Instructions For Schedule T (Form 5500) - 2004

ADVERTISEMENT

EINs may be obtained by applying for one on Form SS-4,

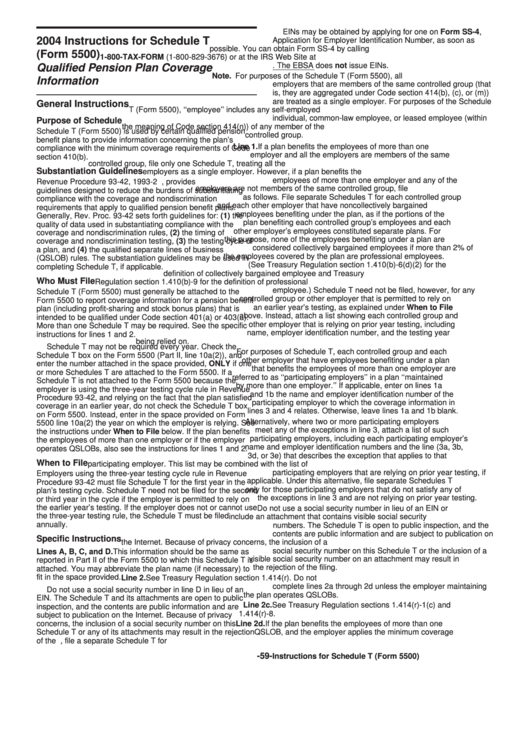

2004 Instructions for Schedule T

Application for Employer Identification Number, as soon as

possible. You can obtain Form SS-4 by calling

(Form 5500)

1-800-TAX-FORM (1-800-829-3676) or at the IRS Web Site at

The EBSA does not issue EINs.

Qualified Pension Plan Coverage

Note. For purposes of the Schedule T (Form 5500), all

Information

employers that are members of the same controlled group (that

is, they are aggregated under Code section 414(b), (c), or (m))

are treated as a single employer. For purposes of the Schedule

General Instructions

T (Form 5500), ‘‘employee’’ includes any self-employed

individual, common-law employee, or leased employee (within

Purpose of Schedule

the meaning of Code section 414(n)) of any member of the

Schedule T (Form 5500) is used by certain qualified pension

controlled group.

benefit plans to provide information concerning the plan’s

Line 1. If a plan benefits the employees of more than one

compliance with the minimum coverage requirements of Code

employer and all the employers are members of the same

section 410(b).

controlled group, file only one Schedule T, treating all the

Substantiation Guidelines

employers as a single employer. However, if a plan benefits the

employees of more than one employer and any of the

Revenue Procedure 93-42, 1993-2 C.B. 540, provides

employers are not members of the same controlled group, file

guidelines designed to reduce the burdens of substantiating

as follows. File separate Schedules T for each controlled group

compliance with the coverage and nondiscrimination

and each other employer that have noncollectively bargained

requirements that apply to qualified pension benefit plans.

employees benefiting under the plan, as if the portions of the

Generally, Rev. Proc. 93-42 sets forth guidelines for: (1) the

plan benefiting each controlled group’s employees and each

quality of data used in substantiating compliance with the

other employer’s employees constituted separate plans. For

coverage and nondiscrimination rules, (2) the timing of

this purpose, none of the employees benefiting under a plan are

coverage and nondiscrimination testing, (3) the testing cycle of

considered collectively bargained employees if more than 2% of

a plan, and (4) the qualified separate lines of business

the employees covered by the plan are professional employees.

(QSLOB) rules. The substantiation guidelines may be used in

(See Treasury Regulation section 1.410(b)-6(d)(2) for the

completing Schedule T, if applicable.

definition of collectively bargained employee and Treasury

Who Must File

Regulation section 1.410(b)-9 for the definition of professional

employee.) Schedule T need not be filed, however, for any

Schedule T (Form 5500) must generally be attached to the

controlled group or other employer that is permitted to rely on

Form 5500 to report coverage information for a pension benefit

an earlier year’s testing, as explained under When to File

plan (including profit-sharing and stock bonus plans) that is

above. Instead, attach a list showing each controlled group and

intended to be qualified under Code section 401(a) or 403(a).

other employer that is relying on prior year testing, including

More than one Schedule T may be required. See the specific

name, employer identification number, and the testing year

instructions for lines 1 and 2.

being relied on.

Schedule T may not be required every year. Check the

For purposes of Schedule T, each controlled group and each

Schedule T box on the Form 5500 (Part II, line 10a(2)), and

other employer that have employees benefiting under a plan

enter the number attached in the space provided, ONLY if one

that benefits the employees of more than one employer are

or more Schedules T are attached to the Form 5500. If a

referred to as ‘‘participating employers’’ in a plan ‘‘maintained

Schedule T is not attached to the Form 5500 because the

by more than one employer.’’ If applicable, enter on lines 1a

employer is using the three-year testing cycle rule in Revenue

and 1b the name and employer identification number of the

Procedure 93-42, and relying on the fact that the plan satisfied

participating employer to which the coverage information in

coverage in an earlier year, do not check the Schedule T box

lines 3 and 4 relates. Otherwise, leave lines 1a and 1b blank.

on Form 5500. Instead, enter in the space provided on Form

Alternatively, where two or more participating employers

5500 line 10a(2) the year on which the employer is relying. See

meet any of the exceptions in line 3, attach a list of such

the instructions under When to File below. If the plan benefits

participating employers, including each participating employer’s

the employees of more than one employer or if the employer

name and employer identification numbers and the line (3a, 3b,

operates QSLOBs, also see the instructions for lines 1 and 2.

3d, or 3e) that describes the exception that applies to that

When to File

participating employer. This list may be combined with the list of

participating employers that are relying on prior year testing, if

Employers using the three-year testing cycle rule in Revenue

applicable. Under this alternative, file separate Schedules T

Procedure 93-42 must file Schedule T for the first year in the

only for those participating employers that do not satisfy any of

plan’s testing cycle. Schedule T need not be filed for the second

the exceptions in line 3 and are not relying on prior year testing.

or third year in the cycle if the employer is permitted to rely on

the earlier year’s testing. If the employer does not or cannot use

Do not use a social security number in lieu of an EIN or

the three-year testing rule, the Schedule T must be filed

include an attachment that contains visible social security

annually.

numbers. The Schedule T is open to public inspection, and the

contents are public information and are subject to publication on

Specific Instructions

the Internet. Because of privacy concerns, the inclusion of a

social security number on this Schedule T or the inclusion of a

Lines A, B, C, and D. This information should be the same as

visible social security number on an attachment may result in

reported in Part II of the Form 5500 to which this Schedule T is

the rejection of the filing.

attached. You may abbreviate the plan name (if necessary) to

fit in the space provided.

Line 2. See Treasury Regulation section 1.414(r). Do not

complete lines 2a through 2d unless the employer maintaining

Do not use a social security number in line D in lieu of an

the plan operates QSLOBs.

EIN. The Schedule T and its attachments are open to public

Line 2c. See Treasury Regulation sections 1.414(r)-1(c) and

inspection, and the contents are public information and are

1.414(r)-8.

subject to publication on the Internet. Because of privacy

concerns, the inclusion of a social security number on this

Line 2d. If the plan benefits the employees of more than one

Schedule T or any of its attachments may result in the rejection

QSLOB, and the employer applies the minimum coverage

of the filing.

requirements on a QSLOB basis, file a separate Schedule T for

-59-

Instructions for Schedule T (Form 5500)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4