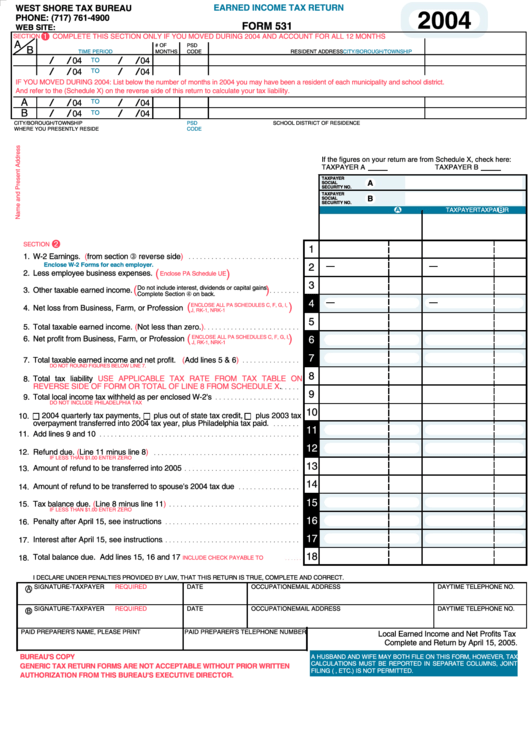

Form 531 - Earned Income Tax Return - 2004

ADVERTISEMENT

WEST SHORE TAX BUREAU

EARNED INCOME TAX RETURN

2004

PHONE: (717) 761-4900

FORM 531

WEB SITE:

$

SECTION

COMPLETE THIS SECTION ONLY IF YOU MOVED DURING 2004 AND ACCOUNT FOR ALL 12 MONTHS

A

# OF

PSD

B

TIME PERIOD

MONTHS

CODE

RESIDENT ADDRESS

CITY/BOROUGH/TOWNSHIP

/

/

/

/

04

04

TO

/

/

/

/

04

TO

04

IF YOU MOVED DURING 2004: List below the number of months in 2004 you may have been a resident of each municipality and school district.

And refer to the (Schedule X) on the reverse side of this return to calculate your tax liability.

A

/

/

/

/

TO

04

04

B

/

/

/

/

04

TO

04

CITY/BOROUGH/TOWNSHIP

PSD

SCHOOL DISTRICT OF RESIDENCE

WHERE YOU PRESENTLY RESIDE

CODE

If the figures on your return are from Schedule X, check here:

TAXPAYER A

TAXPAYER B

TAXPAYER

A

SOCIAL

SECURITY NO.

TAXPAYER

B

SOCIAL

SECURITY NO.

A

B

TAXPAYER

TAXPAYER

#

SECTION

1

W-2 Earnings. (from section " reverse

1.

side)

Enclose W-2 Forms for each employer.

2

(

)

2.

Less employee business expenses.

Enclose PA Schedule UE

3

(

)

Do not include interest, dividends or capital gains.

3.

Other taxable earned income.

Complete Section ! on back.

4

)

(

ENCLOSE ALL PA SCHEDULES C, F, G, I,

4.

Net loss from Business, Farm, or Profession

J, RK-1, NRK-1

5

5.

Total taxable earned income. (Not less than

zero.)

)

(

ENCLOSE ALL PA SCHEDULES C, F, G, I,

6.

Net profit from Business, Farm, or Profession

6

J, RK-1, NRK-1

7

7.

Total taxable earned income and net profit. (Add lines 5 &

6)

DO NOT ROUND FIGURES BELOW LINE 7.

8

Total tax liability

USE APPLICABLE TAX RATE FROM TAX TABLE ON

8.

REVERSE SIDE OF FORM OR TOTAL OF LINE 8 FROM SCHEDULE

X.

9

Total local income tax withheld as per enclosed W-2's

9.

DO NOT INCLUDE PHILADELPHIA TAX

10

2004 quarterly tax payments,

plus out of state tax credit,

plus 2003 tax

10.

overpayment transferred into 2004 tax year, plus Philadelphia tax paid.

11

11.

Add lines 9 and 10

12

12.

Refund due. (Line 11 minus line

8)

IF LESS THAN $1.00 ENTER ZERO

13

13.

Amount of refund to be transferred into 2005

14

14.

Amount of refund to be transferred to spouse's 2004 tax due

15

Tax balance due. (Line 8 minus line

11)

15.

IF LESS THAN $1.00 ENTER ZERO

16

Penalty after April 15, see instructions

16.

17

Interest after April 15, see instructions

17.

18

Total balance due. Add lines 15, 16 and 17

18.

INCLUDE CHECK PAYABLE TO W.S.T.B.

I DECLARE UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN IS TRUE, COMPLETE AND CORRECT.

SIGNATURE-TAXPAYER

REQUIRED

DATE

OCCUPATION

EMAIL ADDRESS

DAYTIME TELEPHONE NO.

A

SIGNATURE-TAXPAYER

REQUIRED

DATE

OCCUPATION

EMAIL ADDRESS

DAYTIME TELEPHONE NO.

B

PAID PREPARER'S NAME, PLEASE PRINT

PAID PREPARER'S TELEPHONE NUMBER

Local Earned Income and Net Profits Tax

Complete and Return by April 15, 2005.

BUREAU'S COPY

A HUSBAND AND WIFE MAY BOTH FILE ON THIS FORM, HOWEVER, TAX

CALCULATIONS MUST BE REPORTED IN SEPARATE COLUMNS, JOINT

GENERIC TAX RETURN FORMS ARE NOT ACCEPTABLE WITHOUT PRIOR WRITTEN

FILING (i.e. COMBINING INCOME, ETC.) IS NOT PERMITTED.

AUTHORIZATION FROM THIS BUREAU'S EXECUTIVE DIRECTOR.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2