Form Op-271 - Connecticut Solid Waste Assessment Return

ADVERTISEMENT

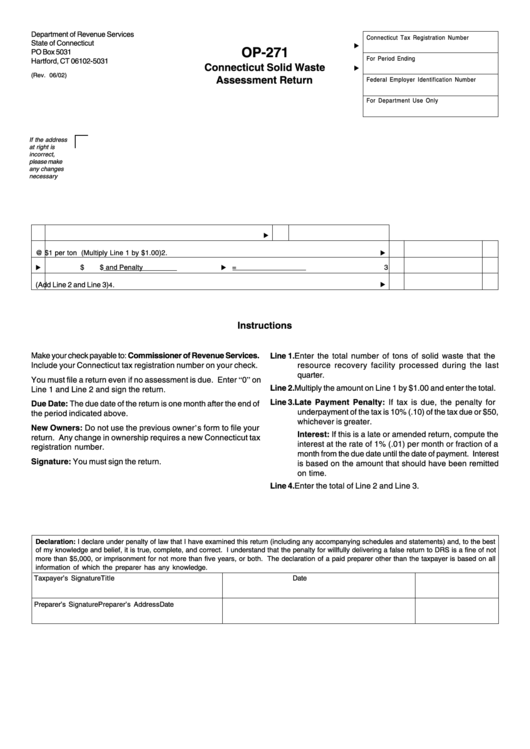

Department of Revenue Services

Connecticut Tax Registration Number

State of Connecticut

OP-271

PO Box 5031

For Period Ending

Hartford, CT 06102-5031

Connecticut Solid Waste

(Rev. 06/02)

Assessment Return

Federal Employer Identification Number

For Department Use Only

If the address

at right is

incorrect,

please make

any changes

necessary

1.

Number of tons of solid waste processed

1.

2.

Tax due @ $1 per ton (Multiply Line 1 by $1.00)

2.

3.

Add Interest

$

and Penalty

$

=

3.

4.

Total amount (Add Line 2 and Line 3)

4.

Instructions

Make your check payable to: Commissioner of Revenue Services.

Line 1. Enter the total number of tons of solid waste that the

Include your Connecticut tax registration number on your check.

resource recovery facility processed during the last

quarter.

You must file a return even if no assessment is due. Enter “0” on

Line 2. Multiply the amount on Line 1 by $1.00 and enter the total.

Line 1 and Line 2 and sign the return.

Line 3. Late Payment Penalty: If tax is due, the penalty for

Due Date: The due date of the return is one month after the end of

underpayment of the tax is 10% (.10) of the tax due or $50,

the period indicated above.

whichever is greater.

New Owners: Do not use the previous owner’s form to file your

Interest: If this is a late or amended return, compute the

return. Any change in ownership requires a new Connecticut tax

interest at the rate of 1% (.01) per month or fraction of a

registration number.

month from the due date until the date of payment. Interest

Signature: You must sign the return.

is based on the amount that should have been remitted

on time.

Line 4. Enter the total of Line 2 and Line 3.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not

more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all

information of which the preparer has any knowledge.

Taxpayer’s Signature

Title

Date

Preparer’s Signature

Preparer’s Address

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1