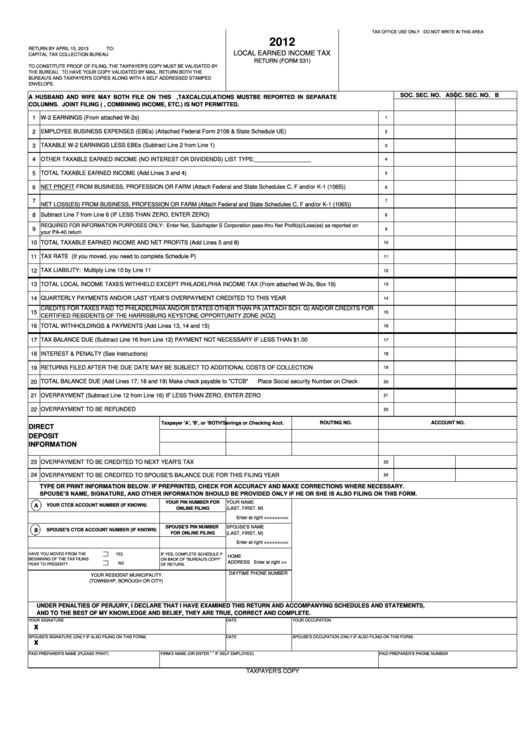

Form 531 - Local Earned Income Tax - 2012

ADVERTISEMENT

TAX OFFICE USE ONLY - DO NOT WRITE IN THIS AREA

2012

RETURN BY APRIL 15, 2013

TO:

LOCAL EARNED INCOME TAX

CAPITAL TAX COLLECTION BUREAU

RETURN (FORM 531)

TO CONSTITUTE PROOF OF FILING, THE TAXPAYER'S COPY MUST BE VALIDATED BY

THE BUREAU. TO HAVE YOUR COPY VALIDATED BY MAIL, RETURN BOTH THE

BUREAU'S AND TAXPAYER'S COPIES ALONG WITH A SELF ADDRESSED STAMPED

ENVELOPE.

SOC. SEC. NO. A

SOC. SEC. NO. B

A HUSBAND AND WIFE MAY BOTH FILE ON THIS FORM. HOWEVER, TAX CALCULATIONS MUST BE REPORTED IN SEPARATE

COLUMNS. JOINT FILING (I.E., COMBINING INCOME, ETC.) IS NOT PERMITTED.

W-2 EARNINGS (From attached W-2s)

1

1

2

EMPLOYEE BUSINESS EXPENSES (EBEs) (Attached Federal Form 2106 & State Schedule UE)

2

3

TAXABLE W-2 EARNINGS LESS EBEs (Subtract Line 2 from Line 1)

3

OTHER TAXABLE EARNED INCOME (NO INTEREST OR DIVIDENDS) LIST TYPE:__________________

4

4

5

TOTAL TAXABLE EARNED INCOME (Add Lines 3 and 4)

5

6

NET PROFIT FROM BUSINESS, PROFESSION OR FARM (Attach Federal and State Schedules C, F and/or K-1 (1065))

6

7

7

NET LOSS(ES) FROM BUSINESS, PROFESSION OR FARM (Attach Federal and State Schedules C, F and/or K-1 (1065))

8

Subtract Line 7 from Line 6 (IF LESS THAN ZERO, ENTER ZERO)

8

REQUIRED FOR INFORMATION PURPOSES ONLY: Enter Net, Subchapter S Corporation pass-thru Net Profit(s)/Loss(es) as reported on

9

9

your PA-40 return

TOTAL TAXABLE EARNED INCOME AND NET PROFITS (Add Lines 5 and 8)

10

10

11

TAX RATE (If you moved, you need to complete Schedule P)

11

12

TAX LIABILITY: Multiply Line 10 by Line 11

12

TOTAL LOCAL INCOME TAXES WITHHELD EXCEPT PHILADELPHIA INCOME TAX (From attached W-2s, Box 19)

13

13

QUARTERLY PAYMENTS AND/OR LAST YEAR’S OVERPAYMENT CREDITED TO THIS YEAR

14

14

CREDITS FOR TAXES PAID TO PHILADELPHIA AND/OR STATES OTHER THAN PA (ATTACH SCH. G) AND/OR CREDITS FOR

15

15

CERTIFIED RESIDENTS OF THE HARRISBURG KEYSTONE OPPORTUNITY ZONE (KOZ)

TOTAL WITHHOLDINGS & PAYMENTS (Add Lines 13, 14 and 15)

16

16

17

TAX BALANCE DUE (Subtract Line 16 from Line 12) PAYMENT NOT NECESSARY IF LESS THAN $1.00

17

18

INTEREST & PENALTY (See Instructions)

18

RETURNS FILED AFTER THE DUE DATE MAY BE SUBJECT TO ADDITIONAL COSTS OF COLLECTION

19

19

20

TOTAL BALANCE DUE (Add Lines 17, 18 and 19) Make check payable to "CTCB"

Place Social security Number on Check

20

21

OVERPAYMENT (Subtract Line 12 from Line 16) IF LESS THAN ZERO, ENTER ZERO

21

OVERPAYMENT TO BE REFUNDED

22

22

ROUTING NO.

ACCOUNT NO.

Taxpayer 'A', 'B', or 'BOTH' Savings or Checking Acct.

DIRECT

DEPOSIT

INFORMATION

23

OVERPAYMENT TO BE CREDITED TO NEXT YEAR'S TAX

23

24

OVERPAYMENT TO BE CREDITED TO SPOUSE'S BALANCE DUE FOR THIS FILING YEAR

24

TYPE OR PRINT INFORMATION BELOW. IF PREPRINTED, CHECK FOR ACCURACY AND MAKE CORRECTIONS WHERE NECESSARY.

SPOUSE’S NAME, SIGNATURE, AND OTHER INFORMATION SHOULD BE PROVIDED ONLY IF HE OR SHE IS ALSO FILING ON THIS FORM.

YOUR PIN NUMBER FOR

YOUR NAME

A

YOUR CTCB ACCOUNT NUMBER (IF KNOWN)

ONLINE FILING

(LAST, FIRST, M)

Enter at right >>>>>>>>>

SPOUSE'S PIN NUMBER

SPOUSE'S NAME

B

SPOUSE'S CTCB ACCOUNT NUMBER (IF KNOWN)

FOR ONLINE FILING

(LAST, FIRST, M)

Enter at right >>>>>>>>>

YES

HAVE YOU MOVED FROM THE

IF YES, COMPLETE SCHEDULE P

HOME

BEGINNING OF THE TAX FILING

ON BACK OF "BUREAU'S COPY"

ADDRESS Enter at right >>

NO

YEAR TO PRESENT?

OF RETURN.

DAYTIME PHONE NUMBER

YOUR RESIDENT MUNICIPALITY

(TOWNSHIP, BOROUGH OR CITY)

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS,

AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE.

YOUR SIGNATURE

DATE

YOUR OCCUPATION

X

X

X

X

SPOUSE'S SIGNATURE (ONLY IF ALSO FILING ON THIS FORM)

DATE

SPOUSE'S OCCUPATION (ONLY IF ALSO FILING ON THIS FORM)

X

X

X

X

PAID PREPARER’S NAME (PLEASE PRINT)

FIRM’S NAME (OR ENTER “S.E.” IF SELF EMPLOYED)

PAID PREPARER’S PHONE NUMBER

TAXPAYER'S COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1