Form Nyc399 - Schedule Of New York City Depreciation Adjustments

ADVERTISEMENT

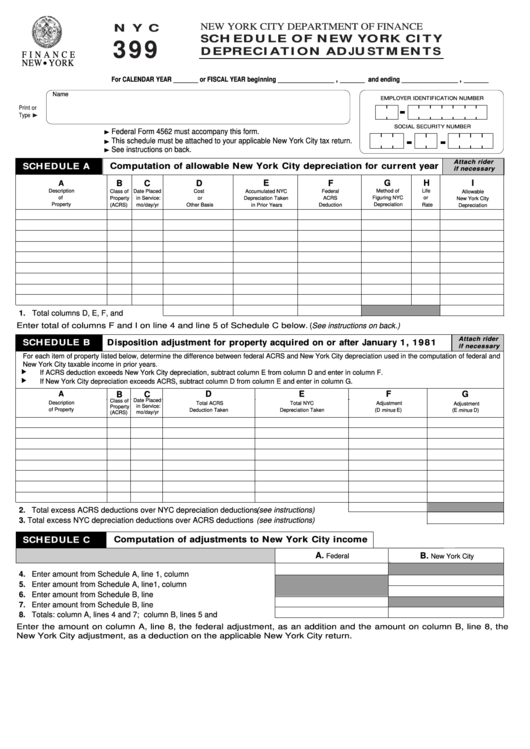

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

SCHEDULE OF NEW YORK CITY

399

DEPRECIATION ADJUSTMENTS

F I N A N C E

NEW YORK

For CALENDAR YEAR _______ or FISCAL YEAR beginning ________________ , _______ and ending ________________ , _______

Name

EMPLOYER IDENTIFICATION NUMBER

Print or

Type ¨

SOCIAL SECURITY NUMBER

¨

Federal Form 4562 must accompany this form.

¨

This schedule must be attached to your applicable New York City tax return.

¨

See instructions on back.

Attach rider

SCHEDULE A

Computation of allowable New York City depreciation for current year

if necessary

E

B

C

D

F

G

H

I

A

Description

Method of

Life

Class of

Date Placed

Cost

Accumulated NYC

Federal

Allowable

of

in Service:

or

ACRS

Figuring NYC

or

Property

Depreciation Taken

New York City

Property

mo/day/yr

Other Basis

Deduction

Depreciation

Rate

(ACRS)

in Prior Years

Depreciation

1. Total columns D, E, F, and I .............

Enter total of columns F and I on line 4 and line 5 of Schedule C below. ( See instructions on back.)

Attach rider

SCHEDULE B

Disposition adjustment for property acquired on or after January 1, 1981

if necessary

For each item of property listed below, determine the difference between federal ACRS and New York City depreciation used in the computation of federal and

New York City taxable income in prior years.

If ACRS deduction exceeds New York City depreciation, subtract column E from column D and enter in column F.

If New York City depreciation exceeds ACRS, subtract column D from column E and enter in column G.

D

E

F

G

A

B

C

Class of

Date Placed

Description

Total ACRS

Total NYC

Adjustment

Adjustment

Property

in Service:

of Property

Deduction Taken

Depreciation Taken

(D minus E)

(E minus D)

mo/day/yr

(ACRS)

2. Total excess ACRS deductions over NYC depreciation deductions (see instructions) ............

3. Total excess NYC depreciation deductions over ACRS deductions (see instructions) ................................................

Computation of adjustments to New York City income

SCHEDULE C

A.

B.

Federal

New York City

4. Enter amount from Schedule A, line 1, column F ..................................

5. Enter amount from Schedule A, line1, column I ....................................

6. Enter amount from Schedule B, line 2 ...................................................

7. Enter amount from Schedule B, line 3 ...................................................

8. Totals: column A, lines 4 and 7; column B, lines 5 and 6 .....................

Enter the amount on column A, line 8, the federal adjustment, as an addition and the amount on column B, line 8, the

New York City adjustment, as a deduction on the applicable New York City return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1