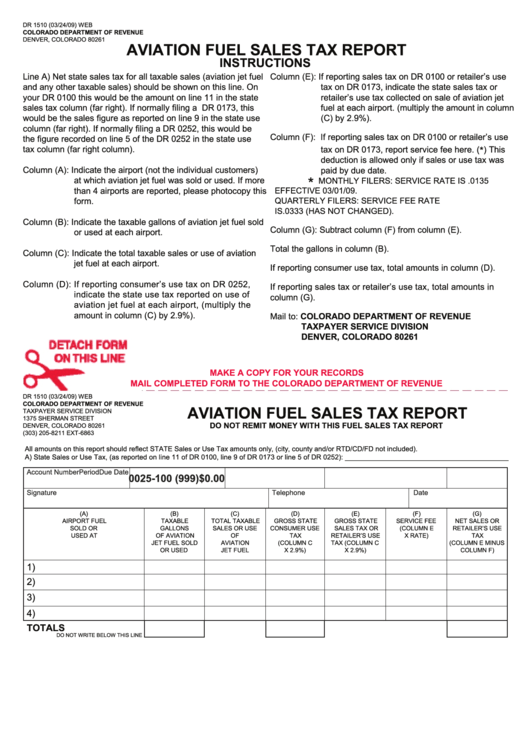

DR 1510 (03/24/09) WEB

ColorADo DepArtMent of revenue

DEnvER, ColoRaDo 80261

AviAtion fuel sAles tAx report

instruCtions

line a) net state sales tax for all taxable sales (aviation jet fuel

Column (E): If reporting sales tax on DR 0100 or retailer’s use

and any other taxable sales) should be shown on this line. on

tax on DR 0173, indicate the state sales tax or

your DR 0100 this would be the amount on line 11 in the state

retailer’s use tax collected on sale of aviation jet

sales tax column (far right). If normally filing a DR 0173, this

fuel at each airport. (multiply the amount in column

would be the sales figure as reported on line 9 in the state use

(C) by 2.9%).

column (far right). If normally filing a DR 0252, this would be

Column (F): If reporting sales tax on DR 0100 or retailer’s use

the figure recorded on line 5 of the DR 0252 in the state use

tax column (far right column).

tax on DR 0173, report service fee here. (

*

) This

deduction is allowed only if sales or use tax was

Column (A): Indicate the airport (not the individual customers)

paid by due date.

*

at which aviation jet fuel was sold or used. If more

MonThly FIlERs: sERvICE RaTE Is .0135

than 4 airports are reported, please photocopy this

EFFECTIvE 03/01/09.

QuaRTERly FIlERs: sERvICE FEE RaTE

form.

Is.0333 (has noT ChangED).

Column (B): Indicate the taxable gallons of aviation jet fuel sold

Column (g): subtract column (F) from column (E).

or used at each airport.

Total the gallons in column (B).

Column (C): Indicate the total taxable sales or use of aviation

jet fuel at each airport.

If reporting consumer use tax, total amounts in column (D).

Column (D): If reporting consumer’s use tax on DR 0252,

If reporting sales tax or retailer’s use tax, total amounts in

indicate the state use tax reported on use of

column (g).

aviation jet fuel at each airport, (multiply the

amount in column (C) by 2.9%).

Mail to: ColorADo DepArtMent of revenue

tAxpAyer serviCe Division

Denver, ColorADo 80261

MAKe A Copy for your reCorDs

MAil CoMpleteD forM to the ColorADo DepArtMent of revenue

DR 1510 (03/24/09) WEB

ColorADo DepArtMent of revenue

AviAtion fuel sAles tAx report

TaXPayER sERvICE DIvIsIon

1375 SHERMAN STREET

Do not reMit Money with this fuel sAles tAx report

DEnvER, ColoRaDo 80261

(303) 205-8211 EXT-6863

All amounts on this report should reflect STATE Sales or Use Tax amounts only, (city, county and/or RTD/CD/FD not included).

A) State Sales or Use Tax, (as reported on line 11 of DR 0100, line 9 of DR 0173 or line 5 of DR 0252): __________________________________________

account number

Period

Due Date

0025-100 (999)

$0.00

signature

Telephone

Date

(a)

(B)

(C)

(D)

(E)

(F)

(g)

aIRPoRT FuEl

TaXaBlE

ToTal TaXaBlE

gRoss sTaTE

gRoss sTaTE

sERvICE FEE

nET salEs oR

solD oR

gallons

salEs oR usE

ConsuMER usE

salEs TaX oR

(ColuMn E

RETAILER’S USE

usED aT

oF avIaTIon

oF

TaX

RETAILER’S USE

X RaTE)

TaX

JET FuEl solD

avIaTIon

(ColuMn C

TaX (ColuMn C

(ColuMn E MInus

oR usED

JET FuEl

X 2.9%)

X 2.9%)

ColuMn F)

1)

2)

3)

4)

totAls

Do noT WRITE BEloW ThIs lInE

1

1