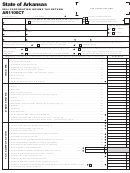

Form 531 - Earned Income Tax Return - 2004 Page 2

ADVERTISEMENT

%

DATE EMPLOYED

TAXPAYER

TAXPAYER

PAGE 2

W-2 WAGES

A

B

SECTION

DURING THIS TAX YEAR

TAX WITHHELD

EMPLOYER'S NAME

GROSS EARNED INCOME

TAX WITHHELD

GROSS EARNED INCOME

FROM

TO

/

/

/

/

a.

b.

/

/

/

/

c.

/

/

/

/

d.

/

/

/

/

e.

/

/

/

/

f.

/

/

/

/

2

TOTAL. CARRY TO SECTION

LINES 1 & 9

ENCLOSE A W-2 FORM FOR EACH EMPLOYER

CARRY TO LINE 9

CARRY TO LINE 1

CARRY TO LINE 9

CARRY TO LINE 1

ON FRONT SIDE

ON FRONT SIDE

ON FRONT SIDE

ON FRONT SIDE

'

DO NOT

SECTION

OTHER TAXABLE INCOME:

REPORT CAPITAL GAINS OR DIVIDENDS, OR INTEREST

ON SAVINGS OR INVESTMENTS, OR SCHEDULE E INCOME

DESCRIPTION OF WORK OR SERVICE PERFORMED,

AMOUNT

AMOUNT

RECEIVED FROM (PAYOR NAME)

A

B

TAXPAYER

TAXPAYER

EX. TIPS, FEE, 1099 MISC INCOME. ENCLOSE A COPY.

$

$

$

$

TRANSFER SECTION 4 TOTALS TO LINE 3 ON FRONT OF TAX RETURN.

$

$

TOTALS

(

SECTION

West Shore Tax Bureau collects the earned income/ compensation tax and the net profits tax for the following school districts

and municipalities. If you were a resident of any of the listed municipalities and school districts for all or any portion of the tax

year, you are required to file a return with this bureau.

TAX TABLE: TOTAL TAX RATE IS INDICATED BELOW FOR EACH OF THE MEMBER SCHOOL DISTRICTS

CUMBERLAND COUNTY TAXING AUTHORITIES:

CUMBERLAND COUNTY AND YORK COUNTY:

01/01/04 - 06/30/04 = 1% RATE

West Shore School District

1.45%

Camp Hill School District

2%

Effective 07/01/2004

07/01/04 - 12/31/04 = 2% RATE

98252 Fairview Township (NR .5%)*

98220 Goldsboro Borough

98050 Camp Hill Borough (NR 1%)*

98057 Lemoyne Borough (NR 1%)*

01/01/04 - 06/30/04 = 1% RATE

98058 Lower Allen Township (NR 1%)*

Cumberland Valley School District

1.6%

Effective 07/01/2004

07/01/04 - 12/31/04 = 1.6% RATE

98242 Newberry Township I (NR 1%)*

98055 Hampden Township (NR 1%)*

98066 New Cumberland Borough (NR 1%)*

98062 Middlesex Township (NR 1%)*

98083 Wormleysburg Borough (NR 1%)*

98063 Monroe Township (NR 1%)*

YORK COUNTY:

98074 Silver Spring Towhship (NR 1%)*

East Pennsboro School District

1.6%

Northeastern School District

1%

98054 East Pennsboro Township (NR 1%)*

67542 Newberry Township II (NR 1%)*

Mechanicsburg School District

1.7%

Northern York County School District

1.25%

98061 Mechanicsburg Borough (NR 1%)*

67500 Carroll Township

98073 Shiremanstown Borough (NR 1%)*

67507 Dillsburg Borough

98059 Shiremanstown Annex (NR 1%)*

67517 Franklin Township

98078 Upper Allen Township (NR 1%)*

NR-INDICATES MUNICIPALITIES WHO

67518 Franklintown Borough (NR .5%)*

HAVE LEVIED THE NON-RESIDENT TAX.

67536 Monaghan Township (NR 1%)*

*Maryland Residents will receive credit

67560 Warrington Township

upon application by the taxpayer.

67562 Wellsville Borough (NR .5%)*

&

SECTION

SCHEDULE X

COLUMN A

COLUMN B

COLUMN C

COLUMN D

# MONTHS @

# MONTHS

# MONTHS

TOTALS

Column A:

For NORTHEASTERN school district residents, indicate number of months you resided in the school

1% TAX RATE

district during 2004. For residents of CAMP HILL S.D. and CUMBERLAND VALLEY S.D., indicate number

of months you resided within the school district between 01/01/04 and 06/30/04 only.

Column B:

For CAMPHILL S.D. and CUMBERLAND VALLEY S.D. residents, indicate the number of months you

resided within the school district between 07/01/04 and 12/31/04 only.

Column C:

For residents of EAST PENNSBORO S.D.; MECHANICSBURG S.D.; WEST SHORE S.D.; NORTHERN

YORK COUNTY S.D. enter the number of full months you were a resident in your school district during

01/01/04 through 12/31/04.

If you moved between these school districts please put the number of months during 01/01/04 through

06/30/04 in Column B, and also put the number of months during 07/01/04 through 12/31/04 in Column C.

1. W-2 earnings

2. Less employee business expense

3. Other taxable earned income

4. Net loss from business, farm or profession

5. Total taxable earned income

6. Net profit from business, farm or profession

7. Total taxable earned income and net profit (add lines 5 & 6)

8. Tax Liability:

Column A:

1% of line 7 of Form 531 for residents of Northeastern School District; Camp Hill

S.D.; and Cumberland Valley S.D. only.

Column B:

Use applicable rate for 07/01/2004 through 12/31/2004 for Camp Hill S.D. and

Cumberland Valley S.D. residents only.

Column C:

Use applicable tax rate for 01/01/2004 through 12/31/2004 for East Pennsboro

S.D.; Mechanicsburg S.D.; West Shore S.D. and Northern York County S.D. residents.

Column D:

Total of columns A+B+C. Enter the figures from column D onto the front of this

tax return form, and also complete lines 9 through 18 on the front of this tax return form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2