Clear

Print

State of Wisconsin

G G G G G DEPARTMENT OF REVENUE

INCOME, SALES, AND EXCISE TAX DIVISION G 4638 UNIVERSITY AVENUE G MADISON, WISCONSIN G

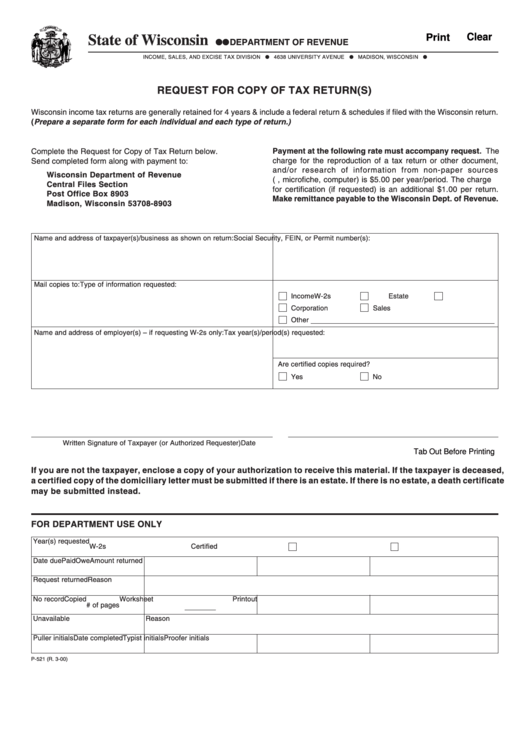

REQUEST FOR COPY OF TAX RETURN(S)

Wisconsin income tax returns are generally retained for 4 years & include a federal return & schedules if filed with the Wisconsin return.

( Prepare a separate form for each individual and each type of return.)

Complete the Request for Copy of Tax Return below.

Payment at the following rate must accompany request. The

charge for the reproduction of a tax return or other document,

Send completed form along with payment to:

and/or research of information from non-paper sources

Wisconsin Department of Revenue

(i.e., microfiche, computer) is $5.00 per year/period. The charge

Central Files Section

for certification (if requested) is an additional $1.00 per return.

Post Office Box 8903

Make remittance payable to the Wisconsin Dept. of Revenue.

Madison, Wisconsin 53708-8903

Name and address of taxpayer(s)/business as shown on return:

Social Security, FEIN, or Permit number(s):

Mail copies to:

Type of information requested:

Income

W-2s

Estate

Corporation

Sales

Other

Name and address of employer(s) – if requesting W-2s only:

Tax year(s)/period(s) requested:

Are certified copies required?

Yes

No

Written Signature of Taxpayer (or Authorized Requester)

Date

Tab Out Before Printing

If you are not the taxpayer, enclose a copy of your authorization to receive this material. If the taxpayer is deceased,

a certified copy of the domiciliary letter must be submitted if there is an estate. If there is no estate, a death certificate

may be submitted instead.

FOR DEPARTMENT USE ONLY

Year(s) requested

W-2s

Certified

Date due

Paid

Owe

Amount returned

Request returned

Reason

No record

Copied

Worksheet

Printout

# of pages

Unavailable

Reason

Puller initials

Date completed

Typist initials

Proofer initials

P-521 (R. 3-00)

1

1