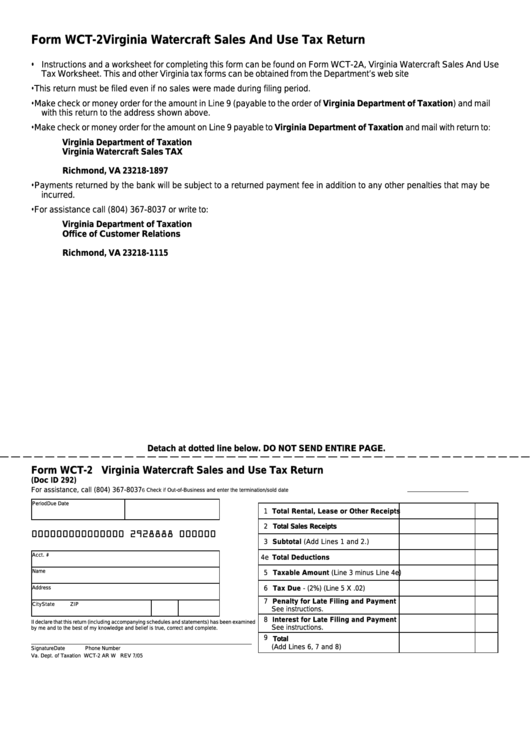

Form WCT-2

Virginia Watercraft Sales And Use Tax Return

• Instructions and a worksheet for completing this form can be found on Form WCT-2A, Virginia Watercraft Sales And Use

Tax Worksheet. This and other Virginia tax forms can be obtained from the Department’s web site

• This return must be filed even if no sales were made during filing period.

• Make check or money order for the amount in Line 9 (payable to the order of Virginia Department of Taxation) and mail

with this return to the address shown above.

• Make check or money order for the amount on Line 9 payable to Virginia Department of Taxation and mail with return to:

Virginia Department of Taxation

Virginia Watercraft Sales TAX

P.O. Box 1897

Richmond, VA 23218-1897

• Payments returned by the bank will be subject to a returned payment fee in addition to any other penalties that may be

incurred.

• For assistance call (804) 367-8037 or write to:

Virginia Department of Taxation

Office of Customer Relations

P.O. Box 1115

Richmond, VA 23218-1115

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Form WCT-2 Virginia Watercraft Sales and Use Tax Return

(Doc ID 292)

For assistance, call (804) 367-8037

6 Check if Out-of-Business and enter the termination/sold date

Period

Due Date

1 Total Rental, Lease or Other Receipts

2 Total Sales Receipts

000000000000000 2928888 000000

3 Subtotal (Add Lines 1 and 2.)

Acct. #

4e Total Deductions

Name

5 Taxable Amount (Line 3 minus Line 4e)

Address

6 Tax Due - (2%) (Line 5 X .02)

7 Penalty for Late Filing and Payment

City

State

ZIP

See instructions.

8 Interest for Late Filing and Payment

II declare that this return (including accompanying schedules and statements) has been examined

See instructions.

by me and to the best of my knowledge and belief is true, correct and complete.

9 Total

(Add Lines 6, 7 and 8)

Signature

Date

Phone Number

Va. Dept. of Taxation WCT-2 AR W REV 7/05

1

1