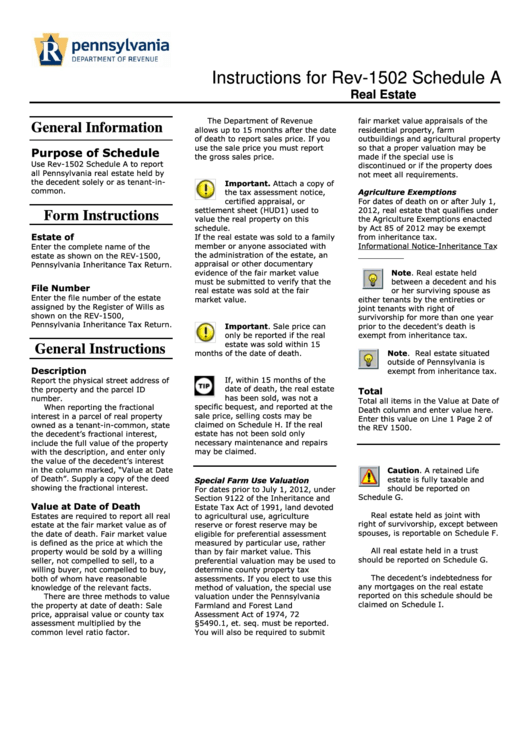

Instructions For Rev-1502 Schedule A - Real Estate

ADVERTISEMENT

Instructions for Rev-1502 Schedule A

Real Estate

The Department of Revenue

fair market value appraisals of the

General Information

allows up to 15 months after the date

residential property, farm

of death to report sales price. If you

outbuildings and agricultural property

use the sale price you must report

so that a proper valuation may be

Purpose of Schedule

the gross sales price.

made if the special use is

Use Rev-1502 Schedule A to report

discontinued or if the property does

all Pennsylvania real estate held by

not meet all requirements.

the decedent solely or as tenant-in-

Important. Attach a copy of

common.

the tax assessment notice,

Agriculture Exemptions

certified appraisal, or

For dates of death on or after July 1,

settlement sheet (HUD1) used to

2012, real estate that qualifies under

Form Instructions

value the real property on this

the Agriculture Exemptions enacted

schedule.

by Act 85 of 2012 may be exempt

Estate of

If the real estate was sold to a family

from inheritance tax.

member or anyone associated with

Informational Notice-Inheritance Tax

Enter the complete name of the

the administration of the estate, an

2012.01.pdf

estate as shown on the REV-1500,

appraisal or other documentary

Pennsylvania Inheritance Tax Return.

evidence of the fair market value

Note. Real estate held

must be submitted to verify that the

between a decedent and his

File Number

real estate was sold at the fair

or her surviving spouse as

Enter the file number of the estate

market value.

either tenants by the entireties or

assigned by the Register of Wills as

joint tenants with right of

shown on the REV-1500,

survivorship for more than one year

Pennsylvania Inheritance Tax Return.

Important. Sale price can

prior to the decedent's death is

only be reported if the real

exempt from inheritance tax.

estate was sold within 15

General Instructions

months of the date of death.

Note. Real estate situated

outside of Pennsylvania is

Description

exempt from inheritance tax.

If, within 15 months of the

Report the physical street address of

date of death, the real estate

the property and the parcel ID

Total

has been sold, was not a

number.

Total all items in the Value at Date of

specific bequest, and reported at the

When reporting the fractional

Death column and enter value here.

sale price, selling costs may be

interest in a parcel of real property

Enter this value on Line 1 Page 2 of

claimed on Schedule H. If the real

owned as a tenant-in-common, state

the REV 1500.

estate has not been sold only

the decedent’s fractional interest,

necessary maintenance and repairs

include the full value of the property

may be claimed.

with the description, and enter only

the value of the decedent’s interest

in the column marked, “Value at Date

Caution. A retained Life

of Death”. Supply a copy of the deed

estate is fully taxable and

Special Farm Use Valuation

showing the fractional interest.

should be reported on

For dates prior to July 1, 2012, under

Schedule G.

Section 9122 of the Inheritance and

Value at Date of Death

Estate Tax Act of 1991, land devoted

Real estate held as joint with

Estates are required to report all real

to agricultural use, agriculture

right of survivorship, except between

estate at the fair market value as of

reserve or forest reserve may be

spouses, is reportable on Schedule F.

the date of death. Fair market value

eligible for preferential assessment

is defined as the price at which the

measured by particular use, rather

All real estate held in a trust

property would be sold by a willing

than by fair market value. This

should be reported on Schedule G.

seller, not compelled to sell, to a

preferential valuation may be used to

willing buyer, not compelled to buy,

determine county property tax

The decedent’s indebtedness for

both of whom have reasonable

assessments. If you elect to use this

any mortgages on the real estate

knowledge of the relevant facts.

method of valuation, the special use

reported on this schedule should be

There are three methods to value

valuation under the Pennsylvania

claimed on Schedule I.

the property at date of death: Sale

Farmland and Forest Land

price, appraisal value or county tax

Assessment Act of 1974, 72 P.S.

assessment multiplied by the

§5490.1, et. seq. must be reported.

common level ratio factor.

You will also be required to submit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1