Form Ast-3 - Virginia Aircraft Sales And Use Tax Return

ADVERTISEMENT

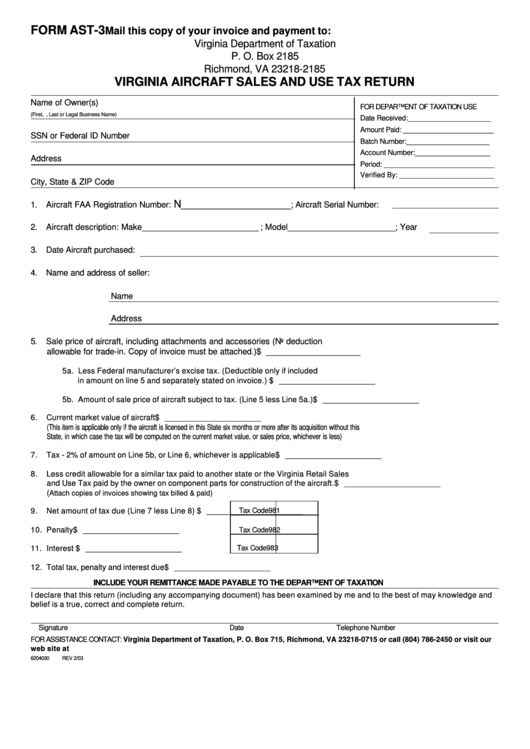

FORM AST-3

Mail this copy of your invoice and payment to:

Virginia Department of Taxation

P. O. Box 2185

Richmond, VA 23218-2185

VIRGINIA AIRCRAFT SALES AND USE TAX RETURN

Name of Owner(s)

FOR DEPARTMENT OF TAXATION USE

(First, M.I., Last or Legal Business Name)

Date Received: _____________________

Amount Paid: _______________________

SSN or Federal ID Number

Batch Number: _____________________

Account Number: ___________________

Address

Period: ____________________________

Verified By: ________________________

City, State & ZIP Code

N ___________________

1. Aircraft FAA Registration Number:

; Aircraft Serial Number:

2. Aircraft description: Make __________________________ ; Model ________________________ ; Year

3. Date Aircraft purchased:

4. Name and address of seller:

Name

Address

5. Sale price of aircraft, including attachments and accessories (No deduction

allowable for trade-in. Copy of invoice must be attached.)................................................. $ _____________________

5a. Less Federal manufacturer’s excise tax. (Deductible only if included

in amount on line 5 and separately stated on invoice.) ............................................................. $ _____________________

5b. Amount of sale price of aircraft subject to tax. (Line 5 less Line 5a.) ...................................... $ _____________________

6.

Current market value of aircraft ...................................................................................................................... $ _____________________

(This item is applicable only if the aircraft is licensed in this State six months or more after its acquisition without this

State, in which case the tax will be computed on the current market value, or sales price, whichever is less)

7.

Tax - 2% of amount on Line 5b, or Line 6, whichever is applicable ........................................................ $ _____________________

8.

Less credit allowable for a similar tax paid to another state or the Virginia Retail Sales

and Use Tax paid by the owner on component parts for construction of the aircraft. .......................... $ _____________________

(

Attach copies of invoices showing tax billed & paid)

Tax Code

981

9.

Net amount of tax due (Line 7 less Line 8) .................................................................................................. $ _____________________

10. Penalty................................................................................................................................................................. $ _____________________

Tax Code

982

11. Interest ................................................................................................................................................................ $ _____________________

Tax Code

983

12. Total tax, penalty and interest due .................................................................................................................. $ _____________________

INCLUDE YOUR REMITTANCE MADE PAYABLE TO THE DEPARTMENT OF TAXATION

I declare that this return (including any accompanying document) has been examined by me and to the best of may knowledge and

belief is a true, correct and complete return.

Signature

Date

Telephone Number

FOR ASSISTANCE CONTACT: Virginia Department of Taxation, P. O. Box 715, Richmond, VA 23218-0715 or call (804) 786-2450 or visit our

web site at .

6204030

REV 2/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1