Instructions For Schedule D (Form 5500) - Dfe/participating Plan Information - 2002

ADVERTISEMENT

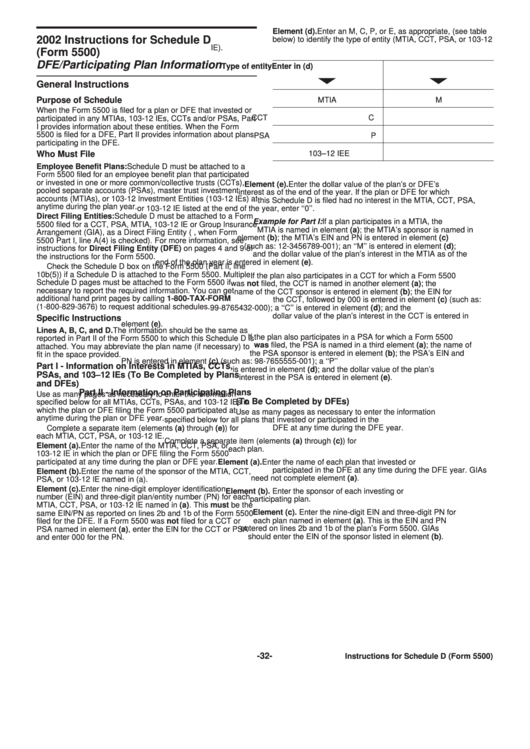

Element (d). Enter an M, C, P, or E, as appropriate, (see table

2002 Instructions for Schedule D

below) to identify the type of entity (MTIA, CCT, PSA, or 103-12

IE).

(Form 5500)

DFE/Participating Plan Information

Type of entity

Enter in (d)

General Instructions

Purpose of Schedule

MTIA

M

When the Form 5500 is filed for a plan or DFE that invested or

CCT

C

participated in any MTIAs, 103-12 IEs, CCTs and/or PSAs, Part

I provides information about these entities. When the Form

5500 is filed for a DFE, Part II provides information about plans

PSA

P

participating in the DFE.

103 – 12 IE

E

Who Must File

Employee Benefit Plans: Schedule D must be attached to a

Form 5500 filed for an employee benefit plan that participated

or invested in one or more common/collective trusts (CCTs),

Element (e). Enter the dollar value of the plan’s or DFE’s

pooled separate accounts (PSAs), master trust investment

interest as of the end of the year. If the plan or DFE for which

accounts (MTIAs), or 103-12 Investment Entities (103-12 IEs) at

this Schedule D is filed had no interest in the MTIA, CCT, PSA,

anytime during the plan year.

or 103-12 IE listed at the end of the year, enter ‘‘0’’.

Direct Filing Entities: Schedule D must be attached to a Form

Example for Part I: If a plan participates in a MTIA, the

5500 filed for a CCT, PSA, MTIA, 103-12 IE or Group Insurance

MTIA is named in element (a); the MTIA’s sponsor is named in

Arrangement (GIA), as a Direct Filing Entity (i.e., when Form

element (b); the MTIA’s EIN and PN is entered in element (c)

5500 Part I, line A(4) is checked). For more information, see

(such as: 12-3456789-001); an ‘‘M’’ is entered in element (d);

instructions for Direct Filing Entity (DFE) on pages 4 and 9 of

and the dollar value of the plan’s interest in the MTIA as of the

the instructions for the Form 5500.

end of the plan year is entered in element (e).

Check the Schedule D box on the Form 5500 (Part II, line

10b(5)) if a Schedule D is attached to the Form 5500. Multiple

If the plan also participates in a CCT for which a Form 5500

Schedule D pages must be attached to the Form 5500 if

was not filed, the CCT is named in another element (a); the

necessary to report the required information. You can get

name of the CCT sponsor is entered in element (b); the EIN for

additional hand print pages by calling 1-800-TAX-FORM

the CCT, followed by 000 is entered in element (c) (such as:

(1-800-829-3676) to request additional schedules.

99-8765432-000); a ‘‘C’’ is entered in element (d); and the

dollar value of the plan’s interest in the CCT is entered in

Specific Instructions

element (e).

Lines A, B, C, and D. The information should be the same as

If the plan also participates in a PSA for which a Form 5500

reported in Part II of the Form 5500 to which this Schedule D is

was filed, the PSA is named in a third element (a); the name of

attached. You may abbreviate the plan name (if necessary) to

the PSA sponsor is entered in element (b); the PSA’s EIN and

fit in the space provided.

PN is entered in element (c) (such as: 98-7655555-001); a ‘‘P’’

Part I - Information on Interests in MTIAs, CCTs,

is entered in element (d); and the dollar value of the plan’s

PSAs, and 103 – 12 IEs (To Be Completed by Plans

interest in the PSA is entered in element (e).

and DFEs)

Part II - Information on Participating Plans

Use as many pages as necessary to enter the information

(To Be Completed by DFEs)

specified below for all MTIAs, CCTs, PSAs, and 103-12 IEs in

which the plan or DFE filing the Form 5500 participated at

Use as many pages as necessary to enter the information

anytime during the plan or DFE year.

specified below for all plans that invested or participated in the

DFE at any time during the DFE year.

Complete a separate item (elements (a) through (e)) for

each MTIA, CCT, PSA, or 103-12 IE.

Complete a separate item (elements (a) through (c)) for

Element (a). Enter the name of the MTIA, CCT, PSA, or

each plan.

103-12 IE in which the plan or DFE filing the Form 5500

participated at any time during the plan or DFE year.

Element (a). Enter the name of each plan that invested or

participated in the DFE at any time during the DFE year. GIAs

Element (b). Enter the name of the sponsor of the MTIA, CCT,

need not complete element (a).

PSA, or 103-12 IE named in (a).

Element (c). Enter the nine-digit employer identification

Element (b). Enter the sponsor of each investing or

number (EIN) and three-digit plan/entity number (PN) for each

participating plan.

MTIA, CCT, PSA, or 103-12 IE named in (a). This must be the

Element (c). Enter the nine-digit EIN and three-digit PN for

same EIN/PN as reported on lines 2b and 1b of the Form 5500

each plan named in element (a). This is the EIN and PN

filed for the DFE. If a Form 5500 was not filed for a CCT or

entered on lines 2b and 1b of the plan’s Form 5500. GIAs

PSA named in element (a), enter the EIN for the CCT or PSA

should enter the EIN of the sponsor listed in element (b).

and enter 000 for the PN.

-32-

Instructions for Schedule D (Form 5500)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1