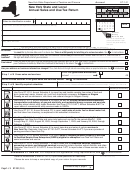

Form St-101 - New York State And Local Annual Sales And Use Tax Return Page 6

ADVERTISEMENT

A04

Page 6 of 8 ST-101 (2/04)

Annual

Add Sales and use tax column total (box 15) to Total special

Step 6

taxes (box 16) and subtract Total tax credits and advance

of 9 Calculate taxes due

Taxes due

payments (box 17).

18

Box 15

Box 16

Box 17

+

=

$

$

$

amount

amount

amount

Step 7

You are eligible for the vendor collection credit ONLY if you file by

of 9 Calculate vendor collection credit

March 22, 2004, and you pay the full amount due with the return.

or pay penalty and interest

If you are not eligible, enter “0” in box 19 and go to 7C.

Note: See page 7, Vendor collection credit calculation worksheet, to determine the vendor collection credit amount, if any, for which you are eligible.

7A

Vendor collection credit for March through May ( from page 7 , Vendor

collection credit calculation worksheet, Section 1, Part 3, box 12)

7B

Vendor collection credit for June through February ( from page 7 , Vendor

collection credit calculation worksheet, Section 2, Part 3, box 25 )

VE 7704

19

Total vendor collection credit

(add 7A and 7B and enter the result or $150, whichever is less)

Penalty and interest

OR

Pay penalty and interest if you are filing late

20

7C

Penalty and interest are calculated on the amount shown in box 18, Taxes due . See

on page 3

in the instructions.

Make check or money order payable to New York State Sales Tax .

Step 8

of 9 Calculate total amount due

Total amount due

Write on your check your sales tax ID#, ST-101, and Fiscal Year 2004 .

Taking vendor collection credit? Subtract box 19 from box 18.

Final calculation:

Paying penalty and interest? Add box 20 to box 18.

Step 9

New:

of 9 Sign and mail this return

Please enter code

Must be postmarked by Monday, March 22, 2004, to be considered

filed on time. See below for complete mailing information.

below

.

(see instructions)

Please be sure to keep a completed copy for your records.

Printed name of taxpayer

Title

Daytime

North American Industry

(

)

Signature of taxpayer

Date

telephone

Classification System

(NAICS)

Printed name of preparer, if other than taxpayer

Preparer’s address

Daytime

(

)

Signature of preparer, if other than taxpayer

telephone

Do you participate in the New Jersey/New York or the

Connecticut/New York Reciprocal Tax Agreement?

March 10, 2004

Where to mail

your return and

No

Yes

New York State Sales Tax

1,050.32

attachments

One thousand fifty and 32/100

If using a private delivery

Address envelope to:

Address envelope to:

service rather than the U.S.

NYS SALES TAX PROCESSING

NYS SALES TAX PROCESSING

Postal Service, see

in

JAF BUILDING

RECIPROCAL TAX AGREEMENT

00-0000000

ST-101

Fiscal Year 2004

instructions for

PO BOX 1205

JAF BUILDING

the correct address.

NEW YORK NY 10116-1205

PO BOX 1209

Don’t forget to write your sales tax ID# ,

Don’t forget to

NEW YORK NY 10116-1209

ST-101, and Fiscal Year 2004

sign your check

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7