Instructions For Rev-1514 Schedule K - Life Estate, Annuity & Term Certain - 2013

ADVERTISEMENT

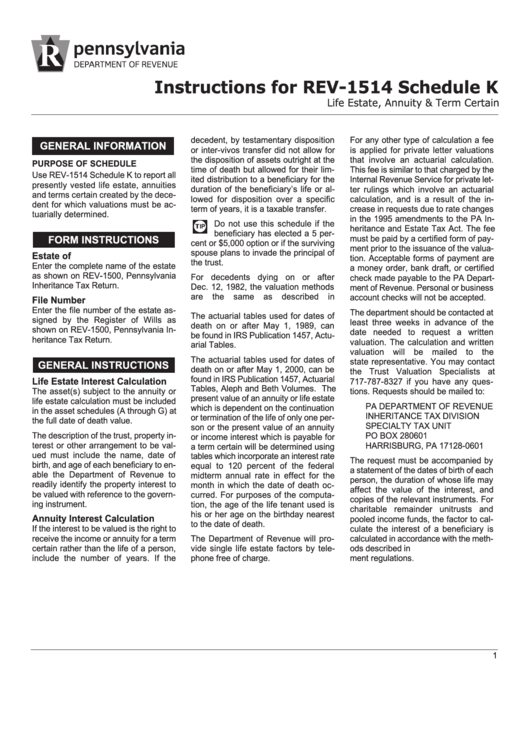

Instructions for REV-1514 Schedule K

Life Estate, Annuity & Term Certain

decedent, by testamentary disposition

For any other type of calculation a fee

GENERAL INFORMATION

or inter-vivos transfer did not allow for

is applied for private letter valuations

the disposition of assets outright at the

that involve an actuarial calculation.

PURPOSE OF SCHEDULE

time of death but allowed for their lim-

This fee is similar to that charged by the

Use REV-1514 Schedule K to report all

ited distribution to a beneficiary for the

Internal Revenue Service for private let-

presently vested life estate, annuities

duration of the beneficiary’s life or al-

ter rulings which involve an actuarial

and terms certain created by the dece-

lowed for disposition over a specific

calculation, and is a result of the in-

dent for which valuations must be ac-

term of years, it is a taxable transfer.

crease in requests due to rate changes

tuarially determined.

in the 1995 amendments to the PA In-

Do not use this schedule if the

heritance and Estate Tax Act. The fee

beneficiary has elected a 5 per-

FORM INSTRUCTIONS

must be paid by a certified form of pay-

cent or $5,000 option or if the surviving

ment prior to the issuance of the valua-

spouse plans to invade the principal of

Estate of

tion. Acceptable forms of payment are

the trust.

Enter the complete name of the estate

a money order, bank draft, or certified

as shown on REV-1500, Pennsylvania

For decedents dying on or after

check made payable to the PA Depart-

Inheritance Tax Return.

Dec. 12, 1982, the valuation methods

ment of Revenue. Personal or business

are

the

same

as

described

in

File Number

account checks will not be accepted.

U.S. Treasury Department regulations.

Enter the file number of the estate as-

The department should be contacted at

The actuarial tables used for dates of

signed by the Register of Wills as

least three weeks in advance of the

death on or after May 1, 1989, can

shown on REV-1500, Pennsylvania In-

date needed to request a written

be found in IRS Publication 1457, Actu-

heritance Tax Return.

valuation. The calculation and written

arial Tables.

valuation will be mailed to the

The actuarial tables used for dates of

state representative. You may contact

GENERAL INSTRUCTIONS

death on or after May 1, 2000, can be

the Trust Valuation Specialists at

Life Estate Interest Calculation

found in IRS Publication 1457, Actuarial

717-787-8327 if you have any ques-

Tables, Aleph and Beth Volumes. The

The asset(s) subject to the annuity or

tions. Requests should be mailed to:

present value of an annuity or life estate

life estate calculation must be included

PA DEPARTMENT OF REVENUE

which is dependent on the continuation

in the asset schedules (A through G) at

INHERITANCE TAX DIVISION

or termination of the life of only one per-

the full date of death value.

SPECIALTY TAX UNIT

son or the present value of an annuity

The description of the trust, property in-

PO BOX 280601

or income interest which is payable for

terest or other arrangement to be val-

HARRISBURG, PA 17128-0601

a term certain will be determined using

ued must include the name, date of

tables which incorporate an interest rate

The request must be accompanied by

birth, and age of each beneficiary to en-

equal to 120 percent of the federal

a statement of the dates of birth of each

able the Department of Revenue to

midterm annual rate in effect for the

person, the duration of whose life may

readily identify the property interest to

month in which the date of death oc-

affect the value of the interest, and

be valued with reference to the govern-

curred. For purposes of the computa-

copies of the relevant instruments. For

ing instrument.

tion, the age of the life tenant used is

charitable remainder unitrusts and

his or her age on the birthday nearest

Annuity Interest Calculation

pooled income funds, the factor to cal-

to the date of death.

If the interest to be valued is the right to

culate the interest of a beneficiary is

receive the income or annuity for a term

calculated in accordance with the meth-

The Department of Revenue will pro-

certain rather than the life of a person,

ods described in U.S. Treasury Depart-

vide single life estate factors by tele-

include the number of years. If the

phone free of charge.

ment regulations.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1