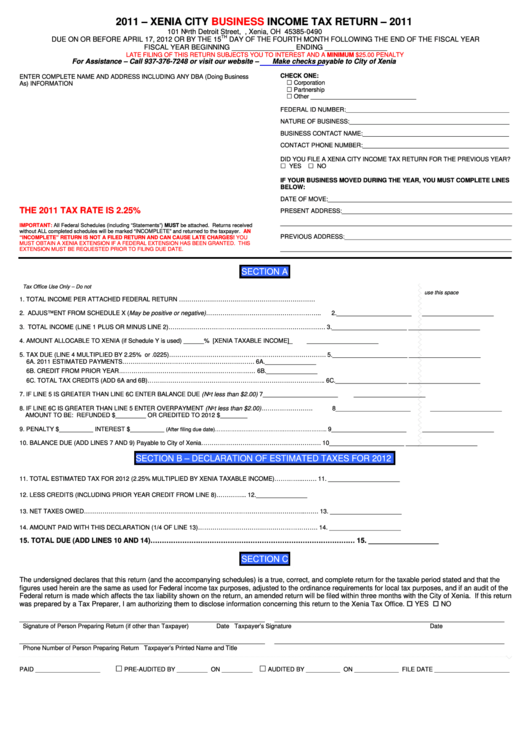

Form R-B - Business Income Tax Return - Xena City, 2011

ADVERTISEMENT

2011 – XENIA CITY

BUSINESS

INCOME TAX RETURN – 2011

101 North Detroit Street, P.O. Box 490, Xenia, OH 45385-0490

TH

DUE ON OR BEFORE APRIL 17, 2012 OR BY THE 15

DAY OF THE FOURTH MONTH FOLLOWING THE END OF THE FISCAL YEAR

FISCAL YEAR BEGINNING ________________ ENDING ________________

LATE FILING OF THIS RETURN SUBJECTS YOU TO INTEREST AND A MINIMUM $25.00 PENALTY

For Assistance – Call 937-376-7248 or visit our website –

Make checks payable to City of Xenia

CHECK ONE:

ENTER COMPLETE NAME AND ADDRESS INCLUDING ANY DBA (Doing Business

Corporation

As) INFORMATION

Partnership

Other _______________________________

FEDERAL ID NUMBER:________________________________________________

NATURE OF BUSINESS:_______________________________________________

BUSINESS CONTACT NAME:___________________________________________

CONTACT PHONE NUMBER:___________________________________________

DID YOU FILE A XENIA CITY INCOME TAX RETURN FOR THE PREVIOUS YEAR?

YES

NO

IF YOUR BUSINESS MOVED DURING THE YEAR, YOU MUST COMPLETE LINES

BELOW:

DATE OF MOVE:______________________________________________________

THE 2011 TAX RATE IS 2.25%

PRESENT ADDRESS:__________________________________________________

____________________________________________________________________

IMPORTANT:

All Federal Schedules (including “Statements”) MUST be attached. Returns received

without ALL completed schedules will be marked “INCOMPLETE” and returned to the taxpayer.

AN

PREVIOUS ADDRESS:_________________________________________________

“INCOMPLETE” RETURN IS NOT A FILED RETURN AND CAN CAUSE LATE CHARGES! YOU

MUST OBTAIN A XENIA EXTENSION IF A FEDERAL EXTENSION HAS BEEN GRANTED. THIS

____________________________________________________________________

EXTENSION MUST BE REQUESTED PRIOR TO FILING DUE DATE.

SECTION A

Tax Office Use Only – Do not

use this space

1. TOTAL INCOME PER ATTACHED FEDERAL RETURN ………………………………………………………….....

1.______________________

_____________________

2. ADJUSTMENT FROM SCHEDULE X (May be positive or negative)………………………………………………..

2.______________________

_____________________

3. TOTAL INCOME (LINE 1 PLUS OR MINUS LINE 2)………………………………………………………………….

3.______________________

_____________________

4. AMOUNT ALLOCABLE TO XENIA (if Schedule Y is used) ______% [XENIA TAXABLE INCOME]...................

4.______________________

_____________________

5. TAX DUE (LINE 4 MULTIPLIED BY 2.25% or .0225)………………………………………………………………….

5.______________________

_____________________

6A. 2011 ESTIMATED PAYMENTS……………………………………………………….

6A._______________

6B. CREDIT FROM PRIOR YEAR…………………………………………………………

6B._______________

6C. TOTAL TAX CREDITS (ADD 6A and 6B)…………………………………………………………………………..

6C._____________________

_____________________

7. IF LINE 5 IS GREATER THAN LINE 6C ENTER BALANCE DUE (Not less than $2.00)

7______________________

_____________________

8. IF LINE 6C IS GREATER THAN LINE 5 ENTER OVERPAYMENT (Not less than $2.00)…………………….

8______________________

_____________________

AMOUNT TO BE: REFUNDED $_________ OR CREDITED TO 2012 $________

9. PENALTY $__________ INTEREST $__________

9______________________

_____________________

(After filing due date)……………………………………………………...

10. BALANCE DUE (ADD LINES 7 AND 9) Payable to City of Xenia………………………………………………….

10______________________

_____________________

SECTION B – DECLARATION OF ESTIMATED TAXES FOR 2012

11. TOTAL ESTIMATED TAX FOR 2012 (2.25% MULTIPLIED BY XENIA TAXABLE INCOME)…………..…….

11. _____________________

12. LESS CREDITS (INCLUDING PRIOR YEAR CREDIT FROM LINE 8)…………...

12._______________

13. NET TAXES OWED……………………………………………………………………………………………..…….

13. _____________________

14. AMOUNT PAID WITH THIS DECLARATION (1/4 OF LINE 13)………………………………………………….

14. _____________________

15. TOTAL DUE (ADD LINES 10 AND 14)………………………………………………………………………………

15. __________________

SECTION C

The undersigned declares that this return (and the accompanying schedules) is a true, correct, and complete return for the taxable period stated and that the

figures used herein are the same as used for Federal income tax purposes, adjusted to the ordinance requirements for local tax purposes, and if an audit of the

Federal return is made which affects the tax liability shown on the return, an amended return will be filed within three months with the City of Xenia. If this return

was prepared by a Tax Preparer, I am authorizing them to disclose information concerning this return to the Xenia Tax Office. YES NO

_______________________________________________________________

___________________________________________________________

Signature of Person Preparing Return (if other than Taxpayer)

Date

Taxpayer’s Signature

Date

_______________________________________________________________

___________________________________________________________

Phone Number of Person Preparing Return

Taxpayer’s Printed Name and Title

PAID ___________________

PRE-AUDITED BY _________ ON _________

AUDITED BY __________ ON _____________ FILE DATE ______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2