAND S.

7/80-12/81

12/80

3,500

ADAMS

1981

8,000

Exclude amounts specifically designated as damages, penalties, etc.

1

Exclude the amount of back pay, if any, included in that amount.

2

For periods before January 1, 1978 (and for state and local government (Section 218) employers before January 1, 1981), show the wage amounts by calendar

3

quarters. The social security and/or Medicare Qualified Government Employment (MQGE) wages (where applicable) must be shown separately FOR ALL YEARS.

(Wages subject ONLY to MQGE would be shown in the Medicare/MQGE column; no wages would be shown in the Soc. Sec. column.) For tax years 1991 and later,

the social security and Medicare wages must be listed separately.

Explanation of examples.

Helen T. Smith–The back pay award, excluding interest, was $100,000 for the periods 1/2009-12/2012. In 2012, this employee was also paid

$40,000 in other wages. (Her Form W-2 for 2012 reported $110,100 for social security and $140,000 for Medicare. The SSA allocation will result in

adjusted posted wages of $68,000 for social security and $68,000 for Medicare for 2012.)

Sam W. Evans–The back pay award was $30,000 for the periods 7/89-12/91. This employee was hired in 1989 and was subject to MQGE only. He

was no longer employed by this governmental employer in 2012. (His Form W-2 for 2012 reported $30,000 for social security and $30,000 for

Medicare. After the SSA allocation, he will not have any net posted wages for 2012.)

Roland S. Adams–The back pay award was $15,000 for the periods 7/80-12/81. He was no longer employed by this state and local government

(Section 218) employer in 2012. (His Form W-2 for 2012 reported $15,000 for social security and $15,000 for Medicare; after the SSA allocation, he

will not have any net posted wages for 2012.)

If the state Social Security Administrator's office

reported to the SSA. Special wage payments may include

needs more information, they can contact the

(but are not limited to):

SSA at the following address:

Accumulated sick and vacation pay,

Back pay,

Social Security Administration

Office of Income Security Programs

Bonuses,

Office of Earnings and Program Integrity Policy

Deferred compensation,

6401 Security Boulevard 2506 OPS

Baltimore, MD 21235

Payments because of retirement,

Sales commissions,

2. Special Wage Payments

Severance pay, and

Stock options.

A special wage payment (SWP) is an amount paid by an

employer to an employee (or former employee) for serv-

Note. Payments made after retirement that are part of

ices performed in a prior year. Employers should report to

the normal payroll cycle should not be routinely reported

the SSA special wage payments made to employees and

as special wage payments.

former employees who are recipients of social security re-

tirement benefits. Special wage payments made to a re-

Earnings Test. Benefits paid to a social security benefi-

tired employee receiving social security or to an employee

ciary under full retirement age may be reduced if the ben-

who continues to work while receiving social security ben-

eficiary continues to work. The SSA uses the information

efits may reduce the benefits the individual receives if not

in boxes 1, 3, and 5 of Form W-2 to determine the

Page 4

Publication 957 (January 2013)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13