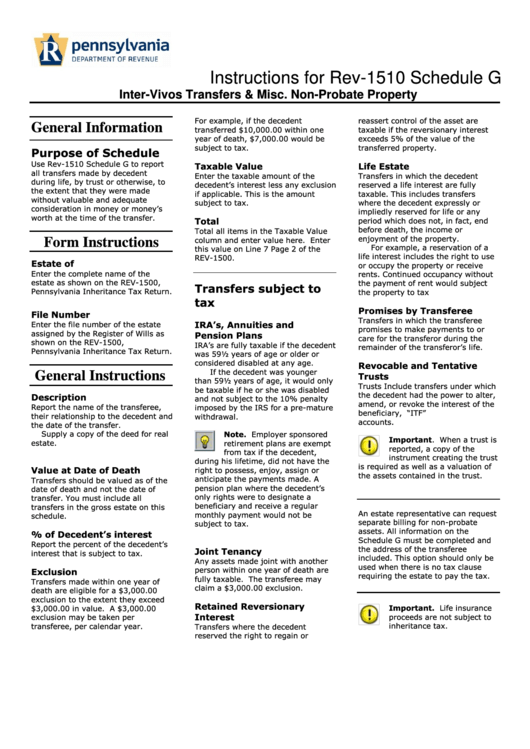

Instructions For Rev-1510 Schedule G - Inter-Vivos Transfers & Misc. Non-Probate Property

ADVERTISEMENT

Instructions for Rev-1510 Schedule G

Inter-Vivos Transfers & Misc. Non-Probate Property

For example, if the decedent

reassert control of the asset are

General Information

transferred $10,000.00 within one

taxable if the reversionary interest

year of death, $7,000.00 would be

exceeds 5% of the value of the

subject to tax.

transferred property.

Purpose of Schedule

Use Rev-1510 Schedule G to report

Taxable Value

Life Estate

all transfers made by decedent

Enter the taxable amount of the

Transfers in which the decedent

during life, by trust or otherwise, to

decedent’s interest less any exclusion

reserved a life interest are fully

the extent that they were made

if applicable. This is the amount

taxable. This includes transfers

without valuable and adequate

subject to tax.

where the decedent expressly or

consideration in money or money’s

impliedly reserved for life or any

worth at the time of the transfer.

Total

period which does not, in fact, end

before death, the income or

Total all items in the Taxable Value

enjoyment of the property.

column and enter value here. Enter

Form Instructions

For example, a reservation of a

this value on Line 7 Page 2 of the

life interest includes the right to use

REV-1500.

Estate of

or occupy the property or receive

Enter the complete name of the

rents. Continued occupancy without

estate as shown on the REV-1500,

the payment of rent would subject

Transfers subject to

Pennsylvania Inheritance Tax Return.

the property to tax

tax

Promises by Transferee

File Number

Transfers in which the transferee

IRA’s, Annuities and

Enter the file number of the estate

promises to make payments to or

assigned by the Register of Wills as

Pension Plans

care for the transferor during the

shown on the REV-1500,

IRA’s are fully taxable if the decedent

remainder of the transferor’s life.

Pennsylvania Inheritance Tax Return.

was 59½ years of age or older or

considered disabled at any age.

Revocable and Tentative

If the decedent was younger

General Instructions

Trusts

than 59½ years of age, it would only

Trusts Include transfers under which

be taxable if he or she was disabled

the decedent had the power to alter,

Description

and not subject to the 10% penalty

amend, or revoke the interest of the

Report the name of the transferee,

imposed by the IRS for a pre-mature

beneficiary, e.g. In trust for “ITF”

their relationship to the decedent and

withdrawal.

accounts.

the date of the transfer.

Supply a copy of the deed for real

Note. Employer sponsored

Important. When a trust is

estate.

retirement plans are exempt

reported, a copy of the

from tax if the decedent,

instrument creating the trust

during his lifetime, did not have the

is required as well as a valuation of

Value at Date of Death

right to possess, enjoy, assign or

the assets contained in the trust.

anticipate the payments made. A

Transfers should be valued as of the

pension plan where the decedent’s

date of death and not the date of

only rights were to designate a

transfer. You must include all

beneficiary and receive a regular

transfers in the gross estate on this

An estate representative can request

monthly payment would not be

schedule.

separate billing for non-probate

subject to tax.

assets. All information on the

% of Decedent’s interest

Schedule G must be completed and

Report the percent of the decedent’s

the address of the transferee

Joint Tenancy

interest that is subject to tax.

included. This option should only be

Any assets made joint with another

used when there is no tax clause

person within one year of death are

Exclusion

requiring the estate to pay the tax.

fully taxable. The transferee may

Transfers made within one year of

claim a $3,000.00 exclusion.

death are eligible for a $3,000.00

exclusion to the extent they exceed

Retained Reversionary

$3,000.00 in value. A $3,000.00

Important. Life insurance

Interest

proceeds are not subject to

exclusion may be taken per

inheritance tax.

transferee, per calendar year.

Transfers where the decedent

reserved the right to regain or

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1