Instructions For Blue Ash Income Tax Return Form Br

ADVERTISEMENT

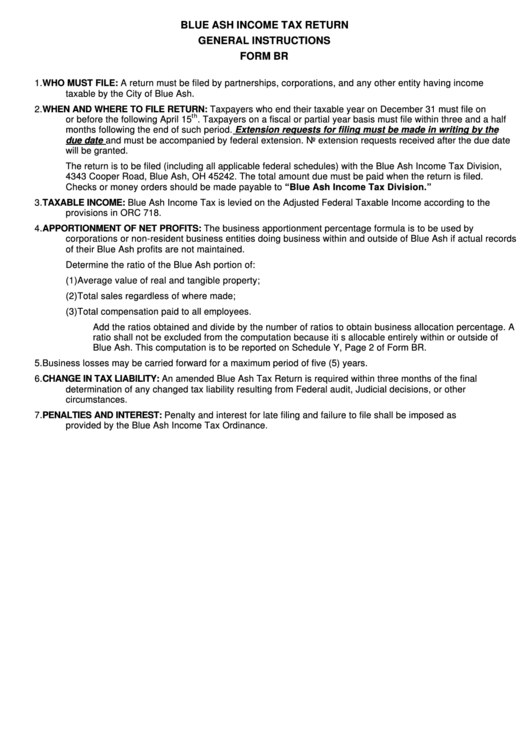

BLUE ASH INCOME TAX RETURN

GENERAL INSTRUCTIONS

FORM BR

1.

WHO MUST FILE: A return must be filed by partnerships, corporations, and any other entity having income

taxable by the City of Blue Ash.

2.

WHEN AND WHERE TO FILE RETURN: Taxpayers who end their taxable year on December 31 must file on

th

or before the following April 15

. Taxpayers on a fiscal or partial year basis must file within three and a half

months following the end of such period. Extension requests for filing must be made in writing by the

due date and must be accompanied by federal extension. No extension requests received after the due date

will be granted.

The return is to be filed (including all applicable federal schedules) with the Blue Ash Income Tax Division,

4343 Cooper Road, Blue Ash, OH 45242. The total amount due must be paid when the return is filed.

Checks or money orders should be made payable to “Blue Ash Income Tax Division.”

3.

TAXABLE INCOME: Blue Ash Income Tax is levied on the Adjusted Federal Taxable Income according to the

provisions in ORC 718.

4.

APPORTIONMENT OF NET PROFITS: The business apportionment percentage formula is to be used by

corporations or non-resident business entities doing business within and outside of Blue Ash if actual records

of their Blue Ash profits are not maintained.

Determine the ratio of the Blue Ash portion of:

(1)

Average value of real and tangible property;

(2)

Total sales regardless of where made;

(3)

Total compensation paid to all employees.

Add the ratios obtained and divide by the number of ratios to obtain business allocation percentage. A

ratio shall not be excluded from the computation because iti s allocable entirely within or outside of

Blue Ash. This computation is to be reported on Schedule Y, Page 2 of Form BR.

5.

Business losses may be carried forward for a maximum period of five (5) years.

6.

CHANGE IN TAX LIABILITY: An amended Blue Ash Tax Return is required within three months of the final

determination of any changed tax liability resulting from Federal audit, Judicial decisions, or other

circumstances.

7.

PENALTIES AND INTEREST: Penalty and interest for late filing and failure to file shall be imposed as

provided by the Blue Ash Income Tax Ordinance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1