Publication 936 - Home Mortgage Interest Deduction - 2003 Page 3

ADVERTISEMENT

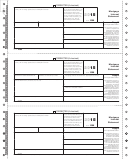

Figure A. Is My Home Mortgage Interest Fully Deductible?

(Instructions: Include balances of ALL mortgages secured by your main home and second home.)

Start Here:

1

Do you meet the conditions

to deduct home

You cannot deduct the interest payments as home

No

4

mortgage interest?

mortgage interest.

Yes

Yes

Were your total mortgage balances $100,000 or

Your home mortgage interest is fully deductible. You

2

less

($50,000 or less if married filing separately) at

do not need to read Part II of this publication.

all times during the year?

No

Were all of your home mortgages taken out on or

Go to Part II of this publication to determine the

Yes

before 10-13-87?

limits on your deductible home mortgage interest.

No

Were all of your home mortgages taken out after

Were your grandfathered debt plus home acquisition

10-13-87 used to buy, build, or improve the main

3

debt balances $1,000,000 or less

($500,000 or less

Yes

home secured by that main home mortgage or used

No

No

if married filing separately) at all times during the

to buy, build, or improve the second home secured

year?

by that second home mortgage, or both?

Yes

Yes

Were the mortgage balances $1,000,000 or less

Were your home equity debt balances $100,000 or

2

($500,000 or less if married filing separately) at all

No

less

($50,000 or less if married filing separately) at

No

times during the year?

all times during the year?

Yes

1

You must itemize deductions on Schedule A (Form 1040) and be legally liable for the loan. The loan must be a secured debt on a qualified home. See

Part I, Home Mortgage Interest.

2

If all mortgages on your main or second home exceed the home’s fair market value, a lower limit may apply. See Home equity debt limit under Home

Equity Debt in Part II.

3

Amounts over the $1,000,000 limit ($500,000 if married filing separately) qualify as home equity debt if they are not more than the total home equity debt

limit. See Part II of this publication for more information about grandfathered debt, home acquisition debt, and home equity debt.

4

See Table 2 for where to deduct other types of interest payments.

Second home rented out. If you have a

More than one second home. If you have

as your second home as of the day you

second home and rent it out part of the year, you

stop using it as your main home.

more than one second home, you can treat only

also must use it as a home during the year for it

one as the qualified second home during any

3) If your second home is sold during the

to be a qualified home. You must use this home

year. However, you can change the home you

year or becomes your main home, you can

more than 14 days or more than 10% of the

treat as a second home during the year in the

choose a new second home as of the day

number of days during the year that the home is

following three situations.

you sell the old one or begin using it as

rented at a fair rental, whichever is longer. If you

your main home.

do not use the home long enough, it is consid-

1) If you get a new home during the year, you

ered rental property and not a second home. For

can choose to treat the new home as your

information on residential rental property, see

Divided use of your home. The only part of

second home as of the day you buy it.

Publication 527.

your home that is considered a qualified home is

2) If your main home no longer qualifies as

the part you use for residential living. If you use

your main home, you can choose to treat it

part of your home for other than residential liv-

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15