Form In-1183 - Statement Of Premiums And Fees For Taxation - Health Maintenance Organizations - 2010

ADVERTISEMENT

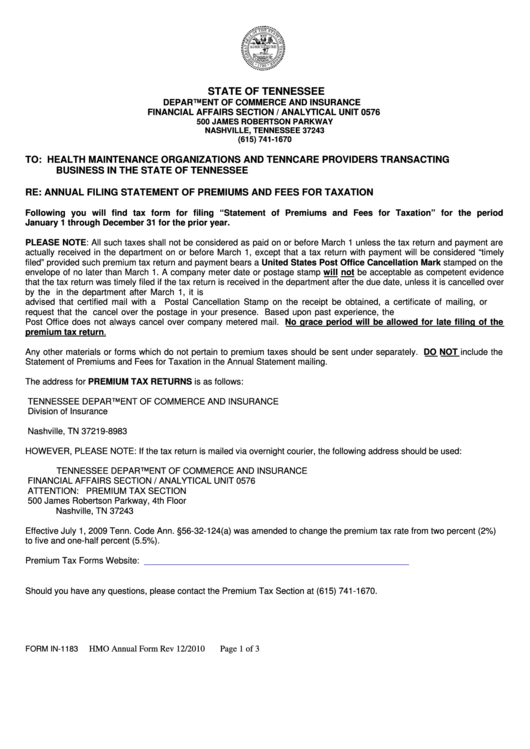

STATE OF TENNESSEE

DEPARTMENT OF COMMERCE AND INSURANCE

FINANCIAL AFFAIRS SECTION / ANALYTICAL UNIT 0576

500 JAMES ROBERTSON PARKWAY

NASHVILLE, TENNESSEE 37243

(615) 741-1670

TO:

HEALTH MAINTENANCE ORGANIZATIONS AND TENNCARE PROVIDERS TRANSACTING

BUSINESS IN THE STATE OF TENNESSEE

RE:

ANNUAL FILING STATEMENT OF PREMIUMS AND FEES FOR TAXATION

Following you will find tax form for filing “Statement of Premiums and Fees for Taxation” for the period

January 1 through December 31 for the prior year.

PLEASE NOTE: All such taxes shall not be considered as paid on or before March 1 unless the tax return and payment are

actually received in the department on or before March 1, except that a tax return with payment will be considered “timely

filed” provided such premium tax return and payment bears a United States Post Office Cancellation Mark stamped on the

envelope of no later than March 1. A company meter date or postage stamp will not be acceptable as competent evidence

that the tax return was timely filed if the tax return is received in the department after the due date, unless it is cancelled over

by the U.S. Postal Service. If your company feels the tax return may be received in the department after March 1, it is

advised that certified mail with a U.S. Postal Cancellation Stamp on the receipt be obtained, a certificate of mailing, or

request that the U.S. Postal authorities cancel over the postage in your presence. Based upon past experience, the U.S.

Post Office does not always cancel over company metered mail. No grace period will be allowed for late filing of the

premium tax return.

Any other materials or forms which do not pertain to premium taxes should be sent under separately. DO NOT include the

Statement of Premiums and Fees for Taxation in the Annual Statement mailing.

The address for PREMIUM TAX RETURNS is as follows:

TENNESSEE DEPARTMENT OF COMMERCE AND INSURANCE

Division of Insurance

P.O. Box 198983

Nashville, TN 37219-8983

HOWEVER, PLEASE NOTE: If the tax return is mailed via overnight courier, the following address should be used:

TENNESSEE DEPARTMENT OF COMMERCE AND INSURANCE

FINANCIAL AFFAIRS SECTION / ANALYTICAL UNIT 0576

ATTENTION: PREMIUM TAX SECTION

500 James Robertson Parkway, 4th Floor

Nashville, TN 37243

Effective July 1, 2009 Tenn. Code Ann. §56-32-124(a) was amended to change the premium tax rate from two percent (2%)

to five and one-half percent (5.5%).

Premium Tax Forms Website:

Should you have any questions, please contact the Premium Tax Section at (615) 741-1670.

FORM IN-1183

HMO Annual Form Rev 12/2010

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3