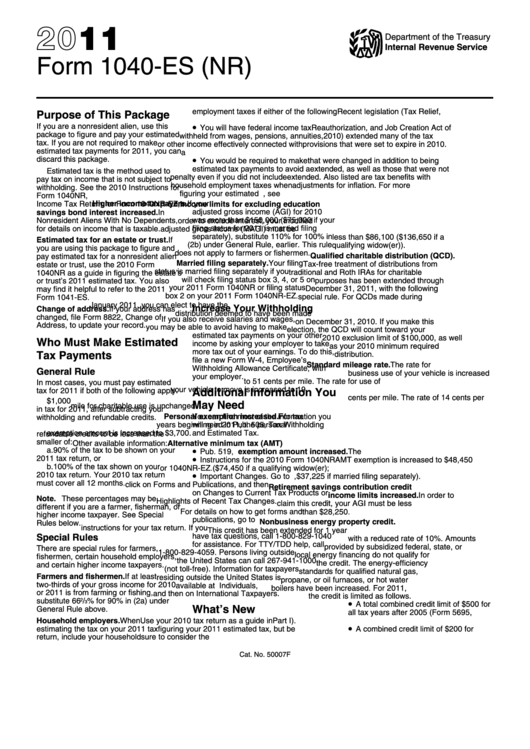

2011

Department of the Treasury

Internal Revenue Service

Form 1040-ES (NR)

U.S. Estimated Tax for Nonresident Alien Individuals

employment taxes if either of the following

Recent legislation (Tax Relief,

Purpose of This Package

applies.

Unemployment Insurance

•

If you are a nonresident alien, use this

You will have federal income tax

Reauthorization, and Job Creation Act of

package to figure and pay your estimated

withheld from wages, pensions, annuities,

2010) extended many of the tax

tax. If you are not required to make

or other income effectively connected with

provisions that were set to expire in 2010.

estimated tax payments for 2011, you can

a U.S. trade or business.

This section lists only those provisions

•

discard this package.

You would be required to make

that were changed in addition to being

estimated tax payments to avoid a

extended, as well as those that were not

Estimated tax is the method used to

penalty even if you did not include

extended. Also listed are tax benefits with

pay tax on income that is not subject to

household employment taxes when

adjustments for inflation. For more

withholding. See the 2010 Instructions for

figuring your estimated tax.

information, see IRS.gov.

Form 1040NR, U.S. Nonresident Alien

Higher income taxpayers. If your

Income Tax Return, or Form 1040NR-EZ,

Income limits for excluding education

adjusted gross income (AGI) for 2010

U.S. Income Tax Return for Certain

savings bond interest increased. In

was more than $150,000 ($75,000 if your

Nonresident Aliens With No Dependents,

order to exclude interest, your modified

filing status for 2011 is married filing

for details on income that is taxable.

adjusted gross income (MAGI) must be

separately), substitute 110% for 100% in

less than $86,100 ($136,650 if a

Estimated tax for an estate or trust. If

(2b) under General Rule, earlier. This rule

qualifying widow(er)).

you are using this package to figure and

does not apply to farmers or fishermen.

Qualified charitable distribution (QCD).

pay estimated tax for a nonresident alien

Married filing separately. Your filing

Tax-free treatment of distributions from

estate or trust, use the 2010 Form

status is married filing separately if you

traditional and Roth IRAs for charitable

1040NR as a guide in figuring the estate’s

will check filing status box 3, 4, or 5 on

purposes has been extended through

or trust’s 2011 estimated tax. You also

your 2011 Form 1040NR or filing status

December 31, 2011, with the following

may find it helpful to refer to the 2011

box 2 on your 2011 Form 1040NR-EZ.

special rule. For QCDs made during

Form 1041-ES.

January 2011, you can elect to have the

Increase Your Withholding

Change of address. If your address has

distribution deemed to have been made

changed, file Form 8822, Change of

If you also receive salaries and wages,

on December 31, 2010. If you make this

Address, to update your record.

you may be able to avoid having to make

election, the QCD will count toward your

estimated tax payments on your other

2010 exclusion limit of $100,000, as well

Who Must Make Estimated

income by asking your employer to take

as your 2010 minimum required

more tax out of your earnings. To do this,

Tax Payments

distribution.

file a new Form W-4, Employee’s

Standard mileage rate. The rate for

Withholding Allowance Certificate, with

General Rule

business use of your vehicle is increased

your employer.

to 51 cents per mile. The rate for use of

In most cases, you must pay estimated

Additional Information You

your vehicle to move is increased to 19

tax for 2011 if both of the following apply.

cents per mile. The rate of 14 cents per

1. You expect to owe at least $1,000

May Need

mile for charitable use is unchanged.

in tax for 2011, after subtracting your

Personal exemption increased. For tax

You can find most of the information you

withholding and refundable credits.

years beginning in 2011, the personal

will need in Pub. 505, Tax Withholding

2. You expect your withholding and

exemption amount is increased to $3,700.

and Estimated Tax.

refundable credits to be less than the

smaller of:

Other available information:

Alternative minimum tax (AMT)

•

a. 90% of the tax to be shown on your

Pub. 519, U.S. Tax Guide for Aliens.

exemption amount increased. The

•

2011 tax return, or

Instructions for the 2010 Form 1040NR

AMT exemption is increased to $48,450

b. 100% of the tax shown on your

or 1040NR-EZ.

($74,450 if a qualifying widow(er);

•

2010 tax return. Your 2010 tax return

Important Changes. Go to IRS.gov,

$37,225 if married filing separately).

must cover all 12 months.

click on Forms and Publications, and then

Retirement savings contribution credit

on Changes to Current Tax Products or

income limits increased. In order to

Note. These percentages may be

Highlights of Recent Tax Changes.

claim this credit, your AGI must be less

different if you are a farmer, fisherman, or

For details on how to get forms and

than $28,250.

higher income taxpayer. See Special

publications, go to IRS.gov or see the

Nonbusiness energy property credit.

Rules below.

instructions for your tax return. If you

This credit has been extended for 1 year

Special Rules

have tax questions, call 1-800-829-1040

with a reduced rate of 10%. Amounts

for assistance. For TTY/TDD help, call

provided by subsidized federal, state, or

There are special rules for farmers,

1-800-829-4059. Persons living outside

local energy financing do not qualify for

fishermen, certain household employers,

the United States can call 267-941-1000

the credit. The energy-efficiency

and certain higher income taxpayers.

(not toll-free). Information for taxpayers

standards for qualified natural gas,

Farmers and fishermen. If at least

residing outside the United States is

propane, or oil furnaces, or hot water

two-thirds of your gross income for 2010

available at IRS.gov. Click on Individuals,

boilers have been increased. For 2011,

or 2011 is from farming or fishing,

and then on International Taxpayers.

the credit is limited as follows.

substitute 66

/

% for 90% in (2a) under

2

•

3

A total combined credit limit of $500 for

What’s New

General Rule above.

all tax years after 2005 (Form 5695,

Household employers. When

Use your 2010 tax return as a guide in

Part I).

•

estimating the tax on your 2011 tax

figuring your 2011 estimated tax, but be

A combined credit limit of $200 for

return, include your household

sure to consider the following.

windows for all tax years after 2005.

Cat. No. 50007F

1

1 2

2 3

3 4

4 5

5 6

6 7

7