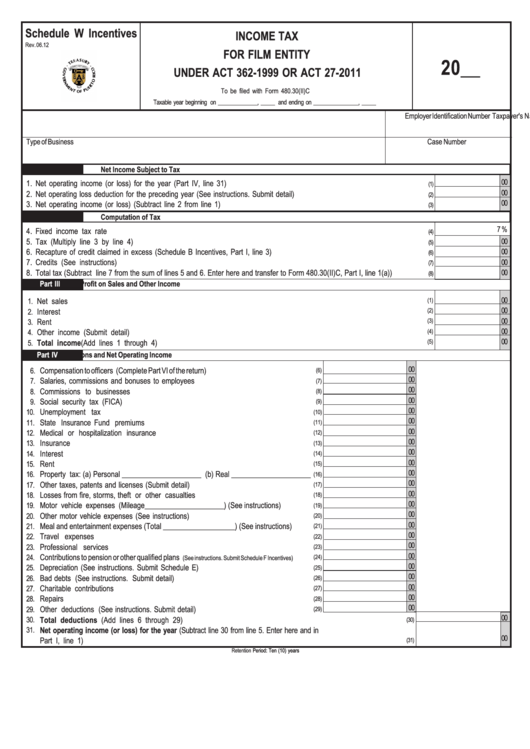

Schedule W Incentives - Income Tax For Film Entity Under Act 362-1999 Or Act 27-2011 - 2012

ADVERTISEMENT

Schedule W Incentives

INCOME TAX

Rev. 06.12

FOR FILM ENTITY

20__

UNDER ACT 362-1999 OR ACT 27-2011

To be filed with Form 480.30(II)C

Taxable year beginning on ______________, _____ and ending on ________________, _____

Taxpayer's Name

Employer Identification Number

Type of Business

Case Number

Part I

Net Income Subject to Tax

00

1.

Net operating income (or loss) for the year (Part IV, line 31) .........................................................................................................

(1)

00

2.

Net operating loss deduction for the preceding year (See instructions. Submit detail) .....................................................................

(2)

00

3.

Net operating income (or loss) (Subtract line 2 from line 1) ............................................................................................................

(3)

Part II

Computation of Tax

7 %

4.

Fixed income tax rate ....................................................................................................................................................................

(4)

5.

Tax (Multiply line 3 by line 4) ........................................................................................................................................................

00

(5)

6.

Recapture of credit claimed in excess (Schedule B Incentives, Part I, line 3) .................................................................................

00

(6)

7.

Credits (See instructions) ..............................................................................................................................................................

00

(7)

8.

Total tax (Subtract line 7 from the sum of lines 5 and 6. Enter here and transfer to Form 480.30(II)C, Part I, line 1(a)) ..................

00

(8)

Part III

Gross Profit on Sales and Other Income

00

Net sales ......................................................................................................................................................................................

(1)

1.

00

2.

Interest ..........................................................................................................................................................................................

(2)

00

Rent ..............................................................................................................................................................................................

3.

(3)

00

Other income (Submit detail) .........................................................................................................................................................

4.

(4)

00

Total income (Add lines 1 through 4) ...........................................................................................................................................

(5)

5.

Part IV

Deductions and Net Operating Income

00

Compensation to officers (Complete Part VI of the return) ........................................................

6.

(6)

00

Salaries, commissions and bonuses to employees ............................................................

7.

(7)

00

Commissions to businesses .............................................................................................

8.

(8)

00

9.

Social security tax (FICA) ..................................................................................................

(9)

00

Unemployment tax ...........................................................................................................

10.

(10)

00

State Insurance Fund premiums .....................................................................................

11.

(11)

00

Medical or hospitalization insurance ...............................................................................

12.

(12)

00

Insurance .........................................................................................................................

13.

(13)

00

Interest ..............................................................................................................................

14.

(14)

00

Rent ..................................................................................................................................

15.

(15)

00

Property tax: (a) Personal _____________________ (b) Real _____________________

16.

(16)

00

Other taxes, patents and licenses (Submit detail) ...............................................................

17.

(17)

00

Losses from fire, storms, theft or other casualties ............................................................

18.

(18)

00

Motor vehicle expenses (Mileage_____________________) (See instructions) ...............

19.

(19)

00

20.

Other motor vehicle expenses (See instructions) ...............................................................

(20)

00

Meal and entertainment expenses (Total ___________________) (See instructions) .........

21.

(21)

00

Travel expenses ..............................................................................................................

22.

(22)

00

Professional services .......................................................................................................

23.

(23)

00

Contributions to pension or other qualified plans

.........

24.

(24)

(See instructions. Submit Schedule F Incentives)

00

25.

Depreciation (See instructions. Submit Schedule E) ..........................................................

(25)

00

Bad debts (See instructions. Submit detail) .......................................................................

26.

(26)

00

Charitable contributions .....................................................................................................

27.

(27)

00

Repairs ..............................................................................................................................

28.

(28)

00

Other deductions (See instructions. Submit detail) ...........................................................

29.

(29)

00

Total deductions (Add lines 6 through 29) ................................................................................................................

30.

(30)

31.

Net operating income (or loss) for the year (Subtract line 30 from line 5. Enter here and in

00

Part I, line 1) ..................................................................................................................................................................

(31)

Retention

Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1