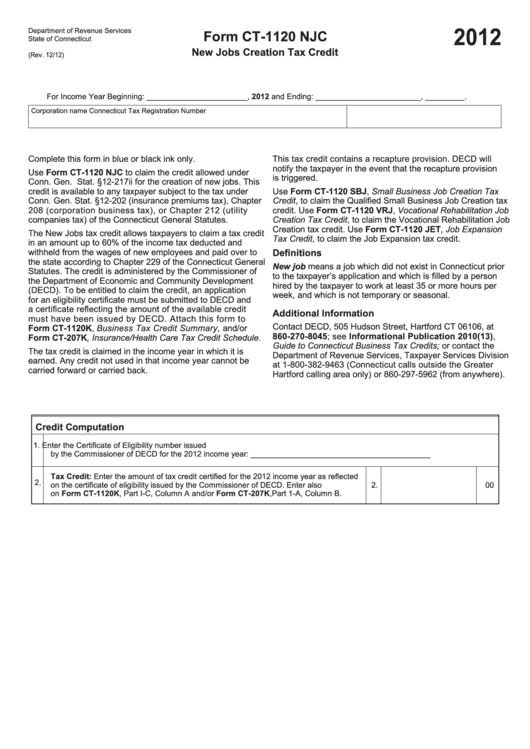

Form Ct-1120 Njc - New Jobs Creation Tax Credit - 2012

ADVERTISEMENT

2012

Department of Revenue Services

Form CT-1120 NJC

State of Connecticut

New Jobs Creation Tax Credit

(Rev. 12/12)

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

This tax credit contains a recapture provision. DECD will

notify the taxpayer in the event that the recapture provision

Use Form CT-1120 NJC to claim the credit allowed under

is triggered.

Conn. Gen. Stat. §12-217ii for the creation of new jobs. This

credit is available to any taxpayer subject to the tax under

Use Form CT-1120 SBJ, Small Business Job Creation Tax

Conn. Gen. Stat. §12-202 (insurance premiums tax), Chapter

Credit, to claim the Qualified Small Business Job Creation tax

208 (corporation business tax), or Chapter 212 (utility

credit. Use Form CT-1120 VRJ, Vocational Rehabilitation Job

companies tax) of the Connecticut General Statutes.

Creation Tax Credit, to claim the Vocational Rehabilitation Job

Creation tax credit. Use Form CT-1120 JET, Job Expansion

The New Jobs tax credit allows taxpayers to claim a tax credit

Tax Credit, to claim the Job Expansion tax credit.

in an amount up to 60% of the income tax deducted and

withheld from the wages of new employees and paid over to

Definitions

the state according to Chapter 229 of the Connecticut General

New job means a job which did not exist in Connecticut prior

Statutes. The credit is administered by the Commissioner of

to the taxpayer’s application and which is filled by a person

the Department of Economic and Community Development

hired by the taxpayer to work at least 35 or more hours per

(DECD). To be entitled to claim the credit, an application

week, and which is not temporary or seasonal.

for an eligibility certificate must be submitted to DECD and

a certificate reflecting the amount of the available credit

Additional Information

must have been issued by DECD. Attach this form to

Contact DECD, 505 Hudson Street, Hartford CT 06106, at

Form CT-1120K, Business Tax Credit Summary, and/or

860-270-8045; see Informational Publication 2010(13),

Form CT-207K, Insurance/Health Care Tax Credit Schedule.

Guide to Connecticut Business Tax Credits; or contact the

The tax credit is claimed in the income year in which it is

Department of Revenue Services, Taxpayer Services Division

earned. Any credit not used in that income year cannot be

at 1-800-382-9463 (Connecticut calls outside the Greater

carried forward or carried back.

Hartford calling area only) or 860-297-5962 (from anywhere).

Credit Computation

1.

Enter the Certificate of Eligibility number issued

by the Commissioner of DECD for the 2012 income year: _________________________________________

Tax Credit: Enter the amount of tax credit certified for the 2012 income year as reflected

2.

on the certificate of eligibility issued by the Commissioner of DECD. Enter also

2.

00

on Form CT-1120K, Part I-C, Column A and/or Form CT-207K,Part 1-A, Column B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1