Form R-B - Business Income Tax Return - City Of Dayton

ADVERTISEMENT

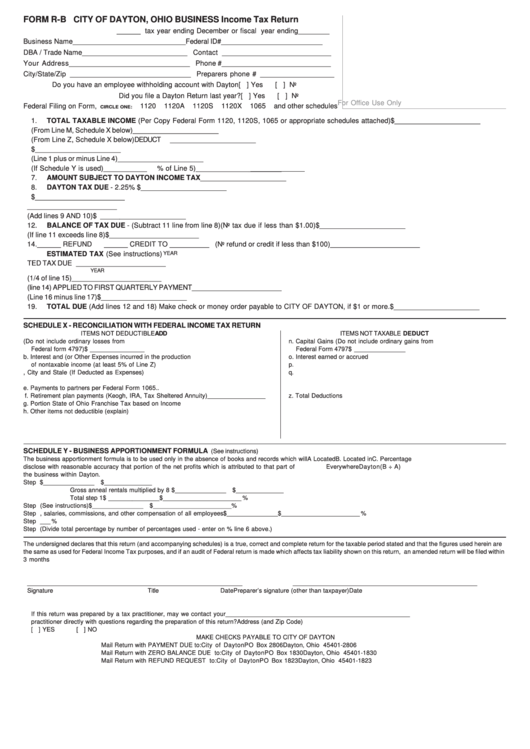

FORM R-B CITY OF DAYTON, OHIO BUSINESS Income Tax Return

______ tax year ending December or fiscal year ending ________

Business Name _____________________________ Federal ID# __________________________

DBA / Trade Name ___________________________ Contact ____________________________

Your Address _______________________________ Phone # ____________________________

City/State/Zip _______________________________ Preparers phone # ___________________

Do you have an employee withholding account with Dayton

[ ] Yes

[ ] No

Did you file a Dayton Return last year?

[ ] Yes

[ ] No

For Office Use Only

Federal Filing on Form,

1120

1120A

1120S

1120X

1065

and other schedules

CIRCLE ONE:

1.

TOTAL TAXABLE INCOME (Per Copy Federal Form 1120, 1120S, 1065 or appropriate schedules attached) .......... $ ______________________

2.

ITEMS NOT DEDUCTIBLE (From Line M, Schedule X below) ...........

ADD

______________________

3.

ITEMS NOT TAXABLE (From Line Z, Schedule X below) .................

DEDUCT

______________________

4.

ENTER EXCESS OF LINE 2 or 3 ...................................................................................................................................... $ ______________________

5.

ADJUSTED NET INCOME (Line 1 plus or minus Line 4) ................................................................................................

______________________

6.

AMOUNT ALLOCABLE TO DAYTON (If Schedule Y is used) ___________

% of Line 5) .................................

______________________

7.

AMOUNT SUBJECT TO DAYTON INCOME TAX .............................................................................................................

______________________

8.

DAYTON TAX DUE - 2.25% ............................................................................................................................................... $ ______________________

9.

ESTIMATED PAYMENTS ............................................................................................................ $ _______________________

10.

PRIOR YEAR OVERPAYMENTS ................................................................................................

_______________________

11.

TOTAL CREDITS (Add lines 9 AND 10) ......................................................................................................................... $ ______________________

12.

BALANCE OF TAX DUE - (Subtract 11 line from line 8) ........ (No tax due if less than $1.00) ..................................... $ ______________________

13.

OVERPAYMENT (If line 11 exceeds line 8) ............................................................................. $ _______________________

14.

______ REFUND

______ CREDIT TO __________ (No refund or credit if less than $100)

_______________________

ESTIMATED TAX (See instructions)

YEAR

15.

TOTAL __________ ESTIMATED TAX DUE .............................................................................

_______________________

YEAR

16.

QUARTERLY AMOUNT DUE (1/4 of line 15) ...........................................................................

_______________________

17.

PRIOR YEAR CREDIT (line 14) APPLIED TO FIRST QUARTERLY PAYMENT .........................

_______________________

18.

BALANCE OF QUARTERLY PAYMENT DUE (Line 16 minus line 17) ........................................................................... $ ______________________

19.

TOTAL DUE (Add lines 12 and 18) Make check or money order payable to CITY OF DAYTON, if $1 or more. ......... $ ______________________

SCHEDULE X - RECONCILIATION WITH FEDERAL INCOME TAX RETURN

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

a. Capital Losses (Do not include ordinary losses from

n. Capital Gains (Do not include ordinary gains from

Federal form 4797) .....................................................................

$ ________________

Federal Form 4797 ...................................................... $ _______________

b. Interest and (or Other Expenses incurred in the production

o. Interest earned or accrued ..........................................

_______________

of nontaxable income (at least 5% of Line Z) ...........................

_________________

p. .....................................................................................

_______________

c. Income Taxes, City and Stale (If Deducted as Expenses) ......

_________________

q. .....................................................................................

_______________

d. Net operating less deduction per Federal return .......................

_________________

.....................................................................................

_______________

e. Payments to partners per Federal Form 1065 ..........................

_________________

.....................................................................................

_______________

f . Retirement plan payments (Keogh, IRA, Tax Sheltered Annuity) _________________

z. Total Deductions ..........................................................

_______________

g. Portion State of Ohio Franchise Tax based on Income ............

_________________

h. Other items not deductible (explain) ..........................................

_________________

....................................................................................................

_________________

m. Total Additions .............................................................................

_________________

SCHEDULE Y - BUSINESS APPORTIONMENT FORMULA

(See instructions)

The business apportionment formula is to be used only in the absence of books and records which will

A Located

B. Located in

C. Percentage

disclose with reasonable accuracy that portion of the net profits which is attributed to that part of

Everywhere

Dayton

(B ÷ A)

the business within Dayton.

Step 1.

Original value of real and tangible personal property ................................................................ $ _______________ $ ______________

Gross anneal rentals multiplied by 8 ............................................................................... $ _______________ $ ______________

Total step 1 ....................................................................................................................... $ _______________ $ ______________

_________ %

Step 2.

Gross receipts from sales and work or services performed (See instructions) ....................... $ _______________ $ ______________

_________ %

Step 3.

Total wages, salaries, commissions, and other compensation of all employees .....................

$ _______________ $ ______________

_________ %

Step 4.

Total percentages .........................................................................................................................

_________ %

Step 5.

Average percentage (Divide total percentage by number of percentages used - enter on % line 6 above.) ..........................................................................

_______

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are

the same as used for Federal Income Tax purposes, and if an audit of Federal return is made which affects tax liability shown on this return, an amended return will be filed within

3 months

_______________________________________________________________

______________________________________________________

Signature

Title

Date

Preparer’s signature (other than taxpayer)

Date

If this return was prepared by a tax practitioner, may we contact your

______________________________________________________

practitioner directly with questions regarding the preparation of this return?

Address (and Zip Code)

[ ] YES

[ ] NO

MAKE CHECKS PAYABLE TO CITY OF DAYTON

Mail Return with PAYMENT DUE to:

City of Dayton

PO Box 2806

Dayton, Ohio 45401-2806

Mail Return with ZERO BALANCE DUE to:

City of Dayton

PO Box 1830

Dayton, Ohio 45401-1830

Mail Return with REFUND REQUEST to:

City of Dayton

PO Box 1823

Dayton, Ohio 45401-1823

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1