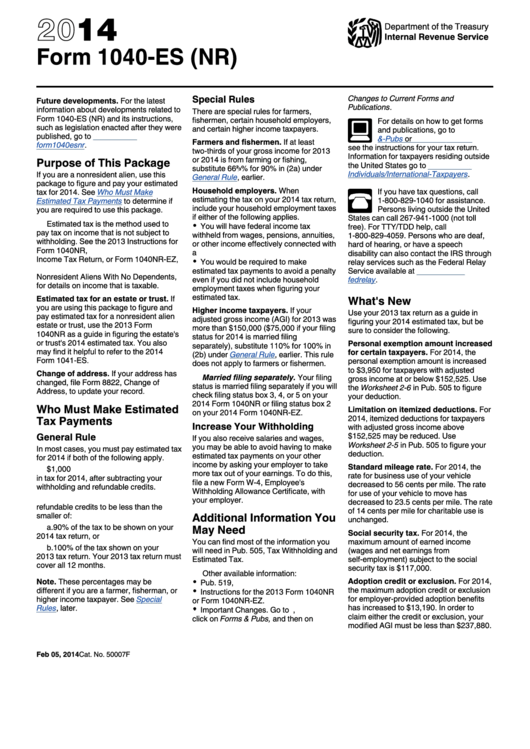

2014

Department of the Treasury

Internal Revenue Service

Form 1040-ES (NR)

U.S. Estimated Tax for Nonresident Alien Individuals

Special Rules

Changes to Current Forms and

Future developments. For the latest

Publications.

information about developments related to

There are special rules for farmers,

Form 1040-ES (NR) and its instructions,

fishermen, certain household employers,

For details on how to get forms

such as legislation enacted after they were

and certain higher income taxpayers.

and publications, go to

published, go to

Forms- &-Pubs

or

Farmers and fishermen. If at least

form1040esnr.

see the instructions for your tax return.

two-thirds of your gross income for 2013

Information for taxpayers residing outside

Purpose of This Package

or 2014 is from farming or fishing,

the United States go to

substitute 66

% for 90% in (2a) under

2

3

Individuals/International-Taxpayers.

If you are a nonresident alien, use this

General

Rule, earlier.

package to figure and pay your estimated

Household employers. When

If you have tax questions, call

tax for 2014. See

Who Must Make

estimating the tax on your 2014 tax return,

1-800-829-1040 for assistance.

Estimated Tax Payments

to determine if

include your household employment taxes

Persons living outside the United

you are required to use this package.

if either of the following applies.

States can call 267-941-1000 (not toll

Estimated tax is the method used to

You will have federal income tax

free). For TTY/TDD help, call

pay tax on income that is not subject to

withheld from wages, pensions, annuities,

1-800-829-4059. Persons who are deaf,

withholding. See the 2013 Instructions for

or other income effectively connected with

hard of hearing, or have a speech

Form 1040NR, U.S. Nonresident Alien

a U.S. trade or business.

disability can also contact the IRS through

Income Tax Return, or Form 1040NR-EZ,

You would be required to make

relay services such as the Federal Relay

U.S. Income Tax Return for Certain

estimated tax payments to avoid a penalty

Service available at

Nonresident Aliens With No Dependents,

even if you did not include household

fedrelay.

for details on income that is taxable.

employment taxes when figuring your

estimated tax.

What's New

Estimated tax for an estate or trust. If

you are using this package to figure and

Higher income taxpayers. If your

Use your 2013 tax return as a guide in

pay estimated tax for a nonresident alien

adjusted gross income (AGI) for 2013 was

figuring your 2014 estimated tax, but be

estate or trust, use the 2013 Form

more than $150,000 ($75,000 if your filing

sure to consider the following.

1040NR as a guide in figuring the estate's

status for 2014 is married filing

or trust's 2014 estimated tax. You also

Personal exemption amount increased

separately), substitute 110% for 100% in

may find it helpful to refer to the 2014

for certain taxpayers. For 2014, the

(2b) under

General

Rule, earlier. This rule

Form 1041-ES.

personal exemption amount is increased

does not apply to farmers or fishermen.

to $3,950 for taxpayers with adjusted

Change of address. If your address has

Married filing separately. Your filing

gross income at or below $152,525. Use

changed, file Form 8822, Change of

status is married filing separately if you will

the Worksheet 2-6 in Pub. 505 to figure

Address, to update your record.

check filing status box 3, 4, or 5 on your

your deduction.

2014 Form 1040NR or filing status box 2

Who Must Make Estimated

Limitation on itemized deductions. For

on your 2014 Form 1040NR-EZ.

Tax Payments

2014, itemized deductions for taxpayers

Increase Your Withholding

with adjusted gross income above

General Rule

$152,525 may be reduced. Use

If you also receive salaries and wages,

Worksheet 2-5 in Pub. 505 to figure your

you may be able to avoid having to make

In most cases, you must pay estimated tax

deduction.

estimated tax payments on your other

for 2014 if both of the following apply.

income by asking your employer to take

Standard mileage rate. For 2014, the

1. You expect to owe at least $1,000

more tax out of your earnings. To do this,

rate for business use of your vehicle

in tax for 2014, after subtracting your

file a new Form W-4, Employee's

decreased to 56 cents per mile. The rate

withholding and refundable credits.

Withholding Allowance Certificate, with

for use of your vehicle to move has

2. You expect your withholding and

your employer.

decreased to 23.5 cents per mile. The rate

refundable credits to be less than the

of 14 cents per mile for charitable use is

Additional Information You

smaller of:

unchanged.

May Need

a. 90% of the tax to be shown on your

Social security tax. For 2014, the

2014 tax return, or

You can find most of the information you

maximum amount of earned income

b. 100% of the tax shown on your

will need in Pub. 505, Tax Withholding and

(wages and net earnings from

2013 tax return. Your 2013 tax return must

Estimated Tax.

self-employment) subject to the social

cover all 12 months.

security tax is $117,000.

Other available information:

Adoption credit or exclusion. For 2014,

Note. These percentages may be

Pub. 519, U.S. Tax Guide for Aliens.

different if you are a farmer, fisherman, or

the maximum adoption credit or exclusion

Instructions for the 2013 Form 1040NR

for employer-provided adoption benefits

higher income taxpayer. See

Special

or Form 1040NR-EZ.

has increased to $13,190. In order to

Rules, later.

Important Changes. Go to IRS.gov,

claim either the credit or exclusion, your

click on Forms & Pubs, and then on

modified AGI must be less than $237,880.

Feb 05, 2014

Cat. No. 50007F

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9