Instructions For Connecticut Hazardous Waste Tax Return Form Op-2231

ADVERTISEMENT

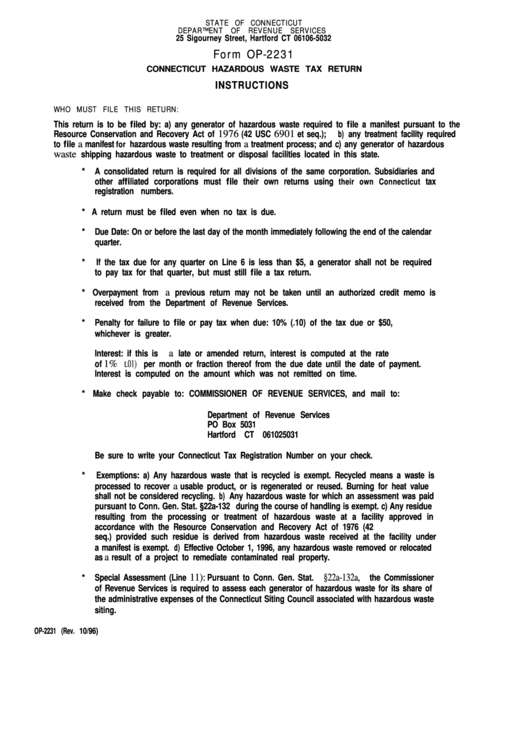

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

25 Sigourney Street, Hartford CT 06106-5032

Form OP-2231

CONNECTICUT HAZARDOUS WASTE TAX RETURN

INSTRUCTIONS

WHO MUST FILE THIS RETURN:

This return is to be filed by: a) any generator of hazardous waste required to file a manifest pursuant to the

Resource Conservation and Recovery Act of

(42 USC

et seq.); b) any treatment facility required

1976

6901

to file

manifest

hazardous waste resulting from

treatment process; and c) any generator of hazardous

for

a

a

shipping hazardous waste to treatment or disposal facilities located in this state.

waste

* A consolidated return is required for all divisions of the same corporation. Subsidiaries and

other affiliated corporations must file their own returns using

tax

their own Connecticut

registration numbers.

* A return must be filed even when no tax is due.

*

Due Date: On or before the last day of the month immediately following the end of the calendar

quarter.

*

If the tax due for any quarter on Line 6 is less than $5, a generator shall not be required

to pay tax for that quarter, but must still file a tax return.

* Overpayment from

previous return may not be taken until an authorized credit memo is

a

received from the Department of Revenue Services.

*

Penalty for failure to file or pay tax when due: 10% (.10) of the tax due or $50,

whichever is greater.

Interest: if this is

late or amended return, interest is computed at the rate

a

of

per month or fraction thereof from the due date until the date of payment.

1% t.01)

Interest is computed on the amount which was not remitted on time.

* Make check payable to: COMMISSIONER OF REVENUE SERVICES, and mail to:

Department of Revenue Services

PO Box 5031

Hartford CT 061025031

Be sure to write your Connecticut Tax Registration Number on your check.

*

Exemptions: a) Any hazardous waste that is recycled is exempt. Recycled means a waste is

processed to recover

usable product, or is regenerated or reused. Burning for heat value

a

shall not be considered recycling. b) Any hazardous waste for which an assessment was paid

pursuant to Conn. Gen. Stat. §22a-132 during the course of handling is exempt. c) Any residue

resulting from the processing or treatment of hazardous waste at a facility approved in

accordance with the Resource Conservation and Recovery Act of 1976 (42 U.S.C. 56901 et

seq.) provided such residue is derived from hazardous waste received at the facility under

a manifest is exempt. d) Effective October 1, 1996, any hazardous waste removed or relocated

as

result of a project to remediate contaminated real property.

a

*

Special Assessment (Line

Pursuant to Conn. Gen. Stat.

the Commissioner

11):

§22a-132a,

of Revenue Services is required to assess each generator of hazardous waste for its share of

the administrative expenses of the Connecticut Siting Council associated with hazardous waste

siting.

OP-2231 (Rev. 10/96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1