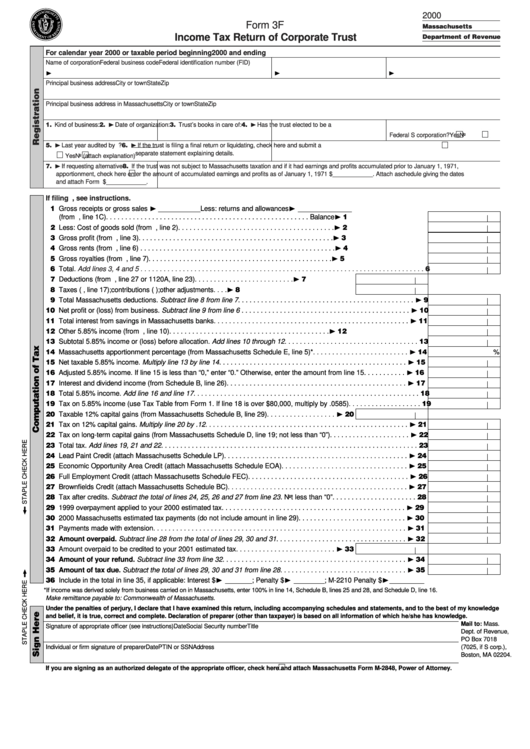

Form 3f - Income Tax Return Of Corporate Trust - 2000

ADVERTISEMENT

2000

Form 3F

Massachusetts

Income Tax Return of Corporate Trust

Department of Revenue

For calendar year 2000 or taxable period beginning

2000 and ending

Name of corporation

Federal business code

Federal identification number (FID)

❿

❿

❿

Principal business address

City or town

State

Zip

Principal business address in Massachusetts

City or town

State

Zip

2. ❿ Date of organization:

4. ❿ Has the trust elected to be a

1. Kind of business:

3. Trust’s books in care of:

Federal S corporation?

Yes

No

5. ❿ Last year audited by IRS

6. ❿ If the trust is filing a final return or liquidating, check here

. Adjustments reported to Massachusetts?

and submit a

separate statement explaining details.

Yes

No (attach explanation)

7. ❿ If requesting alternative

8. If the trust was not subject to Massachusetts taxation and if it had earnings and profits accumulated prior to January 1, 1971,

apportionment, check here

enter the amount of accumulated earnings and profits as of January 1, 1971 $ ____________. Attach a schedule giving the dates

and attach Form AA-1.

and amounts of distributions from such earnings and profits since 1971. Enter the total of such distributions $____________.

If filing U.S. Form 1120S, see instructions.

11 Gross receipts or gross sales ❿ ___________ Less: returns and allowances ❿ ______________

(from U.S. Forms 1120 or 1120A, line 1C). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Balance ❿ 1

12 Less: Cost of goods sold (from U.S. Forms 1120 or 1120A, line 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 2

13 Gross profit (from U.S. Forms 1120 or 1120A, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 3

14 Gross rents (from U.S. Forms 1120 or 1120A, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 4

15 Gross royalties (from U.S. Forms 1120 or 1120A, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 5

16 Total.

Add lines 3, 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Deductions (from U.S. Form 1120, line 27 or 1120A, line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 7

18 Taxes (U.S. Forms 1120 or 1120A, line 17); contributions (U.S. line 19); other adjustments. . . . ❿ 8

19 Total Massachusetts deductions. Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 9

10 Net profit or (loss) from business. Subtract line 9 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 10

11 Total interest from savings in Massachusetts banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 11

12 Other 5.85% income (from U.S. Forms 1120 or 1120A, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 12

13 Subtotal 5.85% income or (loss) before allocation. Add lines 10 through 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Massachusetts apportionment percentage (from Massachusetts Schedule E, line 5)*. . . . . . . . . . . . . . . . . . . . . . . . . ❿ 14

%

15 Net taxable 5.85% income. Multiply line 13 by line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 15

16 Adjusted 5.85% income. If line 15 is less than “0,” enter “0.” Otherwise, enter the amount from line 15 . . . . . . . . . . . ❿ 16

17 Interest and dividend income (from Schedule B, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 17

18 Total 5.85% income. Add line 16 and line 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Tax on 5.85% income (use Tax Table from Form 1. If line 18 is over $80,000, multiply by .0585). . . . . . . . . . . . . . . . . . . 19

20 Taxable 12% capital gains (from Massachusetts Schedule B, line 29) . . . . . . . . . . . . . . . . . . ❿ 20

21 Tax on 12% capital gains. Multiply line 20 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 21

22 Tax on long-term capital gains (from Massachusetts Schedule D, line 19; not less than “0”) . . . . . . . . . . . . . . . . . . . . . ❿ 22

23 Total tax. Add lines 19, 21 and 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Lead Paint Credit (attach Massachusetts Schedule LP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 24

25 Economic Opportunity Area Credit (attach Massachusetts Schedule EOA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 25

26 Full Employment Credit (attach Massachusetts Schedule FEC). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 26

27 Brownfields Credit (attach Massachusetts Schedule BC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 27

28 Tax after credits. Subtract the total of lines 24, 25, 26 and 27 from line 23. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . 28

29 1999 overpayment applied to your 2000 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 29

30 2000 Massachusetts estimated tax payments (do not include amount in line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 30

31 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 31

32 Amount overpaid. Subtract line 28 from the total of lines 29, 30 and 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 32

33 Amount overpaid to be credited to your 2001 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 33

34 Amount of your refund. Subtract line 33 from line 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 34

35 Amount of tax due. Subtract the total of lines 29, 30 and 31 from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 35

36 Include in the total in line 35, if applicable: Interest $❿ _______; Penalty $❿ ________; M-2210 Penalty $❿_________

*If income was derived solely from business carried on in Massachusetts, enter 100% in line 14, Schedule B, lines 25 and 28, and Schedule D, line 16.

Make remittance payable to: Commonwealth of Massachusetts.

Under the penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has knowledge.

Mail to: Mass.

Signature of appropriate officer (see instructions)

Date

Social Security number

Title

Dept. of Revenue,

PO Box 7018

Individual or firm signature of preparer

Date

PTIN or SSN

Address

(7025, if S corp.),

Boston, MA 02204.

If you are signing as an authorized delegate of the appropriate officer, check here

and attach Massachusetts Form M-2848, Power of Attorney.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4