2014

Form 355-ES

Instructions for Corporation

Estimated Tax Payment Vouchers

Massachusetts

Department of

Revenue

What is the purpose of the estimated tax payment vouchers?

1. Complete the enclosed Corporation Estimated Tax Worksheet.

General Information

Specific Instructions

Estimated tax payment vouchers provide a means for paying any

2. Verify your name, address, identification number, taxable year and

current taxes due under Chapter 63 of the Massachusetts General

installment due dates on the preprinted vouchers.

Laws.

3. Enter in item a of the first voucher your total tax for the prior year,

Who must make estimated payments? All corporations that rea-

if any, from item a of the worksheet.

sonably estimate their corporation excise to be in excess of $1,000

4. Enter in item b of the first voucher any overpayment from last

for the taxable year are required to make estimated payments.

year to be credited to estimated tax this year from item b of the

Note: Corporations with more than $100,000 in receipts, sales or

worksheet.

revenue must make all payments electronically. See Technical In-

5. Enter your estimated tax for 2014 from item c of the worksheet in

formation Release (TIR) 05-22. Also, a taxable member of a com-

bined group must make its esti mated payments through WebFile

item c of your first voucher.

for Business. See TIR 09-18. Go to WebFile for Business at www.

6. Enter the amount of this installment from line 1 of the worksheet

mass.gov/dor for more information.

in line 1 of your first voucher.

Are there penalties for failing to pay estimated taxes? Yes. An

7. Enter in line 2 of the first voucher the amount of overpayment

additional charge is imposed on the underpayment of any corporate

from last year to be applied to this installment, if any, from line 2 of

estimated tax for the period of that underpayment. Use Form M-2220

the worksheet.

when filing your annual return to determine any penalty due.

8. Enter in line 3 of the first voucher the amount of this tax ex-

When and where are estimated tax vouchers filed? Estimated

pected to be withheld during 2014 to be applied to this installment,

taxes may be paid in full on or before the 15th day of the third month

if any, from line 3 of the worksheet.

of the corporation’s taxable year or according to the following install-

9. Subtract the total of lines 2 and 3 from line 1 and enter the result

ment amount schedule: on or before the 15th day of the third, sixth,

ninth and twelfth months of the taxable year.

in line 4. File only if line 4 is greater than zero.

10. Check the appropriate box in the section “Check the form you

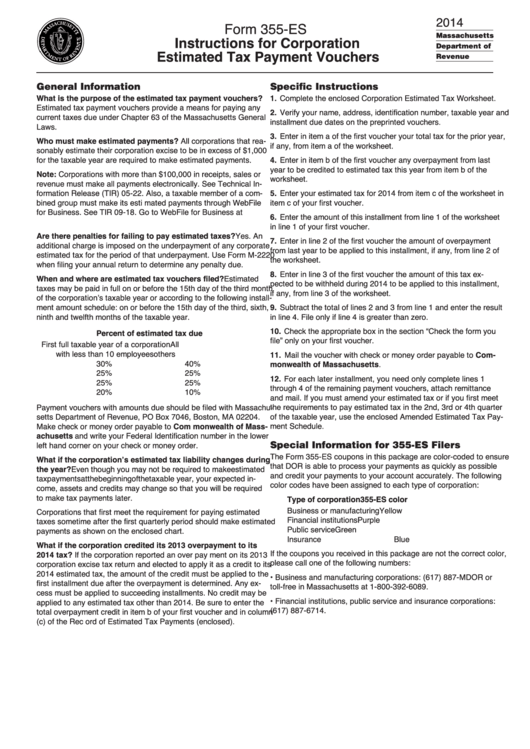

Percent of estimated tax due

file” only on your first voucher.

First full taxable year of a corporation

All

with less than 10 employees

others

11. Mail the voucher with check or money order payable to Com-

30%

40%

monwealth of Massachusetts.

25%

25%

12. For each later installment, you need only complete lines 1

25%

25%

through 4 of the remaining payment vouchers, attach remittance

20%

10%

and mail. If you must amend your estimated tax or if you first meet

Payment vouchers with amounts due should be filed with Massachu-

the requirements to pay estimated tax in the 2nd, 3rd or 4th quarter

setts Department of Revenue, PO Box 7046, Boston, MA 02204.

of the taxable year, use the enclosed Amended Estimated Tax Pay-

Make check or money order payable to Com monwealth of Mass-

ment Schedule.

achusetts and write your Federal Identification number in the lower

left hand corner on your check or money order.

Special Information for 355-ES Filers

The Form 355-ES coupons in this package are color-coded to ensure

What if the corporation’s estimated tax liability changes during

that DOR is able to process your payments as quickly as possible

the year? Even though you may not be required to make estimated

and credit your payments to your account accurately. The following

tax payments at the beginning of the taxable year, your expected in-

color codes have been assigned to each type of corporation:

come, assets and credits may change so that you will be required

to make tax payments later.

Type of corporation

355-ES color

Business or manufacturing

Yellow

Corporations that first meet the requirement for paying estimated

Financial institutions

Purple

taxes sometime after the first quarterly period should make estimated

Public service

Green

payments as shown on the enclosed chart.

Insurance

Blue

What if the corporation credited its 2013 overpayment to its

If the coupons you received in this package are not the correct color,

2014 tax? If the corporation reported an over pay ment on its 2013

please call one of the following numbers:

corporation excise tax return and elected to apply it as a credit to its

2014 estimated tax, the amount of the credit must be applied to the

• Business and manufacturing corporations: (617) 887-MDOR or

first installment due after the overpayment is determined. Any ex-

toll-free in Massachusetts at 1-800-392-6089.

cess must be applied to succeeding installments. No credit may be

• Financial institutions, public service and insurance corporations:

applied to any estimated tax other than 2014. Be sure to enter the

(617) 887-6714.

total overpayment credit in item b of your first voucher and in column

(c) of the Rec ord of Estimated Tax Payments (enclosed).

1

1 2

2