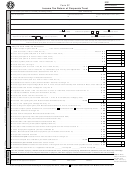

Form 3f - Income Tax Return Of Corporate Trust - 2000 Page 3

ADVERTISEMENT

Schedule D. Long-Term Capital Gains and (Losses) Excluding Collectibles

Attach copy of U.S. Schedule D.

For lines 1, 2, 3, 5, 6 and 8, enter in the appropriate column amounts from the sale, exchange or involuntary conversion of Massachusetts capital assets:

11 Enter net gains or (losses) from U.S. Forms 1120

A.

B.

C.

D.

or 1120S, Schedule D, Part II, line 11. If not filing

Held more than 1 year

Held more than 2 years

Held more than 3 years

Held more than 4 years

but not more than 2 years

but not more than 3 years

but not more than 4 years

but not more than 5 years

U.S. Schedule D, report 100% of capital gains

distributions in line 1 . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Loss on the sale, exchange or involuntary conversion

of property used in a trade or business and held

for more than one year (not included in line 1) . . . . . 2 (

) (

) (

) (

)

13 Carryover losses from prior years (see instructions) 3 (

) (

) (

) (

)

14 Subtotal. Combine line 1, line 2 and line 3 . . . . . . . . 4

15 Net gains or (losses) taxed directly to

Massachusetts trusts and included in line 4 . . . . . . . 5

16 Differences and adjustments, if any

(attach additional statement) . . . . . . . . . . . . . . . . . . 6

17 Exclude/subtract line 5 and line 6 from line 4 . . . . . . 7

18 Long-term gains on collectibles and pre-1996

installment sales. Also, enter this amount in

Schedule B, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Subtotal. Subtract line 8 from line 7 . . . . . . . . . . . . . . 9

10 Long-term capital (losses) applied against long-term

capital gains. See instructions . . . . . . . . . . . . . . . . 10

11 Subtotal. Combine line 9 and line 10 . . . . . . . . . . . . 11

12 Capital (losses) applied against interest, dividends

and/or capital gains. See instructions . . . . . . . . . . 12

13 Subtotal. If line 11 is greater than “0,” subtract line 12 from line 11. If line 11 is less than “0,” combine lines 11 and 12. If line 13 is a loss, omit lines 14

through 19, enter the amount from line 13 in

line 20 and enter “0” on Form 3F, line 22 . . . . . . . . . 13

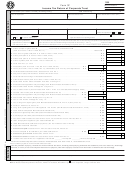

14 Allowable deductions from your trade or business

(from Mass. Schedule C-2; see instructions) . . . . . . 14

15 Subtotal. Subtract line 14 from line 13 . . . . . . . . . . . 15

16 Massachusetts apportionment percentage

(from Massachusetts Schedule E, line 5)* . . . . . . . . 16

%

%

%

%

17 Adjusted long-term capital gains/losses.

Multiply line 15 by line 16. . . . . . . . . . . . . . . . . . . . . 17

Multiply line 17, col. A by .05; Multiply line 17, col. B by .04; Multiply line 17, col. C by .03; Multiply line 17, col. D by .02;

enter result below

enter result below

enter result below

enter result below

18 Multiply line 17 by the applicable tax rate . . . . . . . . 18

19 Tax on long-term capital gains. Add lines 18A, 18B, 18C, 18D and 18E

(Schedule D, page 2). Not less than “0.” Enter result here and on Form 3F, line 22. . . 19

20 Available (losses) for carryover in 2001. Enter in line 20, column A the amount from line 13, column A, only if it is a (loss).

Enter in line 20, column B the amount from line 13, column B, only if it is a (loss). Enter in line 20, column C the amount

from line 13, column C, only if it is a (loss).

Column A

Column B

Column C

Column D

carryover amount

carryover amount

carryover amount

carryover amount

Enter in line 20, column D the amount from

line 13, column D, only if it is a (loss) . . . . . . . . . . . 20 (

) (

) (

) (

)

*If income was derived solely from business carried on in Massachusetts, enter 100% in line 16.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4