Publication 936 - Home Mortgage Interest Deduction - 2003 Page 9

ADVERTISEMENT

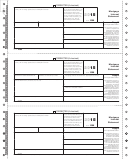

Table 1. Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage

Interest For the Current Year

See the Table 1 Instructions.

(Keep for your records.)

Part I

Qualified Loan Limit

1.

Enter the average balance of all your grandfathered debt. See line 1 instructions . .

1.

2.

Enter the average balance of all your home acquisition debt. See line 2 instructions

2.

3.

Enter $1,000,000 ($500,000 if married filing separately) . . . . . . . . . . . . . . . . . . . . .

3.

4.

Enter the larger of the amount on line 1 or the amount on line 3 . . . . . . . . . . . . . . .

4.

5.

Add the amounts on lines 1 and 2. Enter the total here . . . . . . . . . . . . . . . . . . . . . .

5.

6.

Enter the smaller of the amount on line 4 or the amount on line 5 . . . . . . . . . . . . . .

6.

7.

Enter $100,000 ($50,000 if married filing separately).

See the line 7 instructions for a limit that may apply . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

Add the amounts on lines 6 and 7. Enter the total. This is your qualified loan limit . .

8.

Part II

Deductible Home Mortgage Interest

9.

Enter the total of the average balances of all mortgages on all qualified homes.

See line 9 instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

•

If line 8 is less than line 9, go on to line 10.

•

If line 8 is equal to or more than line 9, stop here. All of your interest

on all the mortgages included on line 9 is deductible as home mortgage

interest on Schedule A (Form 1040).

10. Enter the total amount of interest that you paid. See line 10 instructions . . . . . . . . . . . 10.

11. Divide the amount on line 8 by the amount on line 9.

× .

Enter the result as a decimal amount (rounded to three places) . . . . . . . . . . . . . . . . . 11.

12. Multiply the amount on line 10 by the decimal amount on line 11.

Enter the result. This is your deductible home mortgage interest.

Enter this amount on Schedule A (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Subtract the amount on line 12 from the amount on line 10. Enter the result.

This is not home mortgage interest. See line 13 instructions . . . . . . . . . . . . . . . . . . . 13.

the home acquisition debt limit (discussed ear-

main home and second home is limited to the

FMV of the home less any outstanding mort-

lier), may qualify as home equity debt.

smaller of:

gages or other liens. To consolidate some of

Home equity debt is a mortgage you took out

your other debts, you take out a $42,500 home

mortgage loan [(125% × $110,000) − $95,000]

after October 13, 1987, that:

1) $100,000 ($50,000 if married filing sepa-

with Bank M.

rately), or

1) Does not qualify as home acquisition debt

Your home equity debt is limited to $15,000.

or as grandfathered debt, and

2) The total of each home’s fair market value

This is the smaller of:

(FMV) reduced (but not below zero) by the

2) Is secured by your qualified home.

amount of its home acquisition debt and

1) $100,000, the maximum limit, or

grandfathered debt. Determine the FMV

Example. You bought your home for cash

and the outstanding home acquisition and

2) $15,000, the amount that the FMV of

10 years ago. You did not have a mortgage on

grandfathered debt for each home on the

$110,000 exceeds the amount of home ac-

your home until last year, when you took out a

date that the last debt was secured by the

quisition debt of $95,000.

$20,000 loan, secured by your home, to pay for

home.

your daughter’s college tuition and your father’s

Debt higher than limit.

Interest on

medical bills. This loan is home equity debt.

Example. You own one home that you

amounts over the home equity debt limit (such

as the interest on $27,500 [$42,500 − $15,000]

bought in 1998. Its FMV now is $110,000, and

Home equity debt limit. There is a limit on the

the current balance on your original mortgage

in the preceding example) generally is treated

amount of debt that can be treated as home

(home acquisition debt) is $95,000. Bank M of-

as personal interest and is not deductible. But if

equity debt. The total home equity debt on your

fers you a home mortgage loan of 125% of the

the proceeds of the loan were used for invest-

Page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15