Form Dr 0173 - Retailer'S Use Tax Return - Colorado Department Of Revenue

ADVERTISEMENT

1

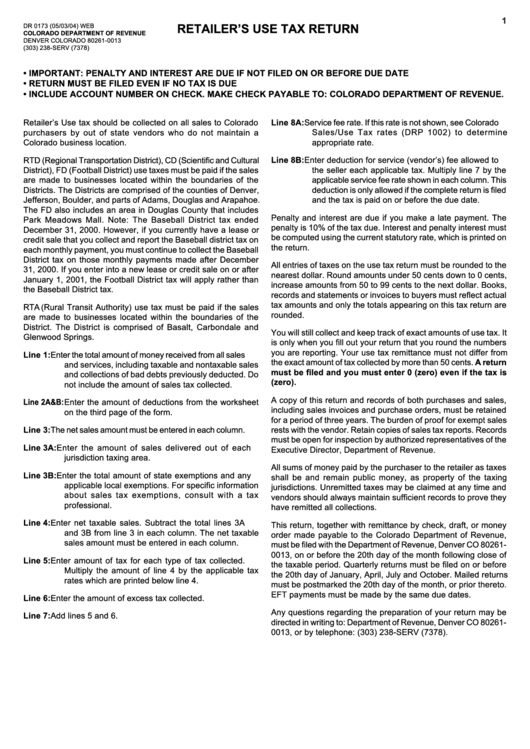

DR 0173 (05/03/04) WEB

RETAILER’S USE TAX RETURN

COLORADO DEPARTMENT OF REVENUE

DENVER COLORADO 80261-0013

(303) 238-SERV (7378)

• IMPORTANT: PENALTY AND INTEREST ARE DUE IF NOT FILED ON OR BEFORE DUE DATE

• RETURN MUST BE FILED EVEN IF NO TAX IS DUE

• INCLUDE ACCOUNT NUMBER ON CHECK. MAKE CHECK PAYABLE TO: COLORADO DEPARTMENT OF REVENUE.

Retailer’s Use tax should be collected on all sales to Colorado

Line 8A: Service fee rate. If this rate is not shown, see Colorado

purchasers by out of state vendors who do not maintain a

Sales/Use Tax rates (DRP 1002) to determine

Colorado business location.

appropriate rate.

RTD (Regional Transportation District), CD (Scientific and Cultural

Line 8B: Enter deduction for service (vendor’s) fee allowed to

District), FD (Football District) use taxes must be paid if the sales

the seller each applicable tax. Multiply line 7 by the

are made to businesses located within the boundaries of the

applicable service fee rate shown in each column. This

Districts. The Districts are comprised of the counties of Denver,

deduction is only allowed if the complete return is filed

Jefferson, Boulder, and parts of Adams, Douglas and Arapahoe.

and the tax is paid on or before the due date.

The FD also includes an area in Douglas County that includes

Penalty and interest are due if you make a late payment. The

Park Meadows Mall. Note: The Baseball District tax ended

penalty is 10% of the tax due. Interest and penalty interest must

December 31, 2000. However, if you currently have a lease or

be computed using the current statutory rate, which is printed on

credit sale that you collect and report the Baseball district tax on

the return.

each monthly payment, you must continue to collect the Baseball

District tax on those monthly payments made after December

All entries of taxes on the use tax return must be rounded to the

31, 2000. If you enter into a new lease or credit sale on or after

nearest dollar. Round amounts under 50 cents down to 0 cents,

January 1, 2001, the Football District tax will apply rather than

increase amounts from 50 to 99 cents to the next dollar. Books,

the Baseball District tax.

records and statements or invoices to buyers must reflect actual

tax amounts and only the totals appearing on this tax return are

RTA (Rural Transit Authority) use tax must be paid if the sales

rounded.

are made to businesses located within the boundaries of the

District. The District is comprised of Basalt, Carbondale and

You will still collect and keep track of exact amounts of use tax. It

Glenwood Springs.

is only when you fill out your return that you round the numbers

you are reporting. Your use tax remittance must not differ from

Line 1:

Enter the total amount of money received from all sales

the exact amount of tax collected by more than 50 cents. A return

and services, including taxable and nontaxable sales

must be filed and you must enter 0 (zero) even if the tax is

and collections of bad debts previously deducted. Do

(zero).

not include the amount of sales tax collected.

A copy of this return and records of both purchases and sales,

Line 2A&B:Enter the amount of deductions from the worksheet

including sales invoices and purchase orders, must be retained

on the third page of the form.

for a period of three years. The burden of proof for exempt sales

Line 3:

The net sales amount must be entered in each column.

rests with the vendor. Retain copies of sales tax reports. Records

must be open for inspection by authorized representatives of the

Line 3A: Enter the amount of sales delivered out of each

Executive Director, Department of Revenue.

jurisdiction taxing area.

All sums of money paid by the purchaser to the retailer as taxes

Line 3B: Enter the total amount of state exemptions and any

shall be and remain public money, as property of the taxing

applicable local exemptions. For specific information

jurisdictions. Unremitted taxes may be claimed at any time and

about sales tax exemptions, consult with a tax

vendors should always maintain sufficient records to prove they

professional.

have remitted all collections.

Line 4:

Enter net taxable sales. Subtract the total lines 3A

This return, together with remittance by check, draft, or money

and 3B from line 3 in each column. The net taxable

order made payable to the Colorado Department of Revenue,

sales amount must be entered in each column.

must be filed with the Department of Revenue, Denver CO 80261-

0013, on or before the 20th day of the month following close of

Line 5:

Enter amount of tax for each type of tax collected.

the taxable period. Quarterly returns must be filed on or before

Multiply the amount of line 4 by the applicable tax

the 20th day of January, April, July and October. Mailed returns

rates which are printed below line 4.

must be postmarked the 20th day of the month, or prior thereto.

EFT payments must be made by the same due dates.

Line 6:

Enter the amount of excess tax collected.

Any questions regarding the preparation of your return may be

Line 7:

Add lines 5 and 6.

directed in writing to: Department of Revenue, Denver CO 80261-

0013, or by telephone: (303) 238-SERV (7378).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1